As we bid farewell to 2023 and usher in the new year, the time has come to ponder what’s on the horizon. Despite 2023 proving to be a year of resilience, with the economy, rates, and the stock market defying expectations, 2024 might just follow suit. Many experts now anticipate even higher stock prices, lower rates, and a gentle economic slowdown. However, the impact of monetary policy and quantitative tightening is expected to catch up in 2024, promising numerous surprises and, notably, reduced equity market valuations.

Inflation Continues to Be a Stubborn Challenge

Expect the unexpected in 2024 as inflation shows resilience, remaining stubbornly above the Fed’s 2% target rate. Prices for goods may witness a resurgence, driven by climbing shipping costs and soaring commodity prices. Notably, the Baltic Dry Index, after soaring to around 2,100 from its low of about 550 at the beginning of 2023, may trigger a reemergence of goods inflation, outpacing improvements in services inflation. Such a scenario could push the year-over-year rate of change higher, especially as the base effects from 2023 diminish. Besides, a hike in commodity prices, particularly in metals such as copper and iron ore, could reignite goods inflation.

While service inflation is on a downward trajectory, the persistence of high rates hint at a potential upswing, triggered by even a modest rise in goods prices. Unless goods prices plummet, the likelihood of an increase appears inevitable, particularly if shipping costs surge.

Furthermore, the upsurge in commodities, especially oil or gasoline, could reignite goods inflation, posing a challenge in 2024.

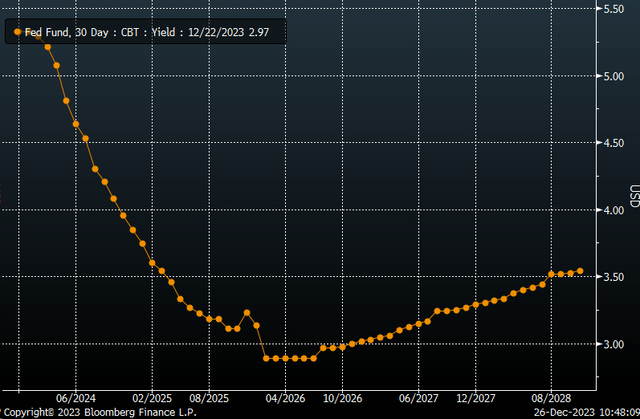

Anticipated Rate Cuts Fail to Materialize

In the wake of a resurgence in inflation, anticipated Fed rate cuts might face a delay, causing a rethink in the market’s outlook for the first half of 2024. With inflation hovering around the 3% mark, the Fed is likely to hold off on rate cuts in 2024. This shift is expected to realign market expectations with the Fed’s projected two to three rate cuts, slated to roll out in the latter half of 2024.

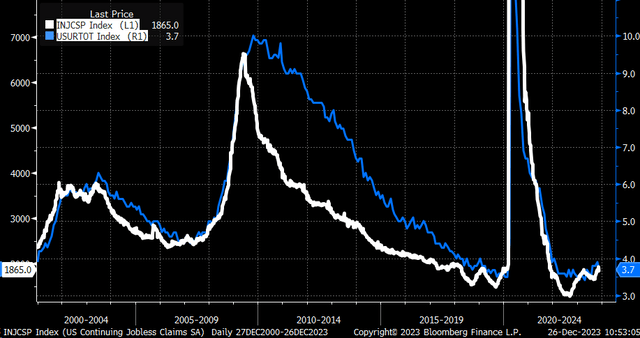

Rising Unemployment Looms Ahead

Heightened inflation and escalating interest rates are projected to exert a drag on the economy, steering it away from the exuberance of 2023. As we progress past the initial quarter of 2024, the optimism for a gentle slowdown is poised to give way to fears of a recession, with the unemployment rate poised to climb toward and possibly surpass 4%. The increase in continuing claims has already hinted at an impending surge in the unemployment rate, stoking concerns among Fed officials.

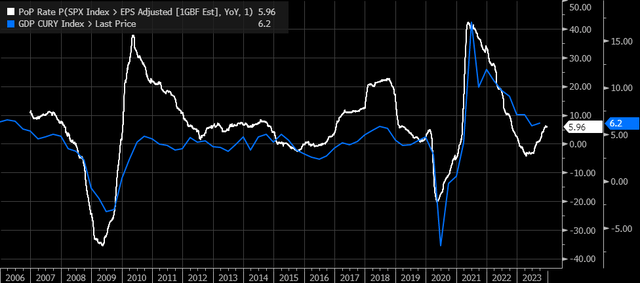

Expanding Credit Spreads Spell Lower Price-to-Earnings Ratios

Fear of an economic downturn could pose a hindrance to the equity market as credit spreads widen, translating into a reduced PE multiple for stock prices. The CDX HY Index’s indication of a substantial narrowing of credit spreads in recent weeks has bolstered stock prices by easing financial conditions. However, a potential rise in the unemployment rate to approximately 4.1% in 2024, combined with a dip in real GDP growth from approximately 2.6% in 2023 to a modest 1.4%, is poised to trigger wider credit spreads and tighter financial conditions, which will act to compress PE multiples in 2024.

Based on the Fed’s forecasts, nominal GDP growth is anticipated to decelerate to around 3.8% from existing estimates of 5.6% in 2023. Should this materialize, it appears unlikely that earnings will surpass the current estimates in 2024, suggesting that projections may have peaked.

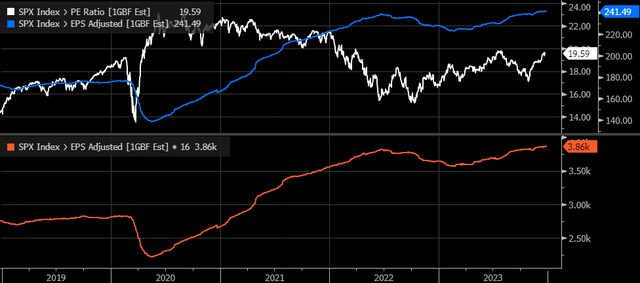

Anticipated Deceleration in the S&P 500

Sticky inflation is expected to prompt the Fed to retain high rates for an extended period amid a slowing economy and a burgeoning unemployment rate. Consequently, credit spreads are likely to widen, and PE multiples may contract, coinciding with the peak of earnings estimates. These developments are poised to throttle the PE ratio down to approximately 16 times, the historical average based on the estimates for 2024 earnings, from the current 19.6. Over the next 12 months, the existing earnings projections stand at $241, implying that the S&P 500 might retrace to around 3,900 in 2024.

Wishing you the best of luck!