Fintel reports that on February 20, 2024, Stifel has reassessed their position on Healthcare Realty Trust (NYSE:HR), shifting their advice from Buy to Hold.

Analyst Price Forecast Predicts 32.51% Upside

As of January 20, 2024, the average one-year price target for Healthcare Realty Trust stands at 18.58. Forecasts range from a low of 16.16 to a high of $19.95. This presents a potential increase of 32.51% from its latest closing price of 14.02.

Find out which companies are leading in terms of price target upside on our leaderboard.

Healthcare Realty Trust is projected to achieve an annual revenue of 1,499MM, reflecting an 11.69% increase. The estimated annual non-GAAP EPS stands at -0.15.

Insight into Fund Sentiments

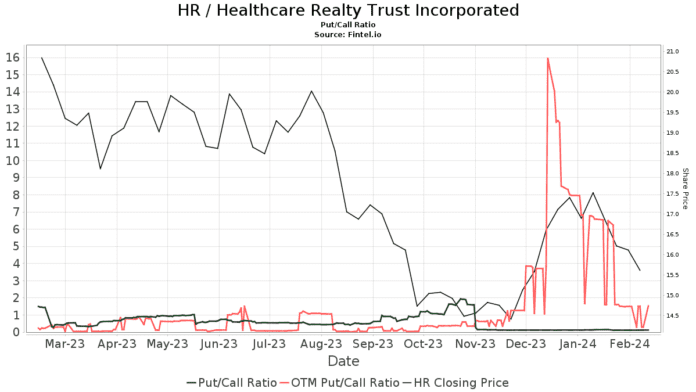

Currently, there are 802 funds or institutions that report positions in Healthcare Realty Trust. This shows an increase of 14 owners or 1.78% in the last quarter. The average portfolio weight allocated to HR by all funds is 0.28%, marking a decrease of 4.21%. Furthermore, institutions’ total shares in the company have grown by 2.07% in the past three months, amounting to 467,717K shares. The put/call ratio of HR is 0.07, signaling a bullish outlook.

Cohen & Steers currently holds 64,169K shares, representing 16.83% ownership of the company. Their recent filing indicated ownership of 64,410K shares, translating to a decrease of 0.38%. The firm reduced its portfolio allocation in HR by 1.05% over the last quarter.

Meanwhile, VGSIX – Vanguard Real Estate Index Fund Investor Shares holds 15,701K shares, accounting for 4.12% ownership. In their prior filing, the firm reported owning 16,046K shares, signifying a decrease of 2.20%. They decreased their portfolio allocation in HR by 14.62% in the last quarter.

Daiwa Securities Group holds 14,190K shares, representing 3.72% ownership of the company. Their previous filing showcased ownership of 14,406K shares, reflecting a decrease of 1.52%. The firm decreased its portfolio allocation in HR by 36.44% over the last quarter.

Moreover, APG Asset Management US holds 12,567K shares, amounting to 3.30% ownership. In their prior filing, the firm owned 11,218K shares, indicating an increase of 10.73%. Their portfolio allocation in HR decreased by 12.03% over the last quarter.

Lastly, Jpmorgan Chase holds 12,509K shares, representing 3.28% ownership. Their previous filing reported ownership of 1,128K shares, reflecting a remarkable increase of 90.98%. The firm augmented its portfolio allocation in HR by 989.22% during the last quarter.

Background on Healthcare Realty Trust

Healthcare Realty Trust is a real estate investment trust that specializes in owning, managing, financing, and developing income-producing real estate properties primarily associated with the delivery of outpatient healthcare services across the United States. As of September 30, 2020, the Company owned 211 real estate properties in 24 states, encompassing 15.5 million square feet and valued at approximately $5.5 billion. The Company offered leasing and property management services for 11.9 million square feet nationwide.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.