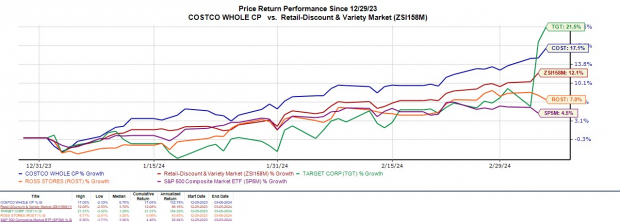

After witnessing its peers in the Zacks Retail-Discount Industry deliver robust quarterly results this week, the stock of Costco (COST) is on an upward trajectory as it gears up to release its fiscal second-quarter report on March 7th.

Ross Stores (ROST) and Target (TGT) comfortably exceeded earnings expectations, leading to a more than 10% surge in Target’s stock. With Costco’s shares up 17% year-to-date, investors are contemplating riding the wave of momentum that Ross Stores and Target have enjoyed.

Image Source: Zacks Investment Research

Preview of Q2 & Expansion into International Markets

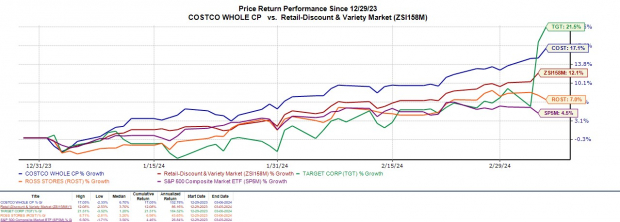

Costco’s Q2 earnings are forecasted to increase by 9% to $3.60 per share, with a sales projection of 7% growth to $59.2 billion. The Zacks ESP (Expected Surprise Prediction) indicates Costco might outperform bottom-line expectations, with the Most Accurate Estimate pointing to Q2 EPS of $3.64 a share, 1% above the Zacks Consensus.

Image Source: Zacks Investment Research

Costco’s growth has been bolstered by its expansion into Canada and other global markets, with warehouses in Europe, Mexico, Japan, Korea, Australia, Taiwan, and China. The company’s presence in international e-commerce sites has contributed to exceeding earnings expectations in the last four quarters, with an average earnings surprise of 2.62%.

Image Source: Zacks Investment Research

Growth Trajectory & Future Outlook

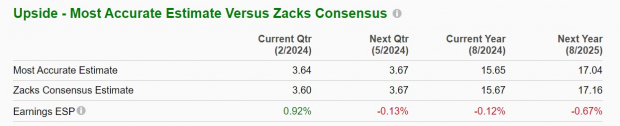

Costco’s annual earnings are anticipated to rise by 6% in fiscal 2024, with a further 9% increase in FY25 to $17.16 per share. Total sales are expected to climb by 4% this year and skyrocket by 7% in FY25 to $271.65 billion.

FY25 projections signal a remarkable 38% sales growth and a substantial 55% surge in earnings over the last five years, showcasing promising prospects for the company’s future.

Image Source: Zacks Investment Research

Conclusion

The captivating journey of Costco’s growth and its notable international expansion make it an appealing prospect for investors. Holding a Zacks Rank #2 (Buy) at present, the uptrend in FY24 and FY25 earnings estimates suggests that Costco is on track to surpass expectations, fueling this year’s rally further.

Explore Zacks’ Picks for $1 Only

Download 7 Best Stocks for the Next 30 Days from Zacks Investment Research

Costco Wholesale Corporation (COST): Free Stock Analysis Report

Target Corporation (TGT): Free Stock Analysis Report

Ross Stores, Inc. (ROST): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.