Bernstein Sees Bright Future for Costco: Initiates Outperform Rating

Fund Ownership on the Rise

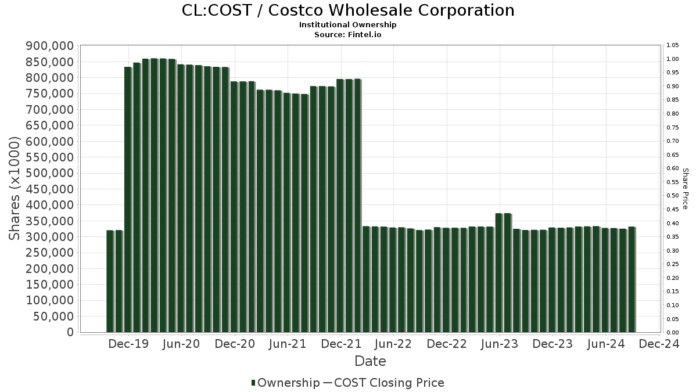

According to Fintel, on October 22, 2024, Bernstein began coverage of Costco Wholesale (SNSE:COST) with an Outperform rating. With strong institutional backing, Costco’s investment appeal is evident.

Currently, 4,742 funds and institutions have reported holdings in Costco Wholesale, marking an increase of 115 or 2.49% since last quarter. The average portfolio weighting for these funds dedicated to COST is now 0.90%, reflecting a 5.79% rise. Over the last three months, total shares held by institutions rose by 6.69%, reaching 339,185K shares.

Institutional Shareholder Movements

The Vanguard Total Stock Market Index Fund Investor Shares, also known as VTSMX, holds 14,012K shares, which is 3.16% of Costco. This represents an uptick from 13,946K shares reported earlier, showing an increase of 0.47% over the last quarter. The firm’s portfolio allocation in Costco rose by 13.35% during this period.

Another significant player, the Vanguard 500 Index Fund Investor Shares (VFINX), currently owns 11,383K shares—2.57% of the company. This is an increase from 11,182K shares in the prior filing, representing a 1.76% growth. The fund’s allocation in Costco increased by 11.80% last quarter.

Geode Capital Management has a stake of 9,325K shares, accounting for 2.10% ownership. Previously, the firm owned 9,090K shares, marking a 2.52% increase. However, its portfolio allocation in Costco decreased significantly by 41.03% over the last quarter.

Invesco QQQ Trust, Series 1, holds 8,542K shares, or 1.93% of the company. This upsurge from 8,318K shares reflects a 2.63% increase, with a portfolio allocation rise of 7.25% in the last quarter.

Lastly, International Assets Investment Management holds 7,371K shares, representing 1.66% ownership, a substantial increase from just 6K shares reported previously. However, this firm decreased its allocation in Costco by 95.60% in the last quarter.

Fintel offers a comprehensive investing research platform for individual investors, traders, financial advisors, and small hedge funds. Our extensive data covers global fundamentals, analyst reports, ownership analysis, and more, all aimed at enhancing investment decisions.

Click to Learn More

This article originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.