Accuray Incorporated ARAY is gearing up for substantial growth in the upcoming quarters, riding on sustained robust demand for its products. While the company’s recent performance in the second quarter of fiscal 2024 and the potential of its Precision Treatment Planning System (TPS) are promising, it continues to grapple with the challenges of over-reliance on technologies and rigorous competition.

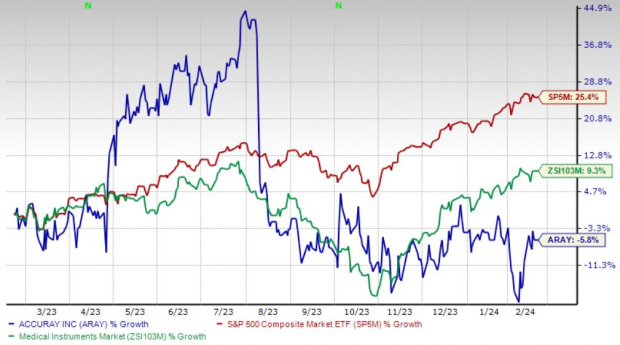

Over the last year, this Zacks Rank #3 (Hold) stock has faced a decline of 5.8%, in stark comparison to the 9.3% increase in the larger industry. A comparison with the S&P 500 reveals a remarkable 25.4% growth in the same period.

With a market capitalization of $275.7 million, Accuray anticipates a robust 50% growth for fiscal 2024 and endeavors to sustain its commendable performance in the coming period. The company’s favorable P/S ratio of 0.6 stands in stark contrast to the industry’s 3.5, highlighting its strong position in the market.

Image Source: Zacks Investment Research

Let’s delve into the reasons behind this resilience.

Solid Product Demand

Accuray’s products have been experiencing strong customer adoption over the past few months, generating noticeable optimism. During the earnings call in January for the second quarter of fiscal 2024, the management confirmed the company’s robust global demand for installation. Notably, the company concluded the quarter with a year-over-year increase in its global installed base of systems, especially driven by the Asia–Pacific (APAC) region, which achieved a milestone of 250 installed systems, underscoring it as one of Accuray’s fastest-growing installed base regions.

In the same month, Accuray revealed the Providence Swedish Radiosurgery Center in Seattle, WA, is reinforcing its cancer treatment capabilities with the acquisition of the latest generation CyberKnife S7 System.

Potential in Precision TPS

There is a sense of optimism surrounding the Accuray Precision TPS, which offers an efficient method for clinicians to craft high-quality radiation therapy treatment plans across various cases. It encompasses features such as multi-modality image fusion with a unique deformable image registration algorithm, a comprehensive set of contouring tools, and options for AutoSegmentation auto contouring for specific body areas.

Strong Q2 Results

Accuray’s performance in the second quarter of fiscal 2024 has infused optimism. The company witnessed impressive Services revenues, with a particularly strong showing in the EIMEA (Europe, India, Middle East and Africa) and Japan regions. Notably, the APAC region registered substantial year-over-year order growth, with significant strength in China. The company’s expansion of the global installed base augurs well for its future prospects.

Downsides

Stiff Competition: The medical device industry, especially the non-invasive cancer treatment segment, is witnessing intense and escalating competition, accompanied by rapid technological advancements. To thrive in this environment, Accuray must continually demonstrate the advantages of its products and technologies over established alternative procedures and other counterparts, and persuade physicians and healthcare decision makers of their benefits.

Overdependence on Technologies: Winning consumer and third-party payer acceptance of the CyberKnife and TomoTherapy platforms as the preferred methods of tumor treatment is pivotal to Accuray’s sustained success. The prospect of Accuray’s products failing to gain significant market acceptance among consumers and healthcare payors despite substantial time and expenses being spent on their education poses a potential challenge to the company’s performance.

Estimate Trend

Accuray has been witnessing a positive estimate revision trend for fiscal 2024. Over the past 90 days, the Zacks Consensus Estimate for its earnings has improved from a loss of 7 cents per share to a loss of 5 cents per share. The Zacks Consensus Estimate for third-quarter fiscal 2024 revenues stands at $114.6 million, indicating a modest 2.9% decline from the year-ago reported number.

Key Picks

Some noteworthy stocks in the broader medical space include DaVita Inc. DVA, Cardinal Health, Inc. CAH, and Integer Holdings Corporation ITGR.

DaVita, holding a Zacks Rank #1 (Strong Buy), boasts of an estimated long-term growth rate of 12.1%. Its earnings have consistently surpassed estimates in each of the past four quarters, with an average surprise of 35.6%. DaVita’s shares have soared 47.1% compared to the industry’s 11.6% rise over the last year.

Cardinal Health, currently sporting a Zacks Rank of 2 (Buy), has an estimated long-term growth rate of 15.9%. The company has outperformed earnings estimates in each of the last four quarters, with an average surprise of 15.6%. Cardinal Health has surged 33.6% compared to the industry’s 11.3% increase over the past year.

Integer Holdings, holding a Zacks Rank of 2 at present, has an estimated long-term growth rate of 15%. Its earnings have surpassed estimates in each of the past four quarters, with an average surprise of 11.5%. Integer Holdings’ shares have rallied 34.9% compared to the industry’s 9.3% rise in the past year.

Just Released: Zacks Top 10 Stocks for 2024

Hurry – you can still get in early on our 10 top tickers for 2024. Hand-picked by Zacks Director of Research, Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2023, the Zacks Top 10 Stocks gained +974.1%, nearly TRIPLING the S&P 500’s +340.1%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2024. You can still be among the first to see these just-released stocks with enormous potential.

Accuray Incorporated (ARAY) : Free Stock Analysis Report

DaVita Inc. (DVA) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Integer Holdings Corporation (ITGR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.