Carlisle Companies – A Strong Contender

Entrenched with expansive bottom-line growth, Carlisle Companies stock allures investors with a diversified global portfolio of niche brands and businesses producing highly engineered products. The products are primarily used in various building solutions that enhance energy efficiency and waterproofing, extending to insulation and roofing in both commercial and residential applications.

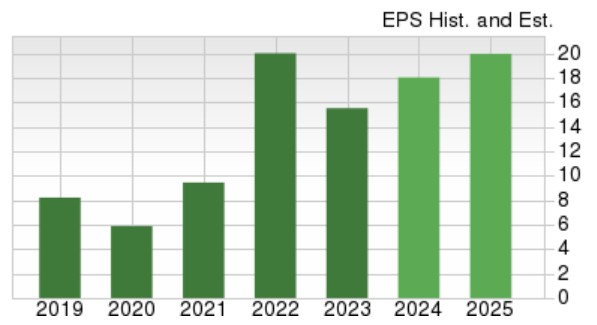

Fiscal 2024 anticipates earnings to rise 16% to $18.03 per share, despite a projected sales decline of -5% to $4.85 billion. Furthermore, FY25 EPS is expected to expand by another 11%, with sales foreseen to rebound and rise 4% to $5.05 billion.

Image Source: Zacks Investment Research

Griffon – A Promising Prospect

Griffon, another multi-sector conglomerate with diversified operations, extends its reach to home-building products, including garage doors and rolling steel doors. Its subsidiaries also manufacture branded consumer and professional tools, as well as residential, industrial, and commercial fans, coupled with home storage and organization products.

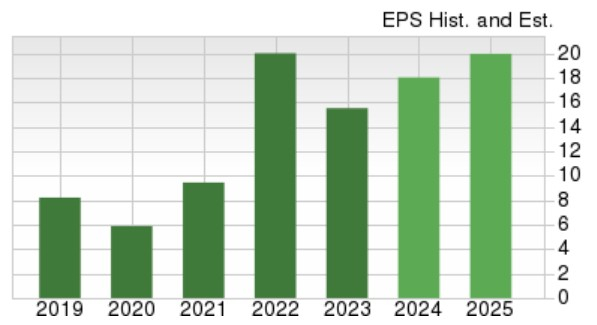

More enticingly, the company’s stock, though having surged +83% over the past year, still trades at 14.1X forward earnings, presenting a pleasing discount compared to the industry average of 20.9X forward earnings and the S&P 500’s 21X.

Image Source: Zacks Investment Research

Vector Group – The Undervalued Contender

Vector Group, a diversified holding company, presents a compelling case for being undervalued considering its growth trajectory. Through its subsidiaries, it engages in the manufacturing of cigarette products and holds minority investments in various real estate projects across the United States.

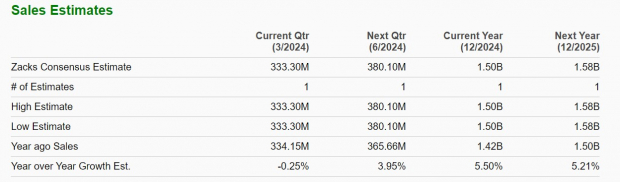

Trading at 9.1X forward earnings, EPS is expected to increase 1% in FY24 and expand by another 7% in FY25 to $1.33 per share. Projections of steady top-line growth further highlight the company’s earnings potential, with sales anticipated to edge up 5% this year and rise another 5% in FY25 to $1.58 billion.

Image Source: Zacks Investment Research

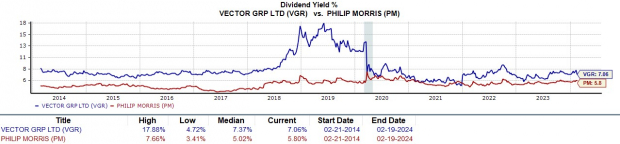

It’s also noteworthy that Vector Group’s stock trades at just 1.2X forward sales and has a current annual dividend yield of 7.06% that towers over the industry average of 1.54% and mirrors the large payout that big tobacco players offer such as Altria Group MO and Philip Morris International PM.

Image Source: Zacks Investment Research

Conclusion

The growth prospects of these Zacks Diversified Operations Industry stocks are very intriguing, considering their reasonable valuations. These companies exhibit strong potential for rewarding investments, and their current standing on the coveted Zacks Rank #1 (Strong Buy) list certainly adds to their appeal for investors eyeing long-term growth opportunities.