There is a belief that the growth of index funds, which prefer to trade in the closing auctions so they track their index, has led to an increase in market-on-close trading. However, the premise behind that is flawed.

In a perfect world (where there are no index changes and no customer deposits or withdrawals), an index fund would, in fact, not trade at all.

This raises an interesting question: Why don’t index funds need to trade each day?

Market cap indexes have special mathematical properties!

The answer revolves around the construction of market cap (or float cap) indexes.

- Market cap indexes include all shares in the market in the index.

- Shares x price gives you the market cap for each company.

- Summing all companies gives you a market cap for the whole market.

It turns out weights have nothing to do with building a portfolio for a market-cap index. Instead, knowing what proportion your fund is of the total market capitalization is all that matters.

Then, an index portfolio manager buys an equal slice of all the shares that each company has in the index.

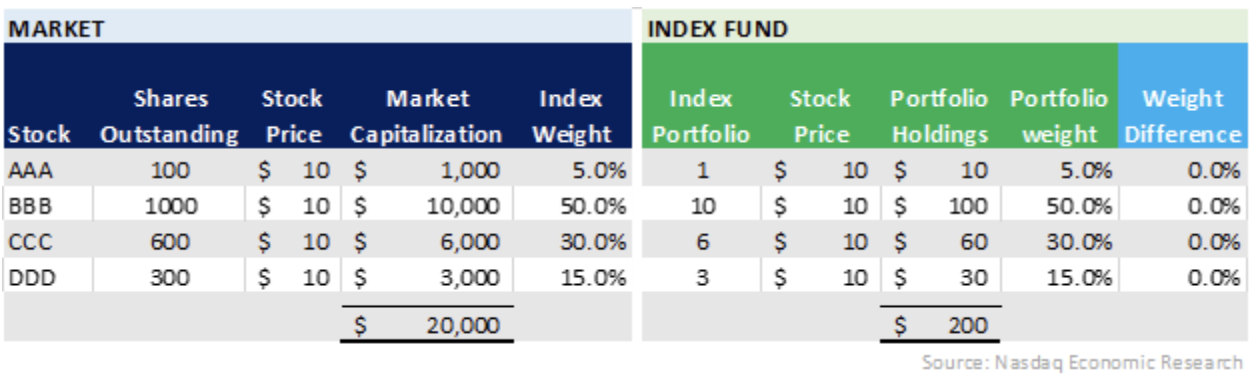

The table below makes it easier to see how this works. If we imagine (for simplicity):

- A market with just four stocks, where each stock has a price of $10, but the shares outstanding are different. We can see that the total market capitalization adds to $20,000, and the largest company (with a market capitalization of $10,000) has the highest market index weight (of 50%).

- An index portfolio that has $200 to invest will represent 1% of total market capitalization. So, the portfolio manager simply needs to buy 1% of all shares outstanding. That results in the fund investing all $200 and having the same stock weights as the larger market.

Table 1: Constructing an index portfolio (where your fund is 1% of the market capitalization)

What happens when prices change?

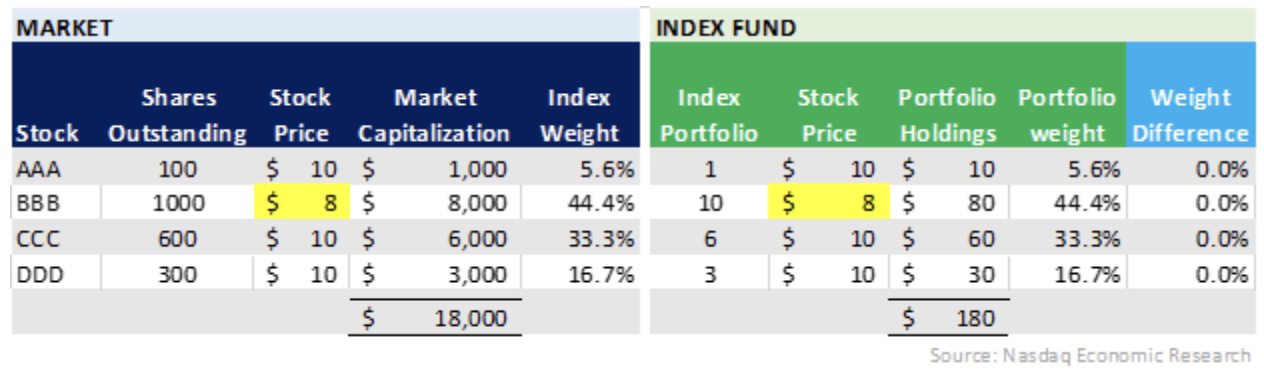

Now let’s see what happens when the price of stock BBB falls by 20%.

For the market:

- The stock falls from $10 to $8.

- The market cap of the stock falls by 20%.

- The capitalization of the total market falls by 10% (50% weight x 20% price fall) to $18,000.

- Shares outstanding did not change.

- But the weights of all four stocks did change. Mathematically, the weight of the smaller stocks increased to offset the decline in the weight of stock BBB.

Table 2: Index portfolio weights change in line with the market without needing to trade

Importantly, exactly the same things happened in the index fund, which fell in value by 10% (to $180). As a result, the index fund remains at index weights without needing to trade.

In short, the weight of its holding of BBB falls because of the price falling — no selling is required.

This is why index funds are often called “passive” investments because, for the most part, the fund rides the market’s ups and downs without needing to do anything.

An equal-weight fund will be different

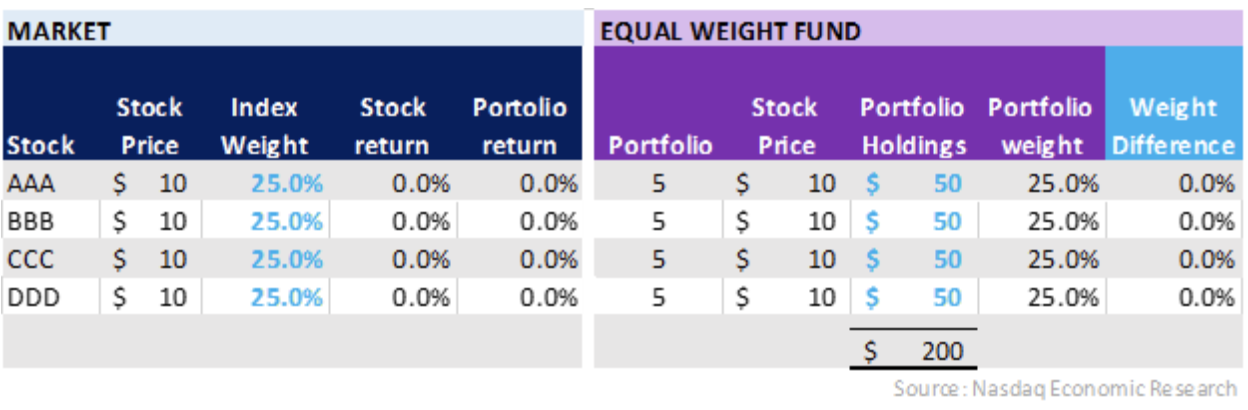

In a recent study, we showed how different portfolio weighting methods work. One simple-sounding way to build a portfolio is to invest the same amount of dollars into each stock, a so-called “equal-weight” portfolio.

In contrast to a market cap-weighted portfolio, an equal-weight portfolio needs to be “rebalanced” frequently.

Let’s use the same example as above but build an equal-weight portfolio. In this example, the market capitalization of the companies is irrelevant. Instead, the weight of each company in the index is “set” to 25%. So, the fund invests one-quarter of its assets into each of the four stocks ($50 each).

In this example, because stock prices are all $10, the math says we buy five shares of each company.

Table 3: With an equal-weight portfolio, weights matter to allocate initial investments

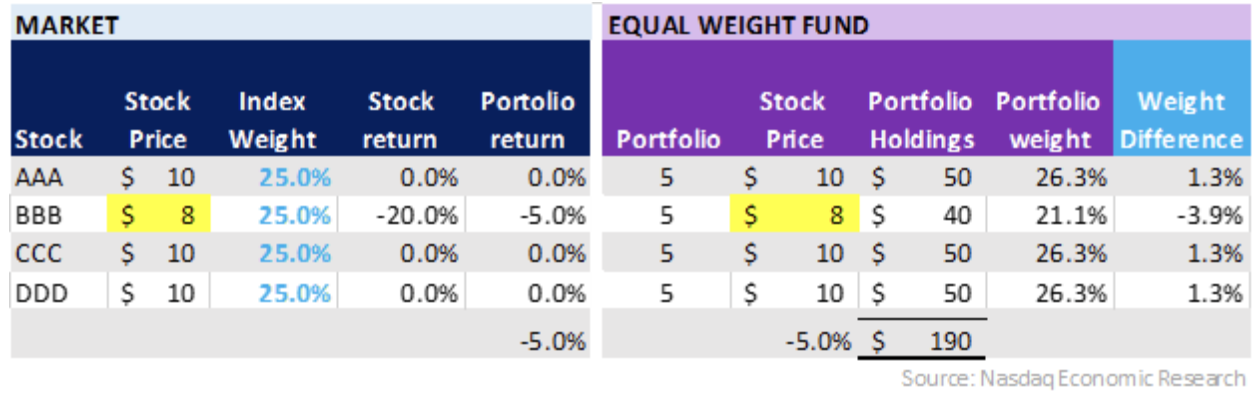

Now, when the price of stock BBB falls by 20%, the index falls by 5% (25% x 20%). Importantly, so does the value of the equal-weight fund, with the price fall of BBB stock reducing the value of the portfolio by $10, which is 5% of the initial investment.

Even though BBB is the largest company, it has a smaller weight in this portfolio, which reduces the impact of a large-cap selloff. This is also why equal-weight portfolio returns often resemble small-cap returns, as the weights favor the returns of the smaller companies in the market.

Table 4: With an equal weight portfolio, weights DO deviate from the index as prices change

However, now none of the stocks in the fund weigh 25%. Instead, the weight of BBB in the portfolio has fallen. Offsetting that, the weight of the other three stocks has increased, leaving them 1.3% too large.

In order to reset the portfolio back to the same (equal) weights as the benchmark, a portfolio manager for the equal weight fund would need to trade so all stocks again add to 25% of the portfolio (25% of $190 = $47.50):

- Selling $2.50 of the portfolio’s worth of AAA, CCC and DDD.

- Reinvesting it into BBB.

Index funds don’t trade on market moves

As we show here, if only prices move, a market cap-weighted index fund doesn’t need to trade at all.

However, there are times when index funds need to trade. In a previous study, we showed that index funds trade a lot on index rebalance days. That makes sense – on those dates, the index itself is adding or deleting stocks, so the fund will need to do so, too. But they only happen a few times a year.

On “normal” close days, the only trades Index Funds need to do is to invest cashflows or maybe accumulated dividends. That’s why we estimated index funds shrink to just 5.5% of trading in the close on non-rebalance days.

The key takeaway here is that, despite their large size, we and others have said that fears of index funds materially shifting the VWAP curve or causing price impacts during the day just aren’t supported by math.