Fintel has reported that on February 20, 2024, UBS progressed from a “Neutral” stance to a “Buy” position on US Foods Holding (NYSE:USFD).

Analyst Price Forecast Indicates 6.20% Upside

As of January 19, 2024, the average one-year price target for US Foods Holding stands at 52.89. Forecasts range from a low of 45.45 to a high of $63.00. This average price target represents a 6.20% increase from its latest reported closing price of 49.80.

For those interested, check out our leaderboard of companies with the largest price target upside.

The projected annual revenue for US Foods Holding is 38,626MM, reflecting an 8.51% increase. Additionally, the projected annual non-GAAP EPS is 3.32.

Fund Sentiment Overview

Currently, there are 932 funds or institutions reporting positions in US Foods Holding. Notably, this marks an increase of 54 owners, or 6.15% in the last quarter. The average portfolio weight of all funds dedicated to USFD stands at 0.47%, a decrease of 2.46%. Moreover, total shares owned by institutions experienced a 0.36% increase in the last three months, amounting to 297,854K shares.

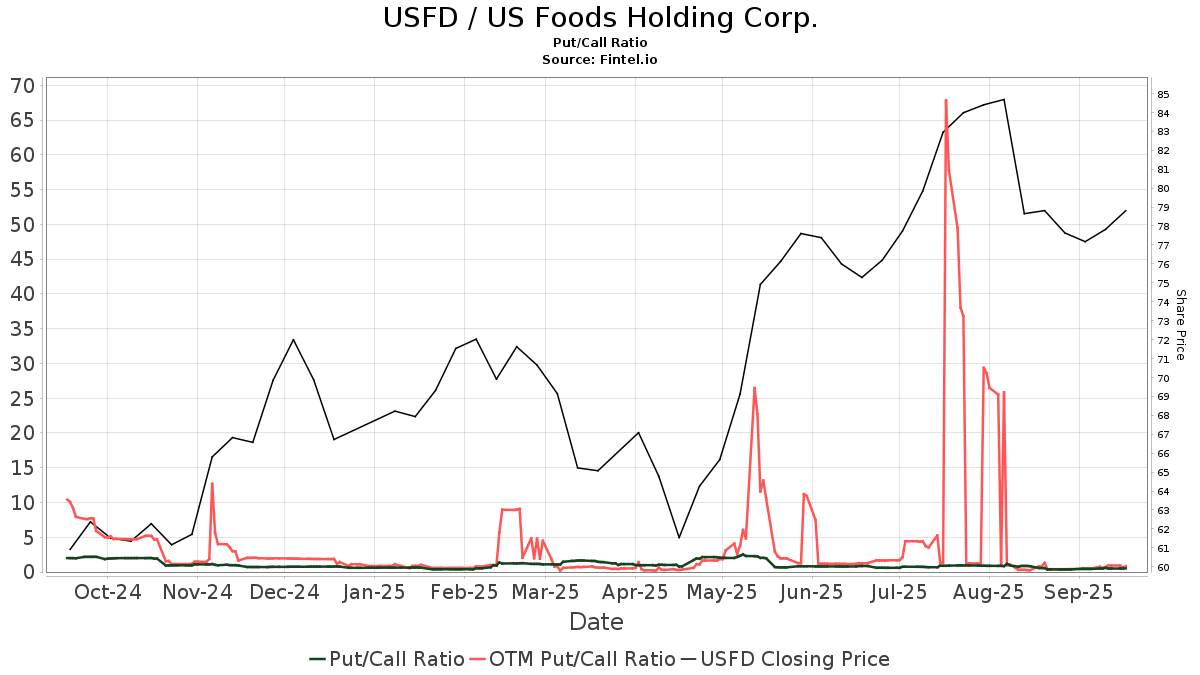

The put/call ratio of USFD currently stands at 2.92, indicating a bearish outlook according to the data.

Boston Partners currently holds 15,962K shares, representing 6.49% ownership of the company. This marks a significant decrease of 14.73%, with a 4.56% decrease in the firm’s portfolio allocation in USFD over the last quarter.

Additionally, Sachem Head Capital Management owns 15,933K shares, representing 6.48% ownership of the company. Similarly, there has been a notable decrease of 18.83%, with a 3.55% reduction in the firm’s portfolio allocation in USFD over the last quarter.

Invesco holds 9,489K shares equating to 3.86% ownership of the company. There has been a decrease of 9.16%, with a substantial 91.56% decrease in the firm’s portfolio allocation in USFD over the last quarter.

Victory Capital Management owns 9,221K shares, representing 3.75% ownership of the company. Interestingly, there has been an impressive increase of 49.55%, with a significant 107.49% surge in the firm’s portfolio allocation in USFD over the last quarter.

Lastly, Clarkston Capital Partners owns 7,974K shares, amounting to 3.24% ownership of the company, with a marginal decrease of 0.62% and an evident 7.30% increase in the firm’s portfolio allocation in USFD over the last quarter.

Insight into US Foods Holding

(This description is provided by the company.)

US Foods is one of America’s esteemed food companies and a leading foodservice distributor, joining forces with approximately 300,000 restaurants and foodservice operators to bolster their business success. With 70 broadline locations and 78 cash and carry stores, US Foods offers its customers a wide-ranging and innovative food selection along with a comprehensive suite of e-commerce, technology, and business solutions. The company’s headquarters are based in Rosemont, Ill.

Fintel presents one of the most extensive investing research platforms accessible to individual investors, traders, financial advisors, and small hedge funds.

Our data encompasses a global scope, including fundamentals, analyst reports, ownership data and fund sentiment, options sentiment, insider trading, options flow, unusual options trades, and much more. Furthermore, our exclusive stock picks are powered by advanced, backtested quantitative models for optimized profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.