Markets

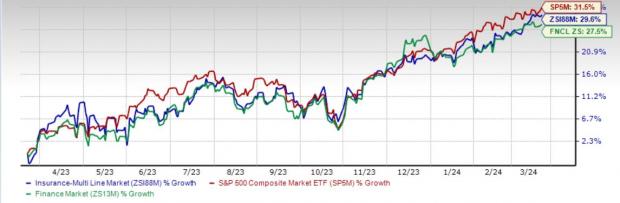

Insights from the Multiline Insurance Sector

The Ever-Evolving Landscape of Multiline Insurance Stocks

Embracing the Power of Diversification In an industry where risk can never be fully eradicated, the strategy of product diversification emerges as the knight ...

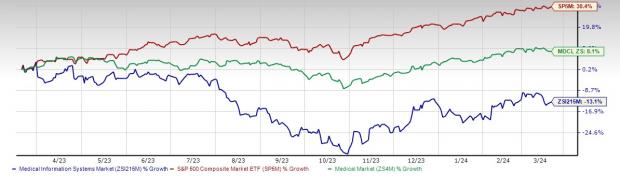

The Rising Tide in Medical Information Systems Industry

The past three years of health crisis have ushered in a veritable renaissance for the Medical Info Systems industry. Bolstered by a surge in ...

Insights on Investment: Growing Opportunities in Business Information Stocks

Insights on Investment: Growing Opportunities in Business Information Stocks

The business information industry, amidst the wave of remote work, is reaching unprecedented heights. Companies in the Zacks Business – Information Services sector, like ...

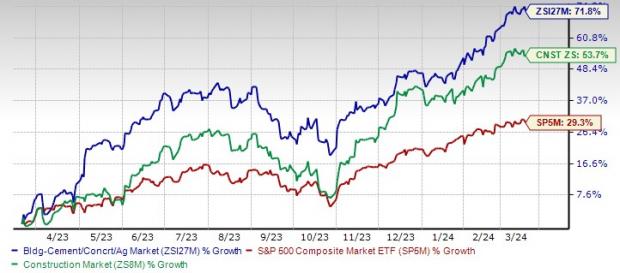

Investor Insights: Unveiling Opportunities in the Building Products Industry

Investor Insights: Unveiling Opportunities in the Building Products Industry

Embracing Growth in the Concrete & Aggregates Sector Despite looming uncertainties, the Zacks Building Products – Concrete & Aggregates industry is basking in a ...

Striking Disparity in Earnings Performance: Big vs Small Caps

A Glimpse Into Earnings Season Trends As the curtain nears on Q4 earnings season, a tale of two sectors unfolds. With 95% of S&P ...

Exploring Opportunities in the Consumer Loan Sector

Exploring Opportunities in the Consumer Loan Sector

Challenges and Optimism in the Landscape The Zacks Consumer Loans industry grapples with high inflation and looming economic slowdown, casting a shadow on consumer ...

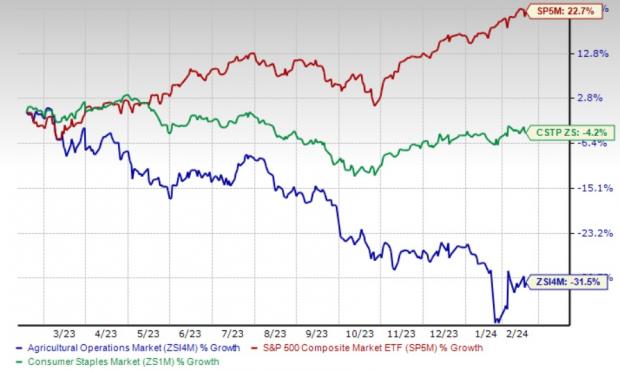

The Landscape of Agricultural Operations Stocks Amidst Inflationary Tides

The agriculture industry has been navigating through a tempestuous terrain. The Zacks Agriculture – Operations industry encompasses a myriad of challenges that impact productivity, ...

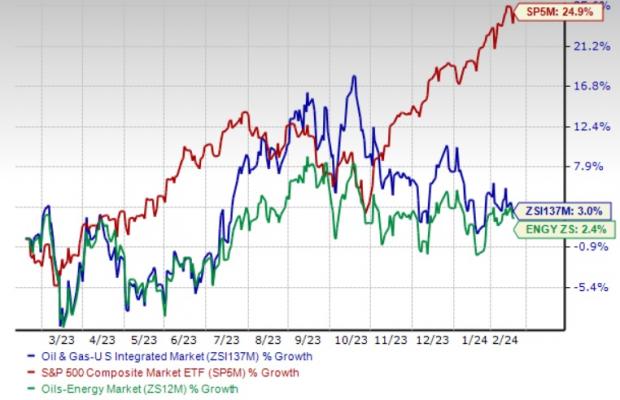

3 Integrated Energy Stocks Thriving Against the Odds

Determined Companies Stand Strong The volatile nature of upstream business in the integrated energy sector often means susceptibility to oil and gas price fluctuations. ...

Market Reacts to CPI Data | Nasdaq

Investor Panic Grips Market as CPI Data Drives Selloff

Market Meltdown Wednesday’s CPI report triggered a market selloff, particularly hitting small caps. Both the Nasdaq-100 ETF and Nasdaq Mid-Caps ETF fell nearly 2% ...

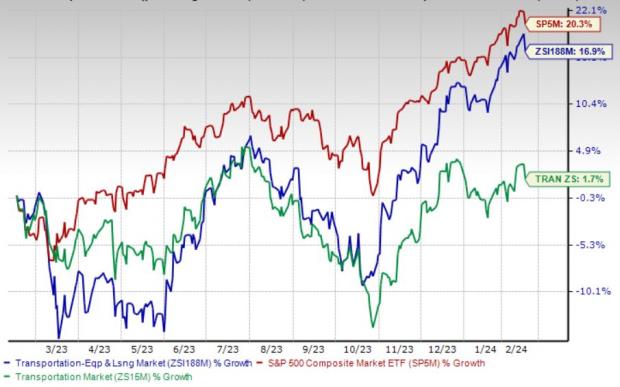

3 Stocks to Watch From the Transport Equipment & Leasing Sector

3 Stocks to Watch From the Transport Equipment & Leasing Sector

The current investor-friendly steps in the Transportation – Equipment and Leasing industry provide a solid foundation for growth. However, challenges such as inflation, interest ...