Southern Company Expects Strong Third-Quarter Earnings Report

The Southern Company SO is poised to announce its third-quarter results on October 31. According to the current Zacks Consensus Estimate, analysts predict earnings of $1.34 per share with total revenues of $7.2 billion.

Stay updated with the latest EPS estimates and surprises on Zacks Earnings Calendar.

Before analyzing the latest quarter, it helps to examine Southern Company’s results from the previous quarter.

Q2 Earnings and Performance Overview

In the last quarter, Southern Company, headquartered in Atlanta, GA, exceeded earnings expectations. Growth in electricity sales, along with favorable weather, pricing adjustments, and increased electricity usage, bolstered the results. The company reported adjusted earnings per share of $1.09, surpassing the Zacks Consensus Estimate of 91 cents. Additionally, revenue reached $6.5 billion, exceeding the consensus estimate by 3.3%.

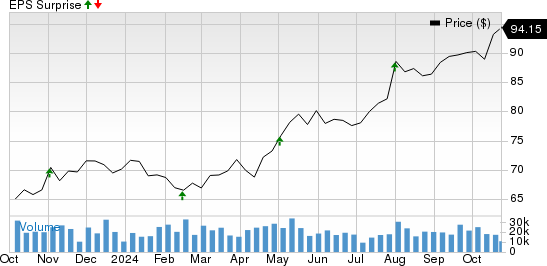

Remarkably, Southern Company has beat the Zacks Consensus Estimate for earnings in each of the past four quarters, with an average trailing four-quarter earnings surprise of 12.6%, as shown in the graphic below:

Southern Company Price and Earnings Surprise

Southern Company price-eps-surprise | Southern Company Quote

Revisions to Earnings Estimates

The Zacks Consensus Estimate for third-quarter earnings has been revised upward by 1.5% in just the past week, although it indicates a 5.6% decline compared to last year. However, revenue expectations show a positive trend, suggesting a 2.8% increase from the same quarter last year.

Factors Influencing this Quarter’s Performance

Southern Company’s regulated utilities serve approximately nine million electric and natural gas customers. The company has been actively working to expand its customer base and has successfully added more than 14,000 new residential electric customers and over 6,000 residential natural gas customers in Q2 2024. This growth trend likely continued due to favorable economic conditions in their service areas.

Moreover, effective management may have helped reduce operations and maintenance costs in the third quarter. Our estimates suggest that these costs fell to $1.2 billion, representing a significant 17.6% decrease from $1.4 billion in the same quarter last year.

Expectations for Earnings Surprise

Given the current conditions and financial outlook, our model forecasts a potential earnings surprise for The Southern Company this quarter. A combination of a positive Earnings ESP and a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) enhances the likelihood of an earnings beat.

Southern Company currently holds an Earnings ESP of +2.25% and a Zacks Rank of #3.

Other Utility Stocks to Watch

Southern Company is not alone in aiming for strong earnings. Other companies in the utilities sector are also expected to perform well this quarter:

Public Service Enterprise Group Incorporated PEG carries an Earnings ESP of +1.50% and a Zacks Rank of #3, with its earnings report due on November 4.

For 2024, PEG anticipates a 5.5% growth in earnings, currently valued at approximately $44.7 billion, reflecting a 49.7% increase over the past year.

The AES Corporation AES also has a promising Earnings ESP of +1.11% and a Zacks Rank of #3, preparing to announce its earnings on October 31.

AES projects an 8.5% increase in earnings for 2024 and is valued around $12.1 billion, with a 16.3% increase over the past year.

Stocks with High Growth Potential

Our experts have identified five stocks that could potentially double in value in 2024. Historically, recommendations have resulted in significant gains, ranging from +143.0% to +673.0%.

Many of these stocks are currently under the radar, representing a unique chance to engage early.

Today, Discover 5 Potential Home Runs >>

Southern Company (The) (SO): Free Stock Analysis Report

Public Service Enterprise Group Incorporated (PEG): Free Stock Analysis Report

The AES Corporation (AES): Free Stock Analysis Report

To access the full article on Zacks.com, click here.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.