Raymond James: A Wind of Change

Fintel revealed that Raymond James took a downward turn on February 20, 2024, downgrading their prior positive assessment of NuStar Energy L.P. – Limited Partnership (NYSE:NS) from Outperform to Market Perform.

Diminished Price Forecast

On January 20, 2024, the average one-year price target for NuStar Energy L.P. – Limited Partnership stood at 19.23, depicting a potential decrease of 18.53% from its most recent closing price of 23.61. This marked decline signifies a significant departure from prior expectations.

Revenue and Dividend Dynamics

The projected annual revenue for NuStar Energy L.P. – Limited Partnership shows a notable increase of 31.01% landing at 2,141MM. Despite this, the company declared a flat regular quarterly dividend of $0.40 per share ($1.60 annualized) on January 25, 2024, with shareholders receiving this payment on February 13, 2024.

The stock’s dividend yield currently stands at 6.78%, a decline from its historical average. Additionally, with a dividend payout ratio of 0.74, the company seems to be wading into riskier waters.

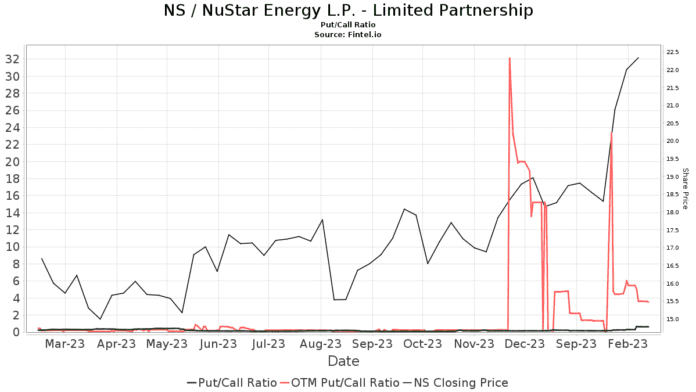

Reportedly, 195 funds or institutions are reporting positions in NuStar Energy L.P. – Limited Partnership, signifying an increase of 11 owners (5.98%) within the last quarter. Meanwhile, the average portfolio weight of all funds dedicated to NS is 0.54%, showing a substantial increase of 10.18%. This potential sign of positive sentiment is further corroborated by a low put/call ratio of 0.44, indicating a bullish outlook.

Several major stakeholders such as Invesco and AMLP – ALERIAN MLP ETF have showcased fluctuations in their position with NuStar Energy L.P. – Limited Partnership. While Invesco’s ownership remained relatively stable, AMLP explicitly displayed a dramatic increase of 36.59% in the last quarter.

NuStar Energy L.P. – Limited Partnership: A Snapshot

NuStar Energy L.P. is a publicly traded master limited partnership known for its status as one of the most substantial independent liquids terminal and pipeline operators in the nation. With its headquarters based in San Antonio, Texas, the company operates approximately 10,000 miles of pipeline and 73 terminal and storage facilities, dealing in the storage and distribution of crude oil, refined products, and specialty liquids. Additionally, NuStar’s combined system boasts an impressive 72 million barrels of storage capacity, with operations spanning across the United States, Canada, and Mexico.

Fintel offers a comprehensive investing research platform for individual investors, traders, financial advisors, and small hedge funds, with data encompassing fundamentals, analyst reports, ownership, options sentiment, insider trading, options flow, unusual options trades, and more.

Click to Learn More

This article originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.