Earnings season for the recent quarter ended March 31 is in full swing, and it’s creating some unique opportunities for investors. Meta Platforms (NASDAQ: META) stock, for example, is down 12% since the company released its results, despite beating Wall Street’s expectations.

The social media giant, which is home to Facebook and Instagram, revealed plans to ramp up its spending on growth initiatives like artificial intelligence (AI), which could dent the company’s earnings potential in the short term. However, this could be a golden opportunity for investors who can afford to hold Meta stock for the next few years.

According to The Wall Street Journal, the overwhelming majority of Wall Street analysts give Meta stock the highest-possible buy rating. Considering it’s now the cheapest name in the trillion-dollar club by one widely used valuation metric, there is no time like the present to follow the Street’s lead.

Image source: Getty Images.

Meta is using AI to transform engagement

Over 3.2 billion people use Meta’s social networks every day, including Facebook, Instagram, and WhatsApp. That’s around 40% of the world’s population — and don’t forget, those platforms are banned in China, which is home to more than 1.4 billion people. Therefore, without a surprise increase in the number of humans living on Earth, it’s going to be really hard for Meta to continue growing its user base over the long term given its high penetration.

As a result, the company is focusing heavily on engagement. In other words, it wants users to spend more time on its platforms so they see more ads, which is how Meta generates revenue. AI is a big part of this. In the past, Facebook and Instagram were focused on connecting people, so most of the posts in users’ feeds would come from their family and friends. Now social media is more about entertainment, and Meta’s AI algorithms have been tasked with recommending an increasing amount of content recently.

AI can rapidly learn what each user likes to see, and it uses that knowledge to feed them similar content. This led to a clear increase in engagement in 2023 across Facebook and Instagram. In Q1, CEO Mark Zuckerberg said AI is currently recommending 30% of all the content Facebook users are seeing, and that number recently crossed 50% on Instagram for the first time. AI is also powering Meta’s advertising engine to match the most relevant ads to each user, which is great for businesses.

But a new feature called Meta AI could be the most powerful engagement tool the company has deployed to date. It’s a chatbot based on Meta’s Llama large language models (LLMs), which will eventually integrate into all of the company’s platforms. Meta AI is capable of answering questions on a broad range of topics and generating images, and it can even be called upon in a group chat to help users plan outings and events.

The recently released Llama 3 LLM is Meta’s most advanced yet, but it’s already training the next version with even more parameters. Each release will give Meta AI more capabilities — eventually, the chatbot could reduce the need for users to leave Facebook or Instagram to find information on other platforms like Google, which translates to more potential advertising dollars for Meta.

Meta’s revenue grew at the fastest pace in almost two years during Q1

Meta generated $36.4 billion in revenue during Q1. It represented a 27% year-over-year increase, which was the fastest pace of growth since the third quarter of 2021. The advertising market continues to improve after a terrible slump in 2022, but Meta is also benefiting from growing engagement, with ad impressions jumping 20% in Q1.

Meta’s net income (profit) also surged 117% compared to the year-ago period as the company reaped the rewards from its “year of efficiency” in 2023, when it laid off over 21,000 employees and trimmed costs across the board. Ironically, a change in tune on this very point is what sent Meta stock sinking after the release of its Q1 results.

CFO Susan Li told investors Meta planned to spend between $35 billion and $40 billion on capital expenditures in 2024, which was a sharp increase from its prior guidance of $30 billion to $37 billion. Investors fear the increase will dent the company’s earnings potential in upcoming quarters, which affects how much they are willing to pay for its stock.

Much of the spending is related to the company’s AI efforts. In January, Zuckerberg committed to purchasing 350,000 of Nvidia‘s H100 graphics processing chips (GPUs) for the data center in a deal worth an estimated $9 billion. The H100 is an industry-leading chip for processing AI workloads, so this will speed up Meta’s development of the Llama LLMs, which will in turn allow the company to release new AI features more quickly.

Wall Street is bullish on Meta stock

Meta looks like a great long-term opportunity for investors. The company has a stellar track record of monetizing new features — just look at smash-hits like Stories and Reels, which are now cornerstone pieces of Facebook and Instagram. If history is any guide, Meta AI will eventually contribute to the company’s financial results, so investors who can look through the increased capital expenditures along the way could do very well.

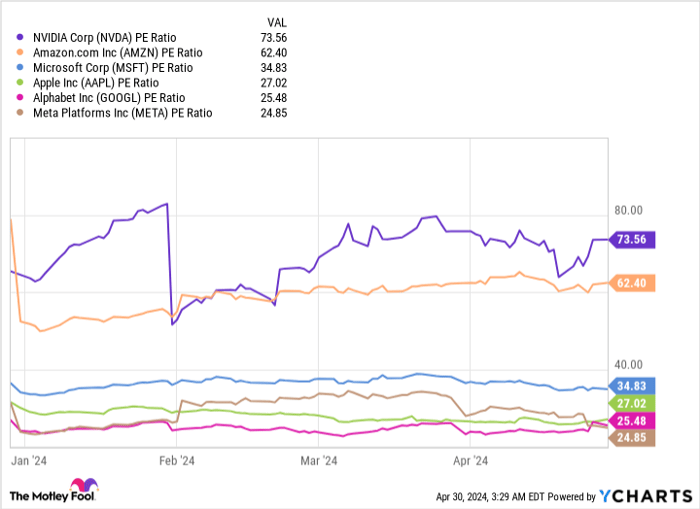

Following the recent dip in Meta stock, it trades at a price to earnings (P/E) ratio of just 24.8, making it the cheapest name in the trillion-dollar club, which includes Nvidia, Amazon, Microsoft, Apple, and Alphabet.

PE Ratio data by YCharts

Given Meta’s current valuation and its recent growth, it’s no surprise Wall Street is extremely bullish on its prospects. The Wall Street Journal tracks 66 analysts covering Meta stock, and 49 of them have given it the highest-possible buy rating. Seven are in the overweight (bullish) camp, eight recommend holding, and just two have given it an underweight (bearish) rating — but no analysts recommend selling.

There’s no time like the present to follow the Street’s lead, as long as investors maintain a time horizon of years rather than weeks or months.

Should you invest $1,000 in Meta Platforms right now?

Before you buy stock in Meta Platforms, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Meta Platforms wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of April 30, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.