The Zacks Manufacturing – General Industrial industry is gearing up for significant growth as supply-chain disruptions begin to ease. Despite a temporary slowdown in manufacturing activities, the industry is bolstered by robust performance in prominent end markets. Notable participants such as Parker-Hannifin Corporation PH, IDEX Corporation IEX, Applied Industrial Technologies, Inc. AIT, and Flowserve Corporation FLS are well-positioned to capitalize on the array of opportunities available.

About the Industry

The Zacks Manufacturing – General Industrial industry is comprised of companies that specialize in a wide spectrum of industrial equipment production. This includes power transmission products, engineered fluid power components and systems, as well as industrial rubber products, among others. These companies cater to diverse sectors such as mining, oil and gas, agriculture, and transportation.

3 Forces Shaping the Future of the Manufacturing General Industrial Industry

Persisting Weakness in the Manufacturing Sector: The industry has been impacted by the prolonged frailty in the manufacturing sector, with demand dipping significantly. Nevertheless, recent data from the Institute for Supply Management indicates a positive trend, with a gradual improvement in new orders, offering hope for the industrial manufacturing companies.

Easing Supply-Chain Disruptions: Despite persistent supply-chain disruptions especially related to electronic components, the situation has shown signs of improvement. The latest ISM report illustrates faster deliveries for the 16th straight month in January, signaling a positive trajectory for industrial manufacturing companies.

Acquisition-Based Growth Strategy: The industry players are focusing on expansion through strategic acquisitions. This approach allows them to tap into new markets, diversify their product offerings, and fortify their competitive position. Furthermore, investments in product development, innovation, and technological advancements are creating a fertile ground for the industry’s growth.

Zacks Industry Rank Indicates Bright Prospects

The Zacks Manufacturing – General Industrial industry, housed within the broader Zacks Industrial Products sector, currently carries a Zacks Industry Rank #71, placing it in the top 28% of more than 250 Zacks industries. The industry’s potential is further underscored by its Zacks Industry Rank, which reflects its bright near-term prospects. Historically, the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

Emboldened by the industry’s bright near-term prospects, let’s explore a few stocks that are compelling for investment. But first, let’s examine the industry’s stock market performance and current valuation.

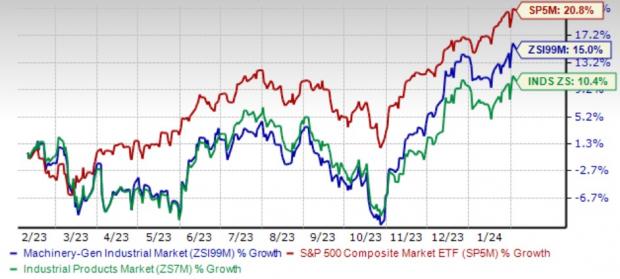

Industry Outperforms Sector But Lags S&P

Over the past year, the Zacks Manufacturing – General Industrial industry has surpassed the broader sector but trailed the Zacks S&P 500 composite index. It has shown a 15% appreciation, compared to the sector’s 10.4% and the S&P 500 Index’s 20.8% growth.

One-Year Price Performance

Industry’s Current Valuation

Based on the forward 12-month Price-to-Earnings (P/E) ratio, a standard valuation metric for manufacturing stocks, the industry is currently trading at 21.15X compared with the S&P 500’s 20.52X. This places it above the sector’s P/E ratio of 17.21X. Over the last five years, the industry’s P/E ratio has fluctuated between 26.92X and 15.92X, with a median of 20.72X, indicating its valuation range.

Price-to-Earnings Ratio

Price-to-Earnings Ratio

4 Manufacturing-General Industrial Stocks Leading the Pack

Each of the companies outlined below currently holds a Zacks Rank #2 (Buy).

Parker-Hannifin: Headquartered in Cleveland, OH, this diversified manufacturer of motion and control technologies is currently enjoying increased demand across end markets. The company has exhibited robust performance in the commercial aftermarket, coupled with effective cost-management actions driving its growth. Its recent Meggitt acquisition and benefits from the Win strategy have further contributed to its upward trajectory.

Parker-Hannifin has surpassed earnings expectations in the last four quarters, with an average earning surprise of 14.4%. The company’s bottom-line estimates have also seen a 2.7% improvement for fiscal 2024 (ending). PH has effectively positioned itself as a stock worth considering for investors.

.jpg)