RBC Capital Elevates Ball’s Outlook from Sector Perform to Outperform

Fintel’s latest report on February 20, 2024, illuminates the buzz surrounding RBC Capital’s upliftment of Ball’s (NYSE:BALL) status from Sector Perform to Outperform. This bullish move has captured the attention of the investment community, signaling a cloak-and-dagger turn of events for the beverage and packaging juggernaut.

Analyst Forecasts Point Towards a Muted Downside

Based on data as of January 20, 2024, the average one-year price outlook for Ball is set at 59.79. These projections oscillate between a low of 50.50 and a high of $78.75. Upon careful scrutiny, the projected price signifies a minor 3.41% reduction from its latest reported closing figure of 61.90.

Revenue Projections Echo a Striking Uptick

Anticipated annual revenue for Ball stands tall at 16,536MM, embodying a staggering surge of 17.87%. This projection hints at a redeeming narrative for the company, potentially fortifying its position in the market. The foreseen annual non-GAAP EPS is estimated at 3.84, further adding to the allure of Ball’s financial prospects.

Fund Sentiment Unveiled

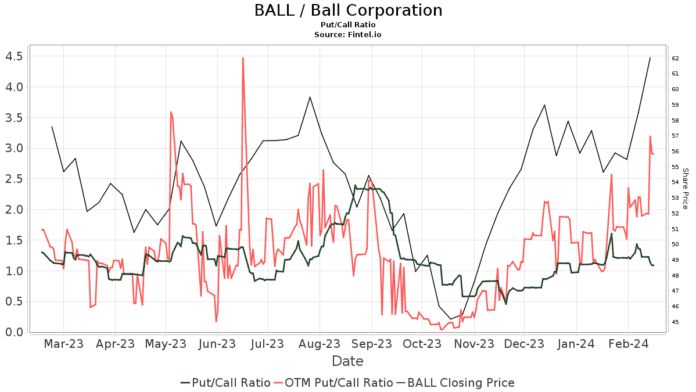

A totality of 1392 funds or institutions has reported their positions in Ball. An increase of 26 owners, representing 1.90% growth in the last quarter. The average portfolio dedication allotted to BALL is reported at 0.22%, exhibiting a modest decline of 11.29%. Additionally, institutional shares witnessed an uptick of 0.14% in the last three months, now culminating at 323,623K shares. A telling put/call ratio of 1.09 flickers a bearish projection for BALL’s future trajectory.

Parnassus Investments asserts its dominion over 21,063K shares, representing a commanding 6.68% ownership of the company. The firm’s recent filing unveiled ownership of 20,064K shares, symbolizing an impressive 4.74% augmentation. The firm bolstered its portfolio allocation in BALL by 10.13% over the last quarter, exuding confidence in the company’s growth trajectory.

Stirring Up Ball’s Strategic Pot of Gold

Ball Corporation, renowned for furnishing innovative, sustainable aluminum packaging solutions for a multitude of sectors, including beverage, personal care, household products, and cutting-edge aerospace technologies, is startling the markets as it continues to expand its footprint. With a global workforce of 21,500 individuals, it reported a staggering net sales figure of $11.8 billion in 2020. This chronicle of success is pulsating with potential as the company stakes its claim in the competitive landscape.

Fintel, the avant-garde in investing research platforms, has become the go-to choice for individual investors, traders, financial advisors, and boutique hedge funds. Offering a comprehensive suite of data that spans the breadth of the globe, including fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and a myriad of other offerings. Its exclusive stock picks are underpinned by sophisticated, backtested quantitative models, aiming to deliver enriched profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.