Witnessing insiders backing their firm with cold, hard cash is like seeing a ship’s captain patch a leak in his own vessel – reassuring and indicative of a smooth voyage ahead. For stakeholders of Real Estate Investment Trusts (REITs), this maxim holds true, especially when considering the recent surge of insider purchases within Agree Realty Corp (ADC). With Chairman Richard Agree and CEO Joey Agree doubling down on ADC shares, the naysayers, including JPMorgan Chase’s Jamie Dimon, seem but a blip on the radar.

About Agree Realty Stock

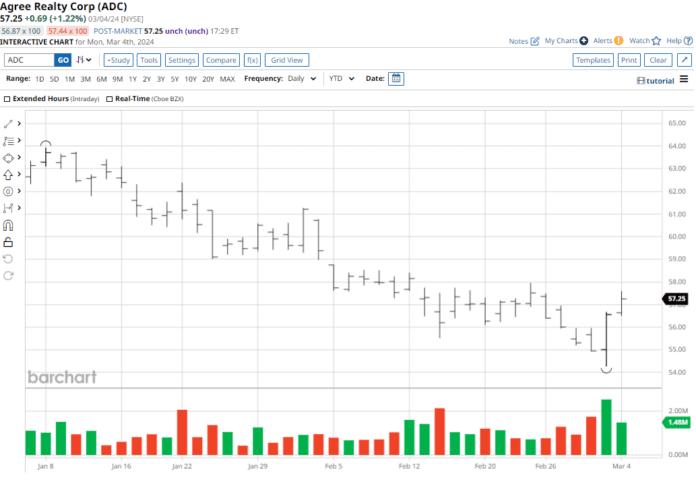

Charting its course since Richard Agree’s founding voyage in 1971, Agree Realty Corp (ADC) stands tall as a beacon in the retail property landscape. Armed with a $5.7 billion market cap, ADC’s portfolio boasts net-leased properties interwoven with national and regional retail players, offering footholds in diverse sectors. Despite a 9.4% YTD dip, the company’s monthly dividend of $0.25 and a tantalizing 5.19% yield are beacons for investors eying long-term moorings.

Heavy Insider Buying on ADC Stock

As the Agree family stokes the fire, Chairman Richard Agree’s gobbled up 16,000 shares in a $888,000 spree. His son, Joey Agree, fired two transactions last month, snapping up 5,500 shares worth $314,340. Not to be outdone, director John Rakolta Jr. dived deep, pocketing 40,532 shares valued at $2.3 million. A family affair, indeed!

Inside ADC’s Earnings

Beyond the sea of EPS figures, Agree Realty’s FFO prowess stood out in Q4 at $1.00 per share, outstripping the consensus. Revenues saw a 23.7% uptick to $144.2 million, buoyed by marquee tenants like Walmart, Dollar General, Best Buy, and CVS Health. Closing the year with a land value rising to $2.3 billion and building value at $4.9 billion, ADC relishes over $1 billion in liquidity reserves.

Inside ADC’s Real Estate Portfolio

Despite storm clouds shadowing commercial real estate, Agree Realty boasts a cavalry of tenants like Walmart, McDonald’s, Costco, and Amazon – stalwarts untethered by economic tempests. With 69% investment-grade tenants offering stability and 16% sub-investment-grade tenants adding spice, ADC’s portfolio is a well-groomed menagerie of renting royalty.

What Do Analysts Expect for ADC Stock?

Tuning into the analyst choir, Agree Realty gleams with a “Strong Buy” label and an optimistic target price of $67.10, signaling a 17.8% upward drift. Deemed a gem by 15 analysts – 10 holding a “Strong Buy” baton, 2 a “Moderate Buy,” and 3 a “Hold” stance – ADC’s narrative resonates positively amidst the tumultuous financial seas.