Unveiling Wall Street’s Whisper

Brokerage recommendations are akin to the heralds of Wall Street, chanting their endorsements in the ears of investors. The saga of BorgWarner (BWA) is no different — a tale of analyst ratings that often sway stock prices. But, do these whispers hold the weight of wisdom?

Before delving into the labyrinth of brokerage recommendations and how they can shape your investment choices, let’s peep into the verdict of the Wall Street mavens for BorgWarner.

BorgWarner presently boasts an Average Brokerage Recommendation (ABR) of 1.83; a number dancing between ‘Strong Buy’ and ‘Buy’ on the 1 to 5 scale. This score is a concoction of the recommendations (Buy, Hold, Sell, etc.) furnished by 15 brokerage firms.

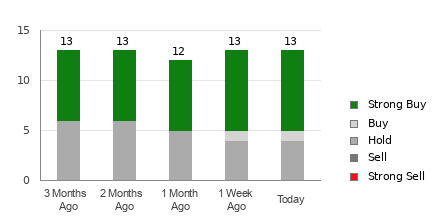

In this symphony of recommendations, eight sing the tune of ‘Strong Buy,’ while one hums ‘Buy.’ A chorus dominated by the fervor for BorgWarner, with ‘Strong Buy’ and ‘Buy’ resounding at 53.3% and 6.7%, respectively.

Decoding Brokerage Recommendation Trends for BWA

Explore BorgWarner’s price target & stock forecast here>>>

The siren call of a bullish ABR may lure you, but anchoring your investment solely on this number could be tantamount to navigating turbulent waters blindfolded. Studies suggest that the guidance offered by brokerage recommendations often fails to steer investors towards stocks with the most promising price appreciation.

Curious as to why this melody might be discordant? The symphony of brokerage recommendations is often orchestrated by a strong positive bias, orchestrated by the vested interests of the analysts in the stocks they cover. For every bleak ‘Strong Sell’ uttered, five exuberant ‘Strong Buy’ cries echo, painting a picture where analysts’ interests may not harmonize with those of retail investors.

Thus, while these ratings may not be the gospel truth, they could serve as a tuning fork for validating your research or as a clue to a reliable price predictor.

The Zacks Rank Versus ABR

Now, peering into the distinctions between the Zacks Rank and ABR is akin to comparing apples to oranges. While both perch on a 1 to 5 scale, their genetic makeup couldn’t be more dissimilar.

Broker recommendations birth the ABR, often bedecked in decimals, with the Zacks Rank donning a robe of whole numbers. Where analysts swathed in brokerage fabric may lean towards optimism, the Zacks Rank is crafted from the fabric of earnings estimate revisions, a marker known to correlate strongly with short-term stock price movements.

The Zacks Rank, akin to a well-tended garden, is ever-fresh. As brokerage analysts fervently prune their earnings estimates to reflect the fluctuating tides of business, the Zacks Rank blossoms promptly, offering a glimpse into future price trajectories.

Is BWA a Gem or a Gamble?

The whispers of earnings estimate revisions for BorgWarner murmur of a Zacks Consensus Estimate for the current year, with a 7.8% decline over the past month to $3.93.

This melancholic chorus of analysts, aligning in revising EPS estimates southward, ushers BorgWarner into the realms of a Zacks Rank #4 (Sell). A cautionary tale or a storm in a teacup?

Hence, treading with caution might be wise when following the Buy-scented ABR for BorgWarner.

Just Released: Zacks Top 10 Stocks for 2024

Hurried whispers echo that it’s not too late to lay hands on the 10 top dancers of 2024. As choreographed by Zacks Director of Research, Sheraz Mian, this ensemble has spun tales of staggering success. Tripling the S&P 500’s gains, the Zacks Top 10 Stocks beckon, promising a waltz through a garden of potential.

Witness the New Top 10 Stocks >>

To absorb this tale on Zacks.com, rendezvous here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.