Encore Capital Group, Inc. ECPG is poised to unveil its fourth-quarter 2023 outcomes on Feb 21, post the market close. The market predicts a surge in both top line and profits during the December quarter.

Encore Capital’s Journey with Earnings Surprises

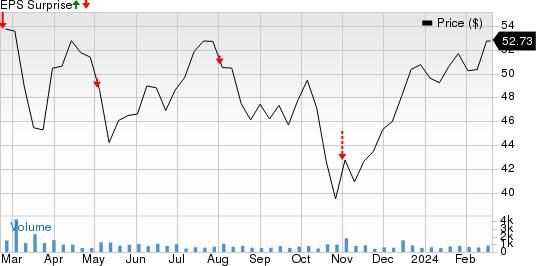

Encore Capital’s earnings have consistently fallen short of the consensus forecast in the previous four quarters, with an average negative surprise of 97.9%. The graph below illustrates this trend:

Charting Encore Capital Group Inc’s Price and EPS Surprise

Encore Capital Group Inc price-eps-surprise | Encore Capital Group Inc Quote

In the most recent quarter, the international specialty finance company recorded adjusted operating earnings per share of 79 cents, missing the Zacks Consensus Estimate by 41.5%. This was due to heightened operating expenses and reduced Servicing revenues. The negatives were partly offset by steady collections performance and enhanced portfolio pricing.

Let’s now examine the run-up to the fourth-quarter earnings disclosure.

Key Pointers for Q4

The Zacks Consensus Estimate for fourth-quarter revenues from receivable portfolios points to an almost $304 million figure, indicating a 3.1% increase year over year. Moreover, the consensus projection suggests a 46.4% upturn in other revenues for the quarter under review.

These factors are likely to have propelled ECPG’s top line. The consensus estimate for fourth-quarter revenues of $330.8 million hints at a 41.4% growth from the year-ago reported number. Increased credit card lending and charge-off rates are expected to have supported U.S. portfolio supply, thus benefiting portfolio pricing and returns.

Rising global collections, driven by a rebound in consumer behavior and a stable collections environment, are likely to have contributed to the company’s performance. The Zacks Consensus Estimate for fourth-quarter global collections stands at $467.3 million, indicating a 7.1% year-over-year growth.

These developments are anticipated to position the company for year-over-year growth. The Zacks Consensus Estimate for fourth-quarter earnings per share of $1.22 suggests a 139.2% surge from the prior-year level. This estimate has remained stable over the past week.

However, the company might have encountered escalated operating expenses due to increased salaries and employee benefits, legal collections costs, and collection agency commissions. This could offset the upside, casting a shadow on the possibility of an earnings beat.

Additionally, the Zacks Consensus Estimate for Servicing revenues in the fourth quarter indicates a 4.3% decline from the year-ago period. The fiercely competitive portfolio purchasing market in Europe is likely to have constrained the company, compelling ECPG to redistribute capital to the U.S. market.

Whispers in the Earnings Arena

Our established model is not conclusively predicting an earnings beat for Encore Capital this time. The combination of a favorable Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) would increase the odds of an earnings beat. In this case, the numbers don’t stack up in favor of such an outcome.

Earnings ESP: The company currently has an Earnings ESP of 0.00%. This is because the Most Accurate Estimate stands at $1.22 per share, aligning with the Zacks Consensus Estimate.

Curious about the best stocks to buy or sell before earnings reports? Uncover them with our Earnings ESP Filter.

Zacks Rank: Encore Capital currently holds a Zacks Rank #3.

You can view the complete list of today’s Zacks #1 Rank stocks here.

Performance of Other Players

Several companies in the broader Finance arena have already released their earnings for the December quarter, including PRA Group, Inc. PRAA, Rithm Capital Corp. RITM, and Virtu Financial, Inc. VIRT.

PRA Group reported a fourth-quarter 2023 loss of 22 cents per share, narrower than the Zacks Consensus Estimate of a loss of 35 cents per share, driven by robust portfolio income, increasing cash collection, improving pricing, and better operational outcomes in Brazil and Europe. However, the positives were partially offset by elevated expenses and weaknesses in PRAA’s U.S. business.

Rithm Capital posted fourth-quarter 2023 adjusted earnings of 51 cents per share, surpassing the Zacks Consensus Estimate by a remarkable 45.7%, supported by improved asset management revenues and continuous acquisition of customer loans. However, RITM’s results were somewhat offset by increased expenses, lower net servicing revenues, and interest income.

Virtu Financial announced fourth-quarter 2023 adjusted earnings per share of 27 cents, missing the Zacks Consensus Estimate by 35.7%, due to a decline in net trading income and commissions, net and technology service revenues, and higher expenses. Nevertheless, VIRT’s results were partially buoyed by improved interest and dividend income.

Keep track of upcoming earnings releases with the Zacks Earnings Calendar.

Newly Unveiled: Zacks Top 10 Stocks for 2024

Hurry – you still have the chance to get in early on our 10 top tickers for 2024. Personally curated by Zacks Director of Research, Sheraz Mian, this portfolio has consistently outperformed the market. From the launch in 2012 through November, 2023, the Zacks Top 10 Stocks surged +974.1%, nearly tripling the S&P 500’s +340.1%. Sheraz has meticulously scrutinized 4,400 companies encompassed by the Zacks Rank and cherry-picked the top 10 to hold in 2024. You can be among the first to explore these newly unveiled stocks with massive potential.

PRA Group, Inc. (PRAA): Free Stock Analysis Report

Encore Capital Group Inc (ECPG): Free Stock Analysis Report

Virtu Financial, Inc. (VIRT): Free Stock Analysis Report

Rithm Capital Corp. (RITM): Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.