The Zacks Finance Sector comprises a variety of players, including credit services providers, banks, investment and insurance companies, payment card providers, and trading platforms, each offering a broad range of financial services. The ongoing market volatility has offered investment prospects for numerous stocks, while also presenting challenges for others.

The significant financial developments have distinguished prudent investors in the market who are seeking to capitalize on winning finance stocks. Among these, Tradeweb Markets Inc. TW, Blue Owl Capital Corporation OBDC, Axos Financial, Inc. AX and PJT Partners Inc. PJT stand out as strong investment choices in the current financial climate.

The Ever-Changing Financial Landscape

The sustained high inflation, despite showing signs of slowing down at present, and other macroeconomic challenges, have continued to impact consumer sentiments. Companies providing various types of loans experienced subdued demand. Nonetheless, with the improving inflation numbers, the Fed has signaled a pause in rate hikes for the time being, and even projected rate cuts in 2024. This is anticipated to have a positive impact on the demand for financial products, including loans and mortgage services, in the future.

Finance companies that have secured high interest rates through prudent investments are witnessing substantial growth in investment income. Assets that are floating in nature are expected to continue generating higher yields. Furthermore, the high interest rate environment is likely to continue benefiting SBIC & Commercial Finance companies due to increased prepayments and demand for refinancing.

Companies operating trading platforms in the finance sector observed an increase in trading volumes amid market volatility. Trade platforms offering government bonds witnessed higher demand from clients seeking better stability. Companies dealing with rates, credit, money markets, and other financial segments are expected to witness ongoing growth in average daily volume (ADV).

The volatile market has also presented M&A opportunities for finance companies aiming to expand their capabilities, footprints, product portfolios, and asset quality. The latter part of 2023 saw numerous deals and agreements across various segments of the finance sector. Larger investment banking companies have extended their geographical reach, expanded businesses, and augmented their networks. However, ongoing geopolitical uncertainties have presented obstacles, hindering them from realizing their full potential.

Finance sector companies continue to invest in cutting-edge technologies such as blockchain, AI, advanced analytics, telematics, cloud computing, and robotic process automation. These advancements are expected to automate processes, reduce operating expenses, and further improve the efficiency and margins of finance companies.

Just recently, the European Union introduced AI regulations, reflecting increasing efforts to regulate artificial intelligence, which could have global implications in the future. These rules aim to safeguard fundamental rights, national security, and employment.

Despite alarming predictions from analysts, consumer spending showed resilience throughout the year, especially during the holiday season. Notably, there was a significant surge in the search for better deals and incentives, with online shopping experiencing considerably greater growth compared to physical stores. The favorable spending habits of consumers indicate promising prospects for finance stocks.

4 Winning Stocks to Consider

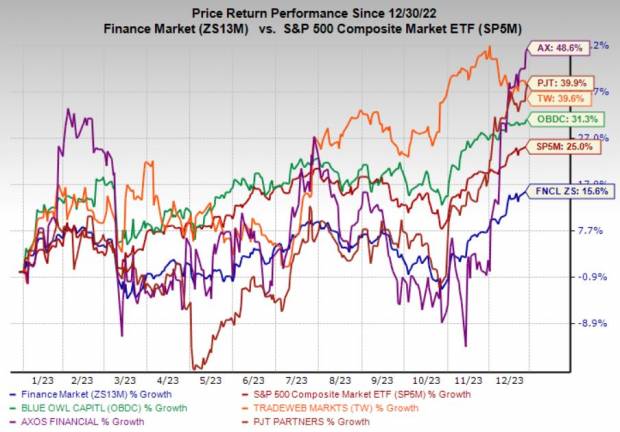

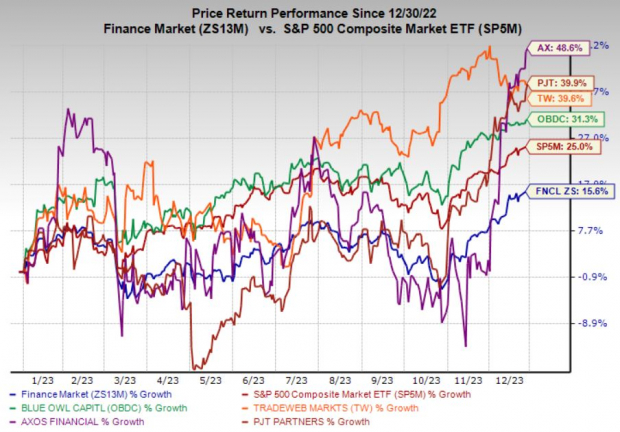

The overall economic outlook is anticipated to result in consistent growth for finance stocks, particularly those with robust business fundamentals. In the year-to-date period, the finance sector has seen a 15.6% increase, compared with the 25% growth of the S&P 500 Index. Considering their operational strength, we have identified four stocks using the Zacks Stock Screener that have gained over 30% year to date and are well positioned to maintain their momentum in 2024. These stocks currently hold either a Zacks Rank #1 (Strong Buy) or a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Rank is a reliable tool that assists in trading with confidence, regardless of trading styles and risk tolerance. To learn more about how this proven system can lead to market-beating gains, visit Zacks Rank Education.

Image Source: Zacks Investment Research

Tradeweb Markets: Headquartered in New York, Tradeweb Markets operates electronic marketplaces globally, facilitating trading in various asset classes and providing access to data and analytics. A robust growth in ADV is expected to boost the company’s bottom line in the future. Strategic acquisitions are also likely to assist TW in scaling its business segments. Its growing cash-generating capabilities are significant positives.

The 2023 Zacks Consensus Estimate for Tradeweb Markets’ earnings stands at $2.19 per share, marking a 15.3% year-over-year growth. The company has seen two upward estimate revisions in the past 30 days, with none in the opposite direction. It has beaten the Zacks Consensus Estimate for earnings in two of the last four quarters and met expectations twice, with an average surprise of 2.6%.

Zacks Rank: #2

Average Broker Recommendation: 1.79

Last Closing Price: $90.63

YTD Price Performance: 39.6%

Blue Owl Capital: This New York-based business development company specializes in different types of fund investments. Its robust portfolio health, inorganic growth opportunities, and increasing investment income are significant tailwinds. The high interest rate environment is also bolstering OBDC’s investment income.

The 2023 Zacks Consensus Estimate for Blue Owl Capital’s earnings stands at $1.91 per share, indicating a 35.5% year-over-year increase. The company has seen six upward estimate revisions in the past 60 days, with none in the opposite direction. OBDC has beaten the Zacks Consensus Estimate for earnings in each of the last four quarters, with an average surprise of 3.4%.

Zacks Rank: #1

Average Broker Recommendation: 1.67

Last Closing Price: $15.17

YTD Price Performance: