I’m not an income investor. However, you could call me a future income investor. In other words, I like stocks that hold the potential to deliver exceptional total returns and could bolster my income when I retire years from now.

Enterprise Products Partners (NYSE: EPD) is a great example of such a stock. I first invested in this limited partnership (LP) a few years ago. Here’s why I just bought more of this ultra-high-yield dividend stock.

1. A mouthwatering distribution

Just how ultra-high is Enterprise Products Partners’ yield? It’s currently above 7.3%. As an LP, Enterprise technically pays a distribution rather than a dividend. Whatever you call it, it’s mouthwatering.

What I like even better is that the distribution should grow. Enterprise Products Partners has increased its distribution for 25 consecutive years with a compound annual growth rate of 7%. The company continues to generate ample cash flow to keep that streak going.

Importantly, Enterprise’s cash flow, which is used to fund its distribution, is reliable. The company operates over 50,000 miles of pipeline (along with other midstream energy assets), raking in money each month regardless of commodity price fluctuations.

I’m not using those distributions to supplement my income (yet). Instead, I plan to reinvest the cash payouts.

2. A compelling valuation

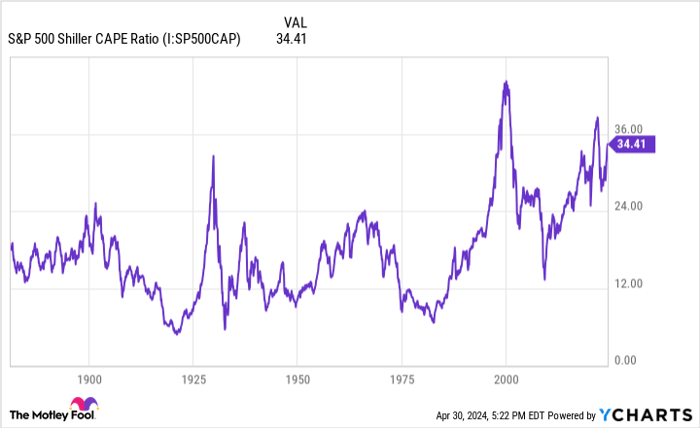

I’m at least a little jittery about the stock market’s valuation. The S&P 500‘s cyclically adjusted price-to-earnings (CAPE) ratio — a metric popularized by economist Robert Shiller — is near its highest levels ever.

S&P 500 Shiller CAPE Ratio data by YCharts

However, I’m not nervous at all about Enterprise Products Partners’ valuation. The stock trades below 10.7 times forward earnings. That’s barely over half the S&P 500’s forward price-to-earnings ratio of 20.5 and well below the S&P 500 energy sector’s forward earnings multiple of 12.7.

Enterprise Products Partners looks attractive using other valuation metrics, too. For example, its enterprise value-to-revenue ratio is a reasonable 1.83.

3. Solid growth prospects

Thanks to its sky-high distribution yield, Enterprise Products Partners won’t have to generate much unit price growth to give me double-digit percentage total returns. The good news is that its growth prospects look promising.

Enterprise has several high-probability growth drivers over the next couple of years. The company plans to begin operations at three natural gas liquids (NGLs) plants in 2025 and 2026. It’s on track to open up a new NGL pipeline in the first half of next year. A new fractionator should be in service by the second half of 2025, with an ethane/propane export terminal coming online by the first half of 2026.

U.S. production forecasts for crude oil, NGLs, and dry natural gas all trend upward through 2030. I don’t expect a slowdown in the next decade either. In my view, Enterprise Products Partners is well-positioned to grow for a long time to come.

What could go wrong?

Anytime I buy a stock, whether initiating a new position or adding to an existing one, I take a step back and think about what could go wrong. With Enterprise Products Partners, a major recession is probably the most concerning negative scenario.

During serious economic pullbacks, energy consumption usually declines. Enterprise’s revenue and cash flow would fall if lower volumes of hydrocarbons flow through its pipelines, processing facilities, and terminals. It’s possible that the situation could get so bad that the company would have to cut its distribution.

While this could happen, I don’t think it will. Enterprise Products Partners has never reduced its distribution — it has continually increased the payout. Even during tough times such as the Great Recession of late 2007 through mid-2009 and the COVID-19 pandemic, the company’s cash flow remained remarkably resilient.

I think it’s more likely that Enterprise Products Partners will grow its distribution and deliver solid growth. And I expect that the stock will one day help me retire comfortably.

Should you invest $1,000 in Enterprise Products Partners right now?

Before you buy stock in Enterprise Products Partners, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Enterprise Products Partners wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $525,806!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of May 3, 2024

Keith Speights has positions in Enterprise Products Partners. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.