Driven by a rebound in travel-related services following the pandemic, Uber Technologies UBER has been one of the market’s best performers in recent years.

Striving to increase its profitability since going public in 2019, Uber has created a competitive advantage in the mobility market due to its vast network of drivers and customers. To that point, in addition to its traditional ride-hailing app, Uber’s business model also includes food delivery services via Uber Eats which has separated the company from its rival Lyft LYFT.

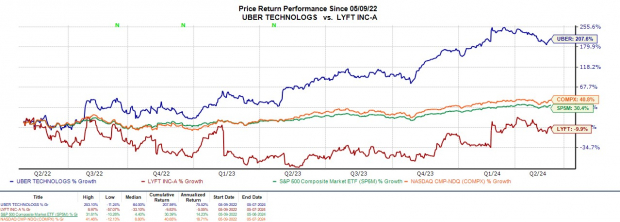

Notably, Uber’s stock has been on a tear over the last two years, soaring over +200% to impressively top the strong performances of the broader indexes and Lyft’s -9%. Furthermore, Uber’s stock is already up +16% year to date which has edged Lyft’s +13%, and the S&P 500 and Nasdaq’s +9%.

Given Uber’s strong price performance, investors have largely anticipated the company’s first quarter results on Wednesday, May 8. With that being said, let’s see why now still appears to be a good time to buy Uber’s stock as earnings approach.

Image Source: Zacks Investment Research

Q1 Growth Expectations

Uber’s Q1 sales are thought to have increased 14% to $10.08 billion compared to $8.82 billion a year ago. More importantly, Q1 EPS is expected to climb swing to $0.21 versus an adjusted loss of -$0.08 a share in the comparative quarter. This comes as Uber most recently obliterated Q4 earnings expectations by 340% in February with EPS at $0.66 compared to the Zacks Consensus of $0.15 a share.

Image Source: Zacks Investment Research

International Expansion

Also fueling Uber’s growth is international expansion outside of the United States and Canada which further distinguishes its operations from Lyft. Uber’s Europe, Middle East, and Africa operating segment has been the most lucrative outside of North America. Last quarter, the Europe, Middle East, and Africa segment sales increased 35% to $2.83 billion and came in 10% above estimates of $2.56 billion. Plus, Q1 sales for the segment are expected to rise 28% year over year to $2.68 billion based on Zacks estimates.

Image Source: Zacks Investment Research

Growth Trajectory

Overall, Uber’s total sales are projected to jump 16% in fiscal 2024 to $43.32 billion compared to $37.28 billion last year. Even better, FY25 sales are forecasted to climb another 17% with projections over $50 billion. Annual earnings are expected to soar 41% this year to $1.23 per share versus $0.87 a share in 2023. More impressive, FY25 EPS is projected to increase another 66% to $2.04 per share.

Image Source: Zacks Investment Research

Average Zacks Price Target & Broker Recommendations

Reassuringly, the Average Zacks Price Target of $85.54 a share suggests 19% upside in Uber’s stock from current levels.

Image Source: Zacks Investment Research

It’s also noteworthy that 35 of the 41 brokers covering Uber’s stock and offering data to Zacks have a strong buy rating. At the moment, UBER has a very convincing average broker recommendation of 1.22 on a scale of 1 to 5 (Strong Buy to Strong Sell).

Image Source: Zacks Investment Research

Bottom Line

Uber has started to deliver on the lofty growth expectations the company foreshadowed when going public. Better still, earnings estimate revisions for FY24 and FY25 are slightly up over the last 30 days landing Uber’s stock a Zacks Rank #1 (Strong Buy) ahead of its Q1 report.

Where Will Stocks Go…

If Biden Wins? If Trump Wins?

The answers may surprise you.

Since 1950, even after negative midterm years, the market has never had a lower presidential election year. With voters energized and engaged, the market has been almost unrelentingly bullish no matter which party wins!

Now is the time to download Zacks’ free Special Report with 5 stocks that offer extreme upside for both Democrats and Republicans…

1. Medical manufacturer has gained +11,000% in the last 15 years.

2. Rental company is absolutely crushing its sector.

3. Energy powerhouse plans to grow its already large dividend by 25%.

4. Aerospace and defense standout just landed a potentially $80 billion contract.

5. Giant Chipmaker is building huge plants in the U.S.

Hurry, Download Special Report FREE >>

Lyft, Inc. (LYFT) : Free Stock Analysis Report

Uber Technologies, Inc. (UBER) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.