Michael Edwards

It’s the end of the line for REITs this week, with a slight dip compared to last week’s performance, following Q4 earnings that left investors unimpressed.

Q4 Earnings Overview

AGNC Investment’s (AGNC) earnings continued to plummet during the quarter, while Weyerhaeuser (WY) saw earnings decline both sequentially and from a year ago. On the other hand, Crown Castle’s (CCI) earnings and revenue managed to surpass Wall Street expectations, albeit with the company only reaffirming its 2024 guidance. Meanwhile, office REIT SL Green Realty (SLG) emerged as an outlier as it posted a revenue beat and raised its 2024 guidance, but was nonetheless affected by earnings hurt due to charges.

Market Performance

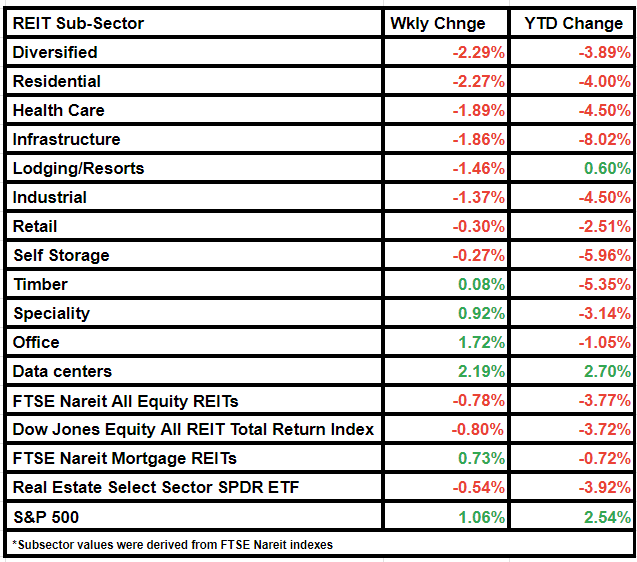

FTSE Nareit All Equity REITs observed a decline of 0.78% from the previous week, settling at $730.34. Simultaneously, the Dow Jones Equity All REIT Total Return Index fell by 0.80% to $2,382. In contrast, the FTSE Nareit Mortgage REITs index rose by 0.73% to $2.77, driven by favorable economic data that sparked expectations of a rate cut at the next Federal Open Market Committee meeting. The S&P 500 experienced a 1.06% rise, spurred by technology and energy stocks. However, despite rate cut speculations, the broader real estate index, Real Estate Select Sector SPDR ETF, was down by 0.54% to end at $38.49.

Performance of Individual REITs

Mortgage REIT Arbor Realty Trust (ABR) and net-lease REIT Spirit Realty Capital (SRC), which recently concluded its merger with Realty Income, were among the notable laggards for the week. Conversely, Power REIT (PW) recorded significant gains. Diversified REITs recorded the most losses in the subsectors, followed by Residential and Health Care, while data centers and Office emerged as the biggest gainers for the week.

For an in-depth look at this week’s subsector performance, refer to the chart below: