The technology sector has been a raging bull in the stock market, growing over 250% in the last decade. With the potential for lofty gains, investors are on the prowl for promising tech stocks that won’t burn a hole in their pockets.

Therefore, considering the affordable yet high-potential tech stocks in the Zacks Computer and Technology sector, there’s no better time than now to dive into these opportunities.

Image Source: Zacks Investment Research

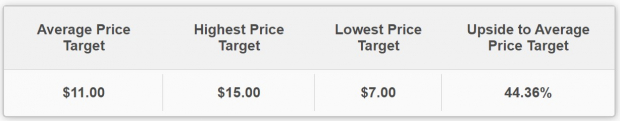

The Gem: eGain (EGAN)

As part of the top-rated Zacks Internet-Software Industry, eGain is a diamond in the rough, providing customer engagement solutions. With its stock currently trading at around $7, eGain’s future looks promising with earnings estimate revisions on the rise. Additionally, its current fiscal 2024 earnings estimates have soared and the stock is projected to trade with a notable discount, presenting a staggering 44% upside potential according to Zacks Price Target.

Image Source: Zacks Investment Research

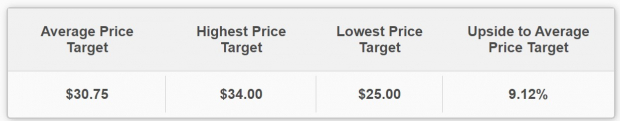

The Hidden Jewel: TTM Technologies (TTMI)

TTM Technologies, a leader in circuit board manufacturing, boasts a compelling combination of value and growth. With earnings estimates on the rise, the stock presents an impressive 18% upside potential according to the Average Zacks Price Target. Trading at a hefty discount to its industry average, the stock appears to be a diamond in the rough.

Image Source: Zacks Investment Research

Others to Keep an Eye On

In addition to eGain and TTM Technologies, Dropbox and Upwork are also rising stars worth watching. With the booming Zacks Internet-Services Industry, these stocks offer promising earnings potential that investors should not overlook.

Image Source: Zacks Investment Research

Conclusion: Bulls Unleashed

The prospects of these affordable tech stocks, fueled by rising earnings estimates, signify an imminent takeover. Despite the Nasdaq’s impressive run, these stocks are poised for abundant upside and are prime candidates for buy-the-dip strategies after any market correction.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

TTM Technologies, Inc. (TTMI) : Free Stock Analysis Report

eGain Corporation (EGAN) : Free Stock Analysis Report

Dropbox, Inc. (DBX) : Free Stock Analysis Report

Upwork Inc. (UPWK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.