The Zacks Wireless Non-US industry seems to be riding a wave of strong demand, driven by the growing need for constant connectivity in the digital age. However, the sector has faced its share of challenges, including high capital expenditures, margin erosion, supply-chain disruptions due to geopolitical conflicts, and inflated customer inventory levels, all of which have affected its bottom line.

Nevertheless, major players like Orange S.A. ORAN, TIM S.A. TIMB, and PLDT Inc. PHI are well-positioned to capitalize on the long-term growth opportunities within the industry and the increasing demand for scalable infrastructure to support wireless and fiber connectivity, fueled by the widespread adoption of IoT and the rapid deployment of 5G technology.

Industry Overview

The Zacks Wireless Non-US industry is comprised of mobile telecommunications and broadband service providers operating outside the United States. These companies offer voice services, value-added services like IoT solutions, content streaming, mobile payment options, as well as IT and hosting services to residential and corporate clients.

Factors Shaping the Future of the Wireless Non-US Industry

Network Convergence: The convergence of network technologies has led to substantial investments from traditional carriers and cloud service providers. The industry is witnessing a surge in demand for advanced networking architecture to support the exponential growth of mobile broadband traffic and home internet solutions, creating the need for network upgrades and advanced wireless products and services. Moreover, telecom services have shown a weak correlation to macroeconomic factors, prompting carriers to focus more on network upgrades to meet evolving customer needs.

Inflated Production Costs: The industry continues to face challenges stemming from chip shortages and high raw material prices due to geopolitical conflicts, leading to disrupted operations and inflated equipment prices. Price-sensitive competition is expected to intensify, limiting the ability to attract and retain customers and affecting financial results.

Holistic Growth Focus: Industry players are striving to accelerate subscriber additions and improve churn management while providing superior wireless connectivity. Companies are also expanding their geographical footprint through strategic acquisitions and adopting unlimited plans to boost revenues.

Industry Outlook

The Zacks Wireless Non-US industry is part of the broader Zacks Computer and Technology sector and currently holds a Zacks Industry Rank of #50, placing it in the top 20% of more than 250 Zacks industries. The industry’s bullish near-term prospects are indicated by the Zacks Industry Rank, with research showing that the top 50% of Zacks-ranked industries outperform the bottom 50% by more than 2 to 1.

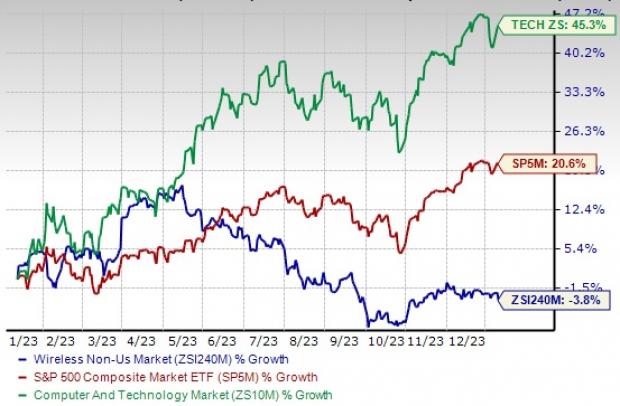

Despite the industry’s growth potential, it has underperformed the S&P 500 and the broader Zacks Computer and Technology sector over the past year, reflecting a 3.8% decline compared to the S&P 500’s 20.6% and the sector’s 45.3% rise during the same period.

Characterizing the 3 Non-US Wireless Stocks:

Orange: Based in Paris, Orange is a leading global telecommunications carrier operating in 26 countries, offering IT and telecommunication services under the brand Orange Business Services. The company’s strategic plan, “Lead the future,” is centered on leveraging network excellence to strengthen its service quality. With a VGM Score of A, the stock has experienced a 7.1% increase in the past year and holds a long-term earnings growth expectation of 16.6%. The Zacks Consensus Estimate for its current-year earnings has been revised 4.2% upward since January 2023. It carries