“`html

Central Banks in Turmoil: A Closer Look at Monetary Policy and Tech Investments

Recently, central banks have made headlines for their puzzling statements and decisions. A Federal Reserve Governor boldly claimed that the Fed has endless dollars, yet dismissed Bitcoin’s worth as nonexistent. Meanwhile, the European Central Bank (ECB) cut interest rates while warning of rising inflation. This scenario highlights a deeper issue: none of these banks seem inclined to reduce spending, which is necessary to address impending financial crises in Japan, the EU, the UK, and the US. China’s economic outlook also appears shaky.

In the past month, tech giants like Google GOOG, Amazon AMZN, and Microsoft MSFT have announced plans to invest in nuclear energy to power their AI data centers. Are you aware of how these moves could impact your investment strategy? A surge in demand for new energy sources is also evident from Taiwan Semiconductor TSM, which exceeded earnings projections thanks to increased AI chip sales. Interestingly, a finance student at the University of Tennessee posed a question about Bitcoin’s value, leading DKI to suggest that perhaps they exhibited more common sense than a Fed Governor. Kudos to the Vols!

This week, we’ll explore the following topics:

-

Fed Governor declares that the Fed has limitless cash but insists Bitcoin BTC/USD is worthless. Surely, he isn’t aware he shattered the irony meter.

-

Google and Amazon invest in nuclear energy to support their AI data centers.

-

Taiwan Semiconductor beats earnings, signaling a growing demand for AI chips. This is positive news for Nvidia and nuclear energy suppliers.

-

The European Central Bank reduces rates while predicting increased inflation. We would consider sending them an irony meter, but it’s already broken due to the Fed’s comments.

-

A student inquiry raises questions about Bitcoin’s value, with University of Tennessee finance students stepping up with insightful inquiries.

Intern Andrew has returned from a memorable trip with his grandfather, relieving Intern Alex of some of their workload. Both interns bring significant skills to the team, and their full presence is welcomed.

Are you prepared for a week dominated by questionable monetary policies and absurd remarks? Let’s take a closer look:

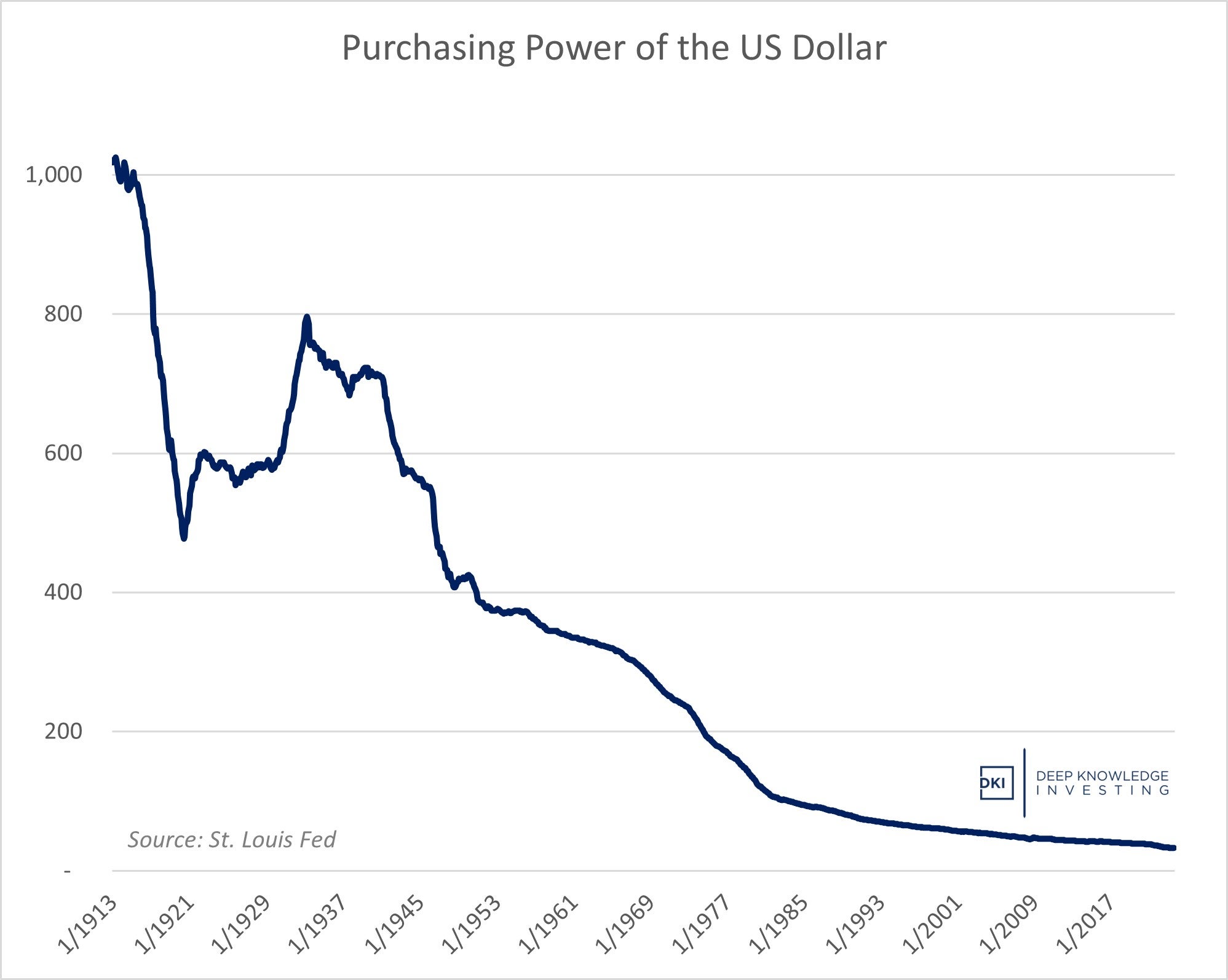

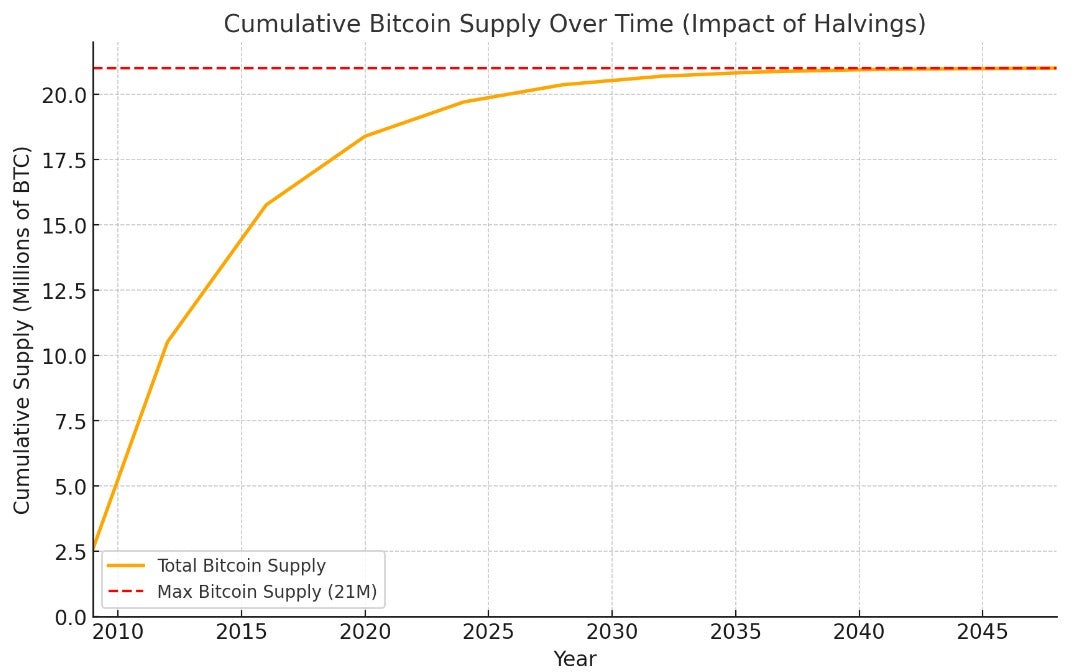

Neel Kashkari recently assured the public that the Federal Reserve possesses “an infinite amount of cash.” Yet, as the Fed prints money excessively, the U.S. dollar’s purchasing power steadily declines. This situation is unsurprising. When money is printed without restraint, it eventually loses value. Last week, Kashkari stated, “Bitcoin remains worthless after twelve years.” Yet, it has transformed into the sixth-largest monetary asset globally (credit to @1basemoney for this statistic). It appears that scarcity, indeed, possesses value. While the dollar continues to devalue, Bitcoin’s capped supply of 21 million means it cannot be easily debased like fiat currency.

Kashkari and the Federal Reserve ought to work on ensuring the dollar retains its value.

DKI Takeaway: Each dollar printed diminishes the value of previous ones, leaving savers vulnerable to inflation. Bitcoin presents an alternative—an asset with a decentralized and fixed supply that is independent of central banks. While the Fed conjures money from thin air, Bitcoin stands as a potential hedge against the very system that Kashkari supports. Today, it seems the only truly “worthless” concept is the belief that unlimited money printing has no repercussions.

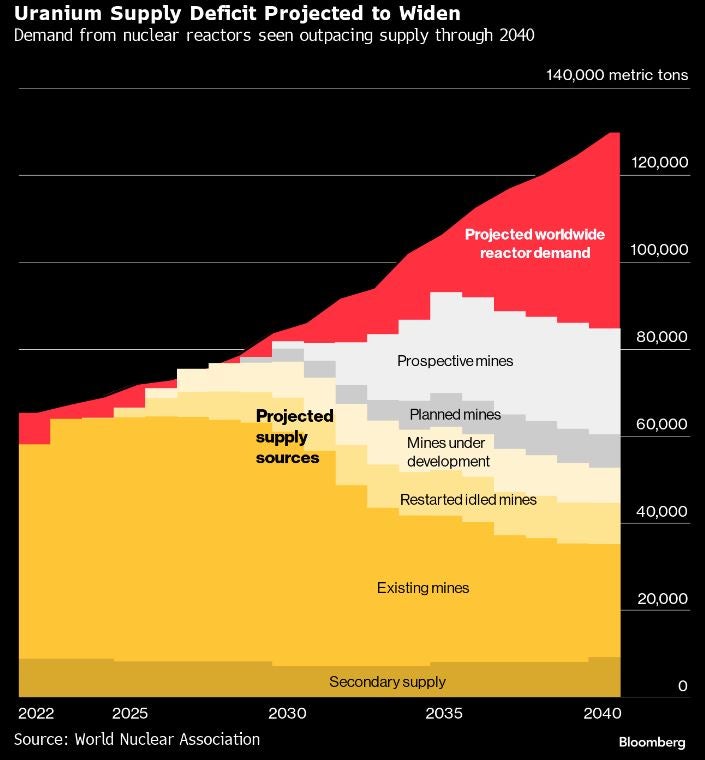

Google $GOOG joins its peers, including Amazon $AMZN and Microsoft $MSFT, in a substantial investment in nuclear energy. Google plans to purchase energy from Kairos, a firm specializing in small modular reactors (SMRs), which appeal to companies due to their lower initial costs and safety. The surge in artificial intelligence (AI) is driving these tech giants to invest billions in data centers, essential for running AI models. Meanwhile, Amazon is also set to invest in a nuclear company alongside Ken Griffin from Citadel.

The accompanying graph from the World Nuclear Association and Bloomberg illustrates unfulfilled demand.

DKI Takeaway: Although nuclear energy projects require considerable time for approval and construction, this does not hinder our interest in uranium. Long-term trends show that demand for nuclear power is outpacing current and projected supply. Traditionally, fear has stymied nuclear energy’s growth, but that fear is waning as nuclear power proves crucial for AI capabilities and non-carbon energy generation. Given the rising demand and stagnant supply, we anticipate ongoing increases in uranium prices. To learn more about our uranium strategy, refer to our recommendations or watch our recent webinar with Enrique Abeyta @enriqueabeyta on $TLN from May.

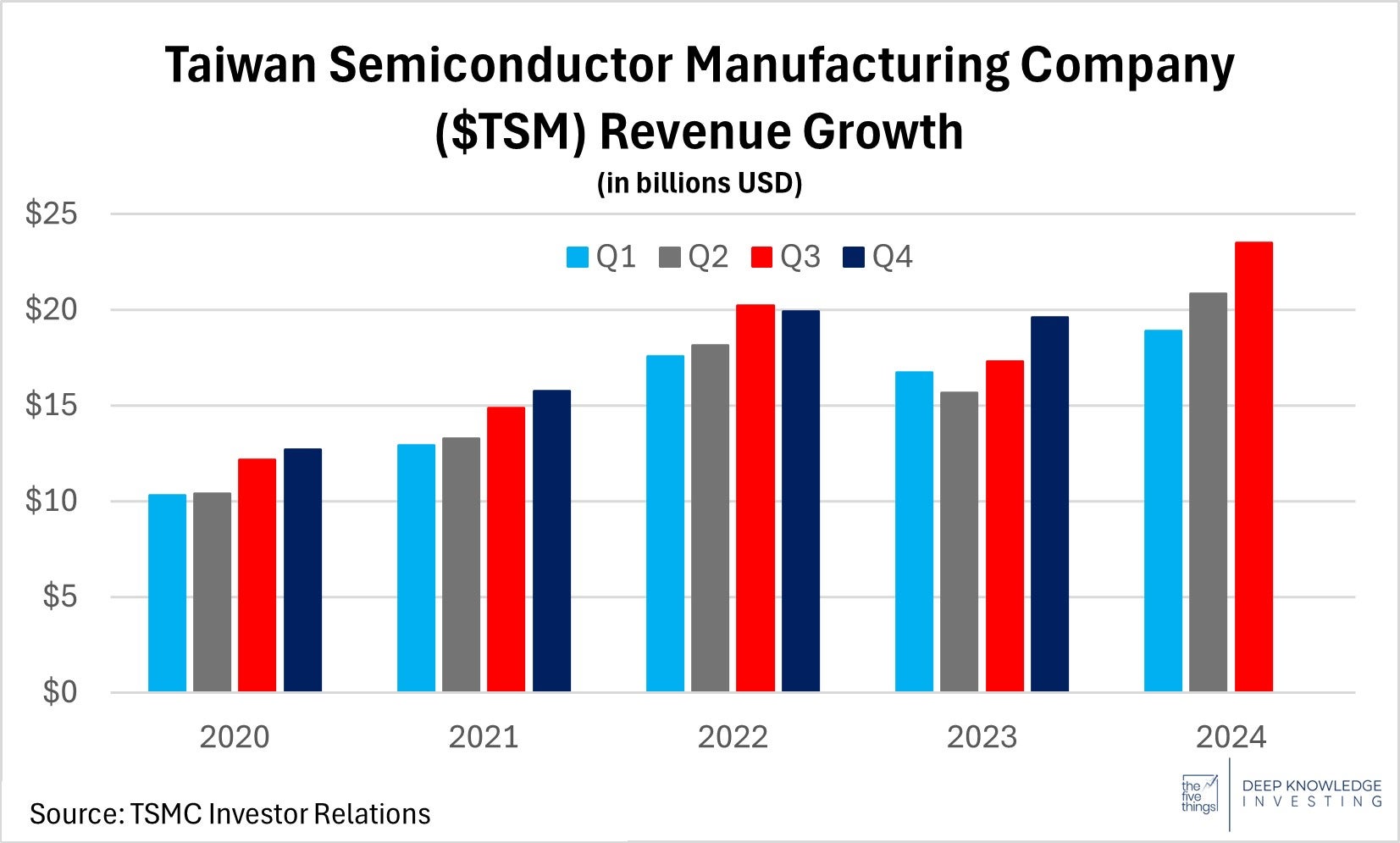

Taiwan Semiconductor Manufacturing Company $TSM, the leading advanced chip manufacturer, reported a revenue of $23.5 billion, reflecting a 36% increase year-over-year and a 12.9% rise since the previous quarter. As the year concludes, the company expects further revenue growth, projecting figures between $26.1 billion and $26.9 billion. A surprising earnings report from fellow chipmaker $ASML created a stir in the market; however, TSMC’s earnings beat bolstered market optimism surrounding AI, resulting in a market uptick early in the day.

Strong revenue growth from TSMC aligns with factors driving Nvidia’s revenue increase.

DKI Takeaway: Nvidia $NVDA relies on TSMC for chip production, providing positive projections for Nvidia’s upcoming earnings. Across the AI sector, companies show strong growth potential, attracting significant cash inflows and new competitors. Major players like Google, Amazon, Apple, and Meta will not tolerate startups encroaching on their market share. In this rapidly moving race for AI advancements, all firms will require ample power generation to support their new chips.

Christine Lagarde, President of the European Central Bank (ECB), announced a 25-basis point rate cut, bringing rates down to 3.25%. Simultaneously, she cautioned of an impending rise in inflation. This contradiction raises an important question: why lower rates when inflation is set to increase? The answer is straightforward: the ECB is entangled in significant debt.

“`

ECB Faces Tough Choices Amid Surging Debt and Inflation Risks

The European Central Bank’s Dilemma: Navigating Debt and Inflation

The European Central Bank (ECB) is currently facing a daunting challenge. Growing debt levels within the eurozone have pushed the central bank into a precarious situation where its traditional tools seem less effective. The ECB is now stuck between two undesirable outcomes: either accept rising inflation or deal with higher interest expenses that could also lead to increased inflation. As the burden of debt continues to mount, the ECB’s actions are beginning to seem disorganized. In a desperate bid to combat the debt crisis, the euro is intentionally being devalued. As inflation rises and the bank’s credibility wanes, the future of the euro appears uncertain.

Source: CanvaAI

DKI Insights: The Central Bank’s Struggle

Two conclusions stand out: central banks are struggling under the weight of debt and unclear monetary policy, or they are deliberately devaluing the euro to postpone an inevitable crisis. For the last two years, DKI has highlighted the parallels between the ECB’s situation and that of the Bank of Japan, which has resisted raising interest rates while its currency has lost value. The United States faces similar problems, as discussed in our eBook, “Counter-Intuitive Inflation: Can Federal Reserve Rate Hikes Cause Inflation.” Amid the challenging landscape, we remind investors that even adverse circumstances can provide opportunities for profit. DKI’s portfolio is structured to capitalize on high inflation trends moving forward. To learn more, feel free to reach out.

During the week, we received an insightful question from a University of Tennessee student: “What am I buying when I invest in Bitcoin? Is it similar to the dollar or more like gold?” This question is vital, especially since Bitcoin is often misunderstood as having no real value. Unlike the dollar, which can be printed indefinitely, Bitcoin has a capped supply. Just like gold was once a new concept, people had their doubts about its value. Interestingly, there was a time when peppercorns were worth more than gold! However, Bitcoin is backed by blockchain technology, which records ownership and is crucial for maintaining its value.

The supply of the dollar is the complete opposite of this graph.

DKI Insights: Bitcoin as a Store of Value

Bitcoin, like gold, functions as a store of value due to its limited supply coupled with growing demand. Yet, Bitcoin has unique advantages, including liquidity and ease of trade, making it more accessible than physical gold. A significant factor to remember when owning Bitcoin is the concept of self-custody, which allows complete control over your investment, especially during times of exchange instability. For more on this, check out our thread on X regarding the self-custody process. In this time of declining dollar value, assets like gold and Bitcoin serve as crucial hedges against future inflation. It’s worth asking those who doubt Bitcoin’s value: Why trust the dollar? After all, its worth relies on “faith and credit,” with an organization holding $36 trillion in debt. You don’t need to be a Bitcoin enthusiast to consider holding 1% of your portfolio in it, rather than watching the Federal Reserve devalue your dollars.

Information provided by Deep Knowledge Investing (“DKI”) is believed to be accurate, based on reliable sources; however, it is presented without any guarantees. DKI makes no claims regarding the completeness, accuracy, or timeliness of the information and opinions expressed here. The reports from DKI do not require the company to update information in the future, except as required by law.

The content found in this report is publicly available and is neither an offer nor a solicitation to trade securities. All opinions are subjective and may change without notice. DKI or its affiliates may hold or trade positions in companies mentioned in their reports without disclosing prior transactions.

The opinions and information in this report do not constitute investment advice. Investors should conduct their research and consult with professionals before making investment decisions.

In no event shall DKI be liable for losses or damages of any kind stemming from this or any of its reports or expressed opinions.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.