Gold

The Federal Reserve’s interest-rate pause, due to successfully lowering inflation, and apparently coming, subsequent pivot

to reducing interest rates in 2024, is good news for commodities.

Lower rates will cause the dollar to weaken, fall and commodity prices to strengthen, rise. When positive real interest

rates, which favor bond investors, turn negative, it will especially affect gold and silver prices to the upside.

The case for gold revolves around three main factors: an increasingly dovish Fed monetary policy; unsustainably high

debt, fueled by excessive government spending; and central bank buying.

We are already seeing bond yields fall and the dollar weakening. Gold and the USD typically move in opposite

directions.

The benchmark 10-year Treasury yield has dropped steadily over the last three months, from 5% in November to the current

3.9%. The US dollar index DXY has dropped from 106.88 on Nov. 23 to 101.71, at time of writing, a reduction of 5%.

MarketWatch) .

CNBC).

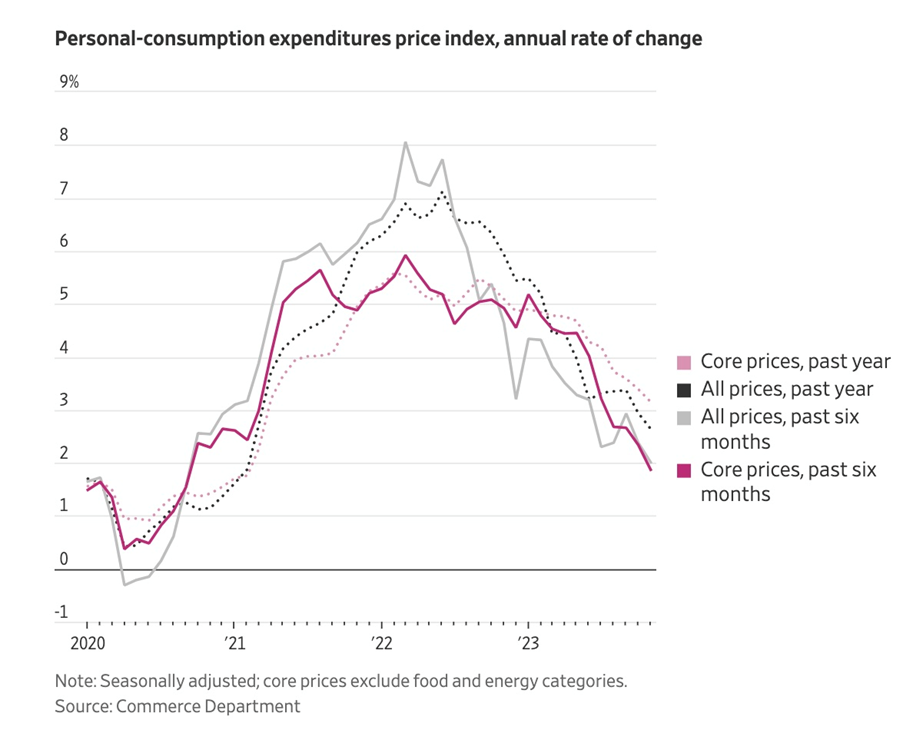

On Friday, Dec. 22, the release of the personal consumption expenditures price index, the Fed’s preferred measure of

inflation, strengthened the argument that the Fed will want to reduce rates in 2024, potentially even more than the 75

basis points telegraphed by the organization earlier this month.

US prices in November fell for the first time in more than 3.5 years, pushing the annual increase to 2.6%, according

to the Commerce Department. Core prices, which exclude food and energy, rose 1.9% on a six-month annualized basis.

Reuters reported Both headline and core measures cooled more than economists had anticipated, bringing the

annualized rates over the past three and six months down to at or below the Fed’s 2% target.

Over the second half of the year, the center of gravity at the Fed policymaking table has become markedly more

dovish, as evidence accumulates that price pressures are easing and the labor market is cooling in the face of the

Fed’s rates hikes from March 2022 to July 2023.

On Thursday, third-quarter US GDP growth came in weaker than expected, at 4.9%, while claims for unemployment

benefits increased by 2,000 to a seasonally adjusted 205,000, worse than market expectations.

Softening economic data and moderating inflation show that the Fed’s monetary policy is restrictive enough to bring

inflation to heel.

However, we are still at positive real rates of 1.3% (3.9% 10-year yield minus 2.6% inflation), which for gold means

further rate cuts are necessary before we are into a negative real rate environment.

The markets are pricing in around 79% odds of a rate cut in March.

Economist Daniel Lacalle maintains that inflation would be coming down faster if it weren’t for the fact that,

“fiscal policy, for the first time in decades, is moving in the opposite direction of monetary policy. And this is

likely to create significant problems in the future.”

We first pointed out this clash between the federal government and the Federal Reserve back in 2018, when Trump was

president. The Fed at the time was raising interest rates, to the disappointment of Trump who wanted to keep them

low.

Consider: As the Fed has pursued a tight monetary policy, unwinding its balance sheet and raising interest rates, the

Treasury has been printing money that the federal government keeps spending to fulfill its many promises. The Biden

administration’s three signature pieces of legislation — the Inflation Reduction Act, the Bipartisan Infrastructure

Law and the CHIPS and Science Act — are costing trillions.

Remember too, that most of this promised money has yet to be spent.

Unsurprisingly, inflation has added a huge chunk to construction project costs, which has also meant delays. An

Economist article notes that the biggest component of the infrastructure package was a 50% increase in funding for

highways to $350B over five years. But highway construction costs soared by more than 50% from the end of 2020 to the

start of 2023, in effect wiping out the extra funding.

The federal government keeps spending money, and the Treasury keeps printing it, to cover the deficits which keep

mounting. Around $13 trillion in government debt is expected to roll over next year, at much higher rates, meaning more

money-printing is on the way.

In a recent interview with BNN Bloomberg, Pierre Lassonde, chair emeritus at Franco-Nevada Mining, said he believes

the US dollar has peaked “and gold is the anti-US dollar so that is one of the reasons why I’m so bullish on

gold for 2024.”

He also said that inflation next year will be “sticky”, around 3-4%, noted that the federal government is going to have

a $2 trillion deficit, and argued that interest rates will come down because there is a presidential election.

“What does the Fed do in an election year? They like to make it easy for the incumbent to win the election,” said

Lassonde. “So interest rates are going to come down but it’s not gonna happen in Europe, I think the euro is going to be

going up vis-a-vis the US dollar, all of the other

Why 2024 Will Be a Stand-Out Year for Precious Metals

When it comes to precious metals and future outlooks, the signs are pointing up like a rocket ship blasting off to the moon. In a recent interview, legendary gold investor, Pierre Lassonde, stated unequivocally that he sees a bullish trend continuing for precious metals. He expects gold to hit a staggering $3,500 an ounce and, as for silver, he anticipates that it will follow in gold’s footsteps like a loyal younger brother. With central bank gold demand reaching record heights and no signs of slowing down, the stage is set for a golden performance that will leave other equities in the dust.

Silver

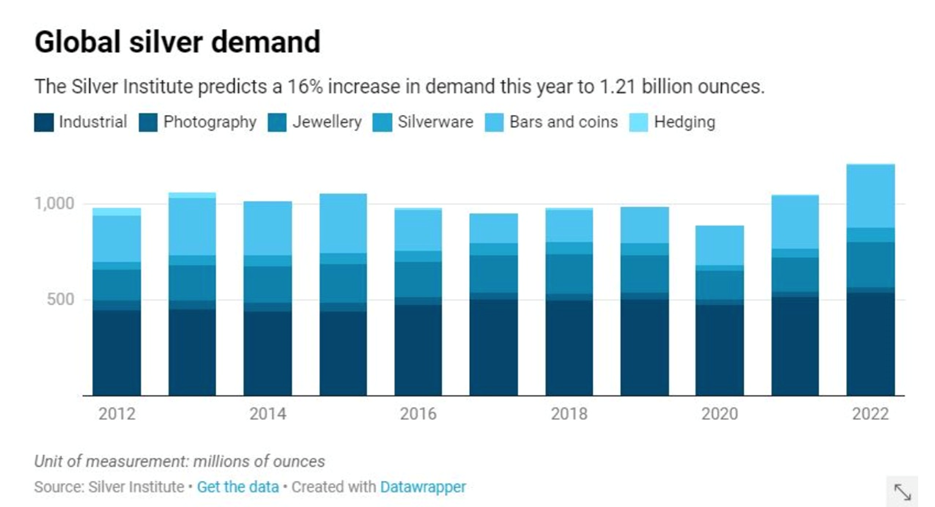

Gold and silver often dance to the same tune. We tend to see silver mimicking gold’s movements, but then, oh boy, it can outshine gold. When precious metals soared in 2020, prompted by lockdowns, zero interest rates, quantitative easing, and general market anxiety, silver’s gain was double that of gold. The price shot up 43% from January to December 2020, compared to gold’s ‘mere’ 20.8% rise. Silver’s rally from under $12 to almost $30 showed a 147% increase, leaving many investors starry-eyed. Fascinatingly, there are investable silver amounts above ground equal to those of gold, as 60% of silver is utilized in industrial applications, with 80% of that winding up buried in landfills.

Outrageous Misappropriation of Silver by Major Chinese Solar Manufacturers Sparks Worldwide Scandal

Can you believe that the U.S. Department of Commerce is slamming the gavel on Chinese solar manufacturers for dodging tariffs and “undermining American industries” with their sneaky antics? I mean, how dare they pull such a shifty move at the expense of hard-working domestic businesses. It’s a scandal of global proportions!

But that’s not all – BMO Capital Markets is predicting annual silver consumption by the solar industry to skyrocket by a whopping 85%, hitting around 185 million ounces in just 10 years. That’s like a silver tsunami washing over the entire industry!

As if that’s not bonkers enough, 5G technology is primed to stomp in and demand its own hefty share of silver. Semiconductor chips, cabling, microelectromechanical systems (MEMS), and Internet of things (IoT) devices are all lined up, ready to siphon off truckloads of silver for their own high-tech purposes.

And don’t even get me started on the automotive industry’s voracious appetite for silver. What’s even crazier is that a report by the Silver Institute predicts that electric vehicles could single-handedly gulp down nearly half of the annual silver supply by 2040. That’s like a silver feeding frenzy!

But wait, there’s more! Brazing and soldering are flexing their silver-studded muscles and showing off a 23% increase in silver demand by 2030. And to top it off, “printed and flexible electronics” are set to gorge themselves on a jumbo-sized 74 million ounces of silver by 2030. Can you believe it? It’s like a silver smorgasbord!

But hold on a second – the plot thickens! The global silver market was undersupplied by a whopping 237.7 million ounces in 2022. That’s possibly the most significant deficit on record! It’s like a heist of epic proportions, with silver flying off the shelves faster than anyone can keep up with.

Now, we’ve got the Silver Institute forecasting a colossal 140 million ounce deficit this year, marking the third consecutive annual shortfall. It’s a silver frenzy out there, people!

Despite all this madness, market analysts have been shouting from the rooftops about a looming silver shortage due to the relentless surge in demand. It’s like watching a runaway train hurtling towards a mountain, and no one seems to be at the brake lever!

But maybe, just maybe, there’s a glimmer of hope on the horizon. The Federal Reserve seems to be tiptoeing around the economic landscape with the finesse of a tightrope walker, keeping inflation in check without toppling everything over. Could there actually be light at the end of this chaotic silver tunnel?

With everything that’s been going on, it’s hard not to feel like the silver world is spinning out of control. But who knows? Maybe there’s a chance for things to settle down and for the silver industry to catch its breath. It’s like witnessing the beginning of a nail-biting thriller movie, and we’re all eagerly waiting to see how it ends.