As February unfurls, stocks remain robust, evoking optimism among investors and painting a picture of wealth accumulation. Amid this market fervor, three stocks, namely Pegasystems PEGA, AppLovin APP, and Medpace MEDP, have emerged as luminaries, embodying the essence of outperformance.

Embracing the Strength of Relative Performance

Relative strength, a beacon for investors seeking fruitful ventures, showcases stocks that exhibit superior performance compared to the market or relevant benchmarks. By gravitating towards such bullish stocks, investors position themselves amidst favorable market trends dominated by buyers.

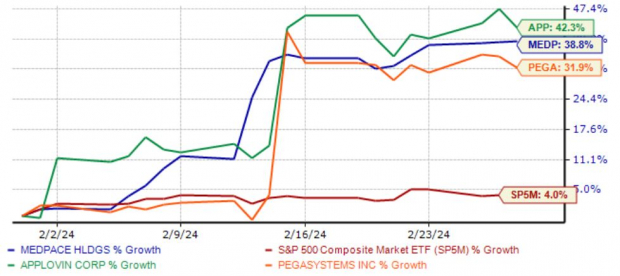

For the momentum enthusiasts, the past month has seen all three stocks surpass expectations, basking in an upward trajectory as depicted below.

Image Source: Zacks Investment Research

Let’s delve deeper into each of these stellar performers.

Unveiling Pegasystems

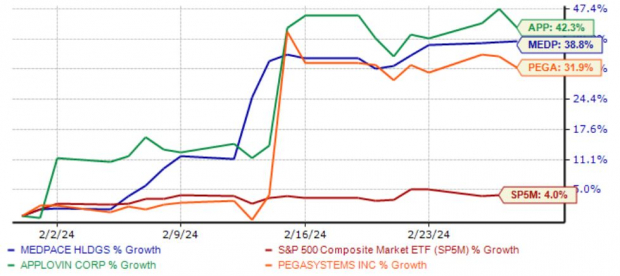

Pegasystems, donned with a Zacks Rank #2 (Buy), is a key player in Customer Relationship Management software, facilitating transaction-heavy organizations in managing various customer interactions. Prompted by a robust Q4 and FY23 release, analysts soared in their expectations for the company.

Image Source: Zacks Investment Research

PEGA witnessed a stellar FY23, witnessing an 11% surge in annual contract value along with record-breaking free cash flow. The market responded zealously, propelling the company’s stock prices. The growth in PEGA’s top line attests to its accelerating trajectory.

Trading at lofty multiples indicative of its anticipated growth, Pegasystems stands at a forward earnings multiple (F1) of 23.7X. With an anticipated 12% surge in earnings and 5% revenue growth in the current year, the company holds a Style Score of ‘D’ for Value.

Exploring AppLovin

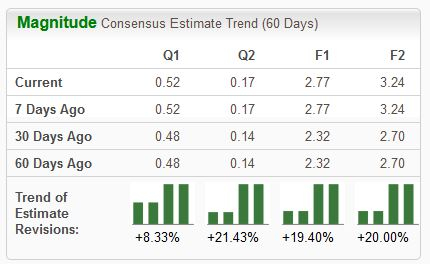

AppLovin, leveraging its proprietary tech and software solutions to enhance app monetization and data-driven marketing, stands tall with a Zacks Rank #1 (Strong Buy). The company’s earnings forecasts have witnessed an upward surge across the board.

Image Source: Zacks Investment Research

AppLovin’s quarterly results underscore its remarkable performance, consistently surpassing the Zacks Consensus EPS estimate by an average of 26% over the last four releases. In its latest quarter, the company raked in $953 million in revenue, boasting a 36% year-over-year growth.

The growth trajectory of AppLovin is striking, backed by a Style Score of ‘A’ for Growth. Current consensus estimates signal a remarkable 150% surge in earnings and a 23% uptick in sales for the current year, with expectations for FY25 projecting improvements of 24% and 10%, respectively.

The Resilience of Medpace

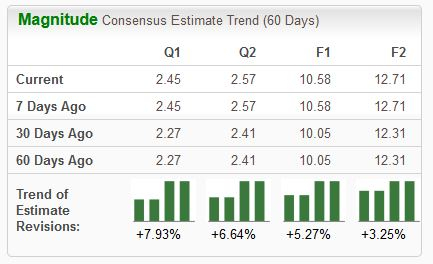

Medpace, a globally renowned clinical research organization offering services to the life sciences sector, has captured the spotlight with analysts elevating their earnings projections, hoisting the stock to a prestigious Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

While the company rides high on its momentum, the valuation outlook appears slightly stretched, as signified by a Style Score of ‘F’ for Value. Medpace’s current forward earnings multiple (F1) stands at 38.2X, significantly above the 29.6X five-year median and the Zacks Medical Services industry average of 14.1X.

Image Source: Zacks Investment Research

The Final Takeaway

As February ushers in its often-chilly market demeanor, the month has birthed champions in Pegasystems PEGA, AppLovin APP, and Medpace MEDP. Marked not only by momentum but also by favorable Zacks ranks, these stocks paint a picture of vibrancy amidst market trends.

Remember, in a market that oscillates like a fickle lover, these stocks are like a reliable partner – offering stability, growth, and potential returns that whisper promises of a bright financial future.