Over the past five decades, S&P Global (NYSE: SPGI) has steadily raised its dividend payout, proving to be a reliable dividend stock you can count on. The company enjoys a robust business model and economic moat that provide it with a steady stream of cash flow. The past few years have been challenging for the business, but 2024 looks like it’s shaping up to be a rebound year. Is now the time to buy S&P Global?

S&P Global has a robust economic moat

When companies borrow money from the public, it’s important for prospective investors to understand the company’s health, whether it will be able to repay its debts, and the risks associated with investing in that debt. Corporate credit rating agencies, like S&P Global, assess the creditworthiness of bonds from corporations, governments, or other instruments to help investors manage their risks.

Making it in the credit rating business is not easy. For one, there are regulatory hurdles that companies must overcome that make barriers to entry quite high. Not only that, but it takes a significant time to build a reputation and gain investors’ trust.

As a result, three credit rating agencies dominate the industry: S&P Global (50% market share), Moody’s Corporation (32% market share), and Fitch Ratings (12% market share). This strong position gives S&P Global an attractive economic moat around its business, providing incredible stability and cash flows.

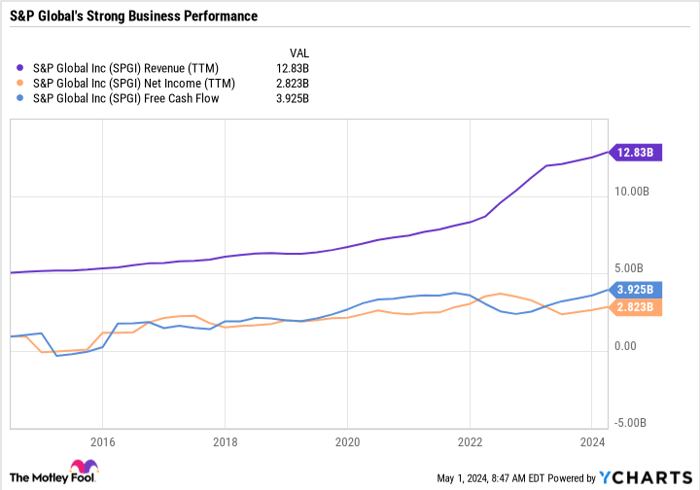

Free cash flow (FCF) shows a company’s leftover cash after accounting for operating expenses and capital assets. This is a good measure of a company’s health and represents money that a company can use to pay down debt, pay to investors through dividends or share purchases, or invest back into growing the business. Last year, S&P Global generated $3.9 billion in FCF.

SPGI Revenue (TTM) data by YCharts

S&P Global projects better-than-expected growth in 2024

The past few years have been challenging for the credit ratings business. In 2022, S&P Global completed a $44 billion, all-stock deal to acquire IHS Markit. The deal expanded S&P Global’s information and analytics offerings. However, the large investment also weighed on the company’s return on invested capital and put pressure on the stock price.

At the same time, the Federal Reserve began aggressively raising interest rates in response to rising inflationary pressures. What followed was the fastest pace of interest rate increases in four decades.

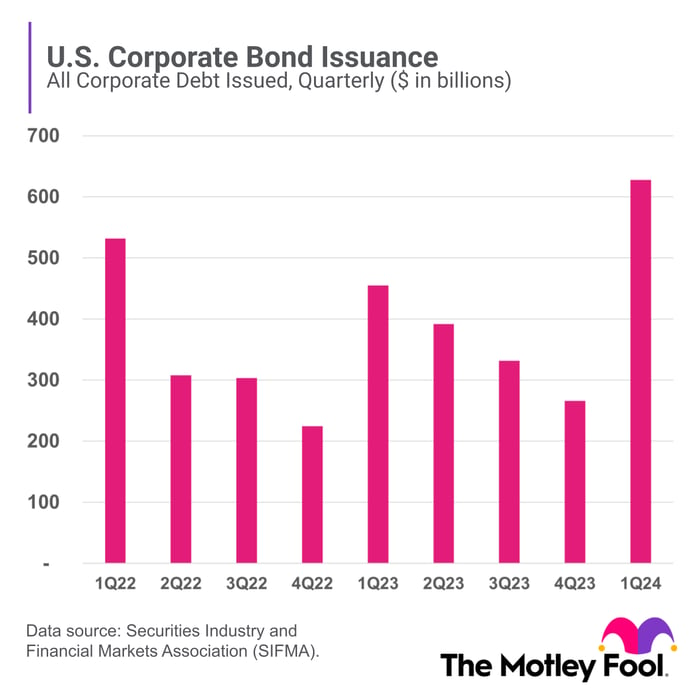

Rapidly rising interest rates and volatility across bond and equity markets kept many issuers on the sidelines. According to the Securities Industry and Financial Markets Association (SIFMA), nearly $2 trillion in corporate bonds were issued in 2021. This fell to $1.4 trillion amid tightening market conditions in 2022, and a similar amount of issuance occurred last year. As a result, S&P Global’s credit rating revenue and income took a hit, while robust performance from its data analytics offerings helped counteract some of the decline.

Conditions are improving. During the first-quarterearnings call Doug Peterson, President and Chief Executive Officer of S&P Global, told investors that “we saw the highest level of debt issuance since 2021.” The company saw billed issuance (customers who issued debt and sought a rating from the agency) of around $1 trillion during the quarter, up 45% from last year.

Chart by author.

Issuers across the spectrum, including investment-grade, high-yield, and bank loan volumes were all up in the first quarter amid favorable financing conditions. Much of the issuance was related to refinancing, as companies took advantage of the relatively calm credit markets in the first quarter.

Is it a buy?

Improving conditions have led the company to raise its revenue growth projections for its rating business. It also raised diluted earnings per share (EPS) guidance by $0.10 to $11.05 on the high end, which would be a 34% increase from last year.

Thanks to its robust economic moat and stellar cash flows, S&P Global has been a top stock for long-term investors. The company has shown its resilience by raising its payout despite challenging market conditions and is a solid blue chip stock for the long haul.

Should you invest $1,000 in S&P Global right now?

Before you buy stock in S&P Global, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and S&P Global wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $544,015!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of May 3, 2024

Courtney Carlsen has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Moody’s and S&P Global. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.