The stock market’s tremendous run in 2023 made way for some of last year’s top performers to experience pullbacks. Griffon Corporation (GFF) and The Andersons (ANDE), two high-growth stocks boasting a Zacks Rank #1 (Strong Buy), have seen recent dips, presenting an opportune moment for investors.

Performance Overview

Griffon, a diversified management holding company, witnessed a remarkable 52% surge in its stock over the past year. On the other hand, The Andersons, known for its diverse agricultural operations, saw a 45% climb in its shares. The versatility of their business operations has driven substantial profitability in recent years.

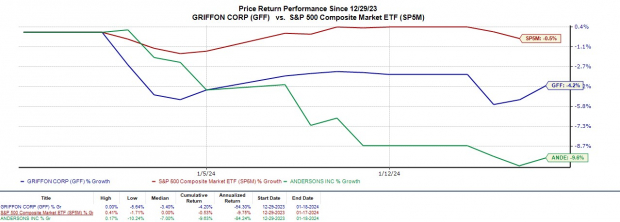

In the current year, Griffon’s stock has descended by 4%, while The Andersons’ stock has retreated by 9%. Despite this, over the past three years, both Griffon and The Andersons have outperformed broader indexes, with their shares skyrocketing by 146% and 102%, respectively.

Growth Trajectories & Profitability

Griffon is anticipated to witness a 2% increase in annual earnings for fiscal 2024, followed by a 20% rise in FY25 to reach $5.56 per share. Notably, FY25 EPS projections signify a remarkable 227% growth over the past five years. The company’s earnings estimate revisions for FY24 and FY25 have shown a positive trend over the last 60 days, indicating potential upside.

Conversely, The Andersons may face a challenging fiscal 2022; however, it is expected to close FY23 with an EPS of $2.92, reflecting a decline of 28%. Nevertheless, earnings are projected to rebound with a substantial 32% leap to $3.86 per share in the current year, signifying a robust post-pandemic recovery compared to the scant $0.09 per share in fiscal 2020.

Takeaway

Amid recent market volatility, Griffon Corporation and The Andersons present appealing “buy the dip” prospects due to their enhanced profitability and robust bottom lines in recent years.

Zacks Reveals ChatGPT “Sleeper” Stock

Within the thriving Artificial Intelligence sector, a little-known company is poised for significant growth. The AI industry, forecasted to yield an economic impact comparable to that of the internet and iPhone by 2030, is the focal point. To aid investors, Zacks is offering a bonus report detailing this high-growth stock, along with four other “must buys” and more.

Download Free ChatGPT Stock Report Right Now >>

Access the Free Stock Analysis Report for The Andersons, Inc. (ANDE)

Explore the Free Stock Analysis Report for Griffon Corporation (GFF)

Please note that the views and opinions expressed herein are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.