The New Payout

Permian Basin Royalty Trust made a splash on February 16, 2024, with an announcement that is music to the ears of its investors. The company’s board revealed a delightful uptick in the regular monthly dividend, which now stands at a pleasing $0.05 per share ($0.55 annualized), up from the previous $0.03 per share. A move that’s sure to have shareholders tapping their feet in satisfaction.

To capture this harmonious dividend, eager investors must seize the opportunity before the ex-dividend date of February 28, 2024. Those fortunate enough to be shareholders of record as of February 29, 2024, will be rewarded with a payment on March 14, 2024.

The Current Landscape

At the current share price of $13.73, the stock’s dividend yield flaunts a welcoming 3.97%. However, a glance at history paints a broader picture. Looking back five years, over 234 samples, the company’s average dividend yield stood at an impressive 6.40%. The contrarian in us can’t help but notice that the current dividend yield is 0.64 standard deviations below this historical average, signaling a potential opportunity for opportunistic investors.

Furthermore, the company’s dividend payout ratio of 0.97 suggests that it has room to maneuver. A payout ratio nearing one indicates that a company is generously sharing profits with its shareholders. However, prudent investors would recognize the need for balance—a payout ratio near or exceeding one could signify a precarious position.

On the flip side, the company’s 3-year dividend growth rate of 2.54% is a testament to its commendable trajectory of enhancing the returns for its loyal investors.

Assessing Fund Sentiment

Investor sentiment is a fickle beast, and analyzing fund positions can yield invaluable insight. The latest data reveals that 102 funds or institutions are monitoring Permian Basin Royalty Trust. However, this marks a 5.56% decrease in oversight from the preceding quarter, coupled with a pronounced 15.43% decrease in average portfolio weight. Despite this, total shares owned by institutions have risen by 1.27% in the last three months to 15,451K shares—a positive indicator.

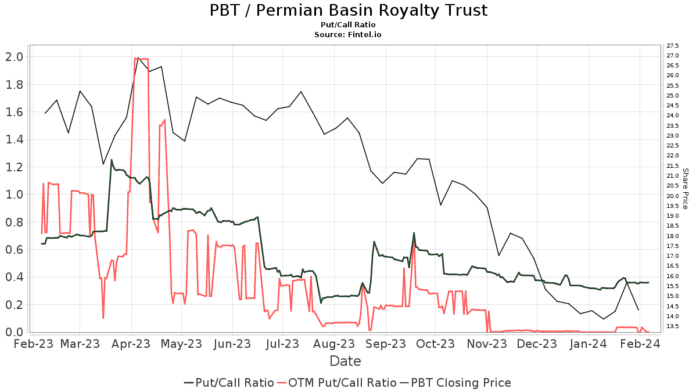

The cherry on top comes in the form of a put/call ratio of 0.34 for PBT, sending a resoundingly bullish signal that is music to the ears of the company and its shareholders.

A Tap on the Shoulder from Investors

In the magic circle of stock ownership, SoftVest Advisors leads the choir with 4,148K shares, representing a commendable 8.90% ownership of the company. Horizon Kinetics Asset Management and INFL – Horizon Kinetics Inflation Beneficiaries ETF, despite a decrease in holdings, continue to sway the company’s sentiment with their significant stakes. Schwartz Investment Counsel’s well-timed addition to its portfolio is music to the ears of Permian Basin Royalty Trust, bringing an upbeat tune to shareholders.

Foundation Resource Management is the faithful follower that maintains its position in the company, unwavering in its support and contributing to the stable landscape.

Into the Trust’s Realm

The Permian Basin Royalty Trust holds court with a regal proposition—its principal assets consist of a 75% net overriding royalty interest from its Waddell Ranch properties and a 95% net overriding royalty interest from its major producing royalty properties in Texas. The company’s net overriding royalty interests stand as monuments, representing a bulwark of trust, unwavering and resolute in the face of time’s relentless march.

As the stage is set for the company’s performance, investors can’t help but admire the commitment to stability and resilience portrayed by the Trust’s overriding royalties, collectively known as the “Royalties.”

Additional reading:

Fintel is one of the most comprehensive investing research platforms available to individual investors, traders, financial advisors, and small hedge funds.

Our data covers the world, and includes fundamentals, analyst reports, ownership data and fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and much more. Additionally, our exclusive stock picks are powered by advanced, backtested quantitative models for improved profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.