Investors seeking a savory addition to their portfolios should consider the tangy and robust flavors offered by Veeva Systems Inc. (VEEV). This cloud-based software applications and data solutions provider, nestled in the life sciences industry, is positioned to deliver substantial growth in the upcoming quarters, garnished with a delectable array of strategic deals and luscious product innovations.

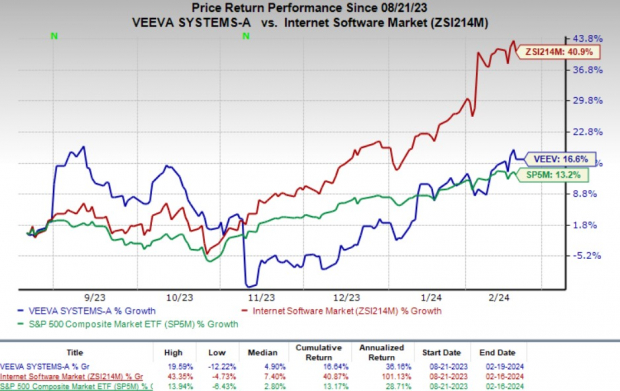

Over the past six months, VEEV has demonstrated a commendable ascent, outpacing a succulent 40.9% growth in the industry and a ripe 13.2% rise of the S&P 500 Composite by a respectable 16.6%. This agile entity, with a market capitalization of $35.32 billion, projects a robust 24.6% growth over the next five years, sprinkling the investment landscape with promising prospects.

Image Source: Zacks Investment Research

The ingredients of Veeva Systems’ success are the unique solutions it brings to the table, including Veeva Vault, Veeva CRM, Veeva Network, and Veeva OpenData. The recent enhancements to its Commercial Cloud by adding Marketing Automation and Patient CRM and expanding Data Cloud to clinical have seasoned the company’s product portfolio, enhancing its appeal to investors seeking robust growth.

Throughout the quarter, its management’s diligence bore fruit, as it secured noteworthy agreements with industry titans such as Boehringer Ingelheim and SK Life Science. These alliances illuminate a path laden with opportunity for VEEV, adding an enticing sparkle to its investment proposition.

The company’s third-quarter fiscal 2024 results stand as a testament to its formidable capabilities. Witnessing an upswing in both its top and bottom lines, Veeva Systems continued to savor the fruits of its labor, propelled by the strong performance of its flagship Vault platform. Its solid showing in Commercial Solutions, with new customer additions and robust win rates in Veeva CRM, sweetens the investment pot further.

Clouds on the Horizon

Veeva Systems is not impervious to the gusts of adversity. The storage and transmission of sensitive information within its solutions make it susceptible to data security threats. Vigilance and preventive measures are integral to preserving the company’s standing, as unauthorized access or security breaches could tarnish its reputation.

Moreover, the competitive landscape is rich with challenges. Veeva Systems operates in a field rife with contenders offering cloud-based solutions for the life sciences industry. The competition with traditional legacy solutions further outlines the fierce battleground this company finds itself in.

Estimate Trends

Veeva Systems hath reaped a bountiful field of positive estimate revisions for fiscal 2025. The Zacks Consensus Estimate for its earnings drifted northward, imparting a rosier hue to its prospects. Additionally, the projected revenue growth for the first quarter of fiscal 2025 stands at a mouthwatering 22.5% improvement from the year-ago quarter’s figure.

Considering the Spread

For those looking to diversify their portfolios, a potluck of options is on offer. Alongside VEEV, the medical space is peppered with other appealing stocks such as Edward Lifesciences, Asensus Surgical, and Integer Holdings Corporation. These savory picks present an indulgent smorgasbord of potential investments, each with its own unique flavor profile tailored to suit various palates.