Westlake’s Earnings Fall Short of Projections

Westlake Corporation WLK underwent a financial upheaval, experiencing a significant loss of $497 million or $3.86 per share in the fourth quarter of 2023, sharply contrasting with the prior year’s profit of $232 million or $1.79 per share. The downward spiral in earnings was mainly attributed to a non-cash impairment charge of $475 million, pertainient to the company’s base epoxy resin assets in The Netherlands and the goodwill associated with its epoxy business.

Struggle with Sales Performance

The company’s sales saw a decline of about 14.3% year over year to $2,826 million during the quarter, missing the Zacks Consensus Estimate of $2,854.2 million.

Performance and Essential Materials Segment

In the Performance and Essential Materials segment, the sales plummeted approximately 20% year over year to $1,880 million, a significant shortfall from the estimated $1,916.5 million. Loss from operations amounted to $39 million, as compared to an income from operations of $219 million in the same quarter last year.

Housing and Infrastructure Products Segment

In contrast, sales in the Housing and Infrastructure Products segment reached $946 million, marking a modest 1% increase from the previous year. Income from operations was also on the rise by $53 million, totaling $121 million. This growth was fueled by heightened sales volume, particularly for pipe and fittings, along with reduced material costs.

Financial Position and End of Year Results

Despite the challenges, in the fourth quarter of 2023, Westlake managed to generate net cash of $573 million from operating activities, leading to cash and cash equivalents totaling $3,304 million by the end of December. Nevertheless, the company held a total debt of $4,906 million. For the full year of 2023, Westlake reported net sales of $12,548 billion, net income at $479 million, and EBITDA totaling $1,962 million.

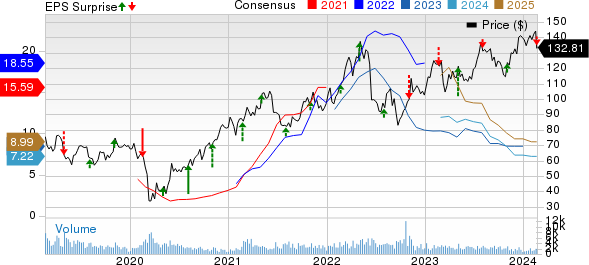

Outlook and Price Performance

Looking ahead to 2024, Westlake anticipates an expansion in the Housing and Infrastructure Products segment due to a robust consumer spending environment in the United States. Moreover, the company foresees stabilization in sales prices and volumes in the Performance and Essential Materials segment, offering some hope for recovery. In the stock market, Westlake’s shares have marginally ascended by 12% over the past year, as compared to the 16.7% industry rise.

Predictions & Preferred Picks

Westlake is currently holding a Zacks Rank #3 (Hold). Some standout performers in the Basic Materials space are Carpenter Technology Corporation CRS, Eldorado Gold Corporation EGO, and Hawkins, Inc. HWKN, all displaying promising potential for returns. With a mix of Zacks Rank #1 (Strong Buy) and Zacks Rank #2 (Buy) respectively, these stocks offer hopeful prospects in contrast to Westlake’s recent performance.

Given the promising future outlook for these companies, potential investors should be cautious in absorbing a slew of mixed signals from Westlake Corporation’s unstable 2023 performance. While the company still shows some potential, the road to recovery appears to be a taxing climb.