Allegion plc ALLE recently finalized the purchase of Montajes electronics Dorcas S.L. (“Dorcas”), a leading provider of electro-mechanical access control solutions. The financial details of the deal remain confidential.

Allegion’s stock saw a modest increase of 1.6% yesterday, closing the trading day at $128.79.

Based in Siete Aguas, Spain, Dorcas specializes in producing electro-mechanical and electro-magnetic locks, electric strikes, and other access control solutions. The company caters to a robust customer base, particularly entrenched in European markets.

Strategic Acquisition

This recent acquisition aligns with Allegion’s strategy of acquiring businesses to enhance its market presence and customer reach. By integrating Dorcas’ prowess in electric strikes and lock solutions, along with their robust innovation capabilities, Allegion aims to strengthen its security product offerings. This move is set to propel ALLE’s footprint in key sectors like healthcare and education.

The Dorcas operations will be amalgamated with Allegion’s international segment and will be overseen by Tim Eckersley, the senior vice president.

Acquisitions serve as a vital pillar of Allegion’s growth agenda. The firm endeavors to fortify its long-term performance through strategic acquisitions and continuous innovation. Earlier in February 2024, ALLE acquired Boss Door Controls to broaden its U.K. operations with an expanded portfolio and wider channel access. In January, the assets of the software-as-a-service (SaaS) workforce management company Plano Group were procured by Allegion, enriching its Interflex portfolio and AWFM business through additional capabilities in SaaS models.

Market Performance and Future Estimates

With a market capitalization of approximately $11.3 billion, Allegion currently holds a Zacks Rank #3 (Hold). The company stands to benefit from its robust electronic product line, ongoing product innovations, and a sizeable customer base over the long term. However, subdued demand in the home builder markets could pose challenges.

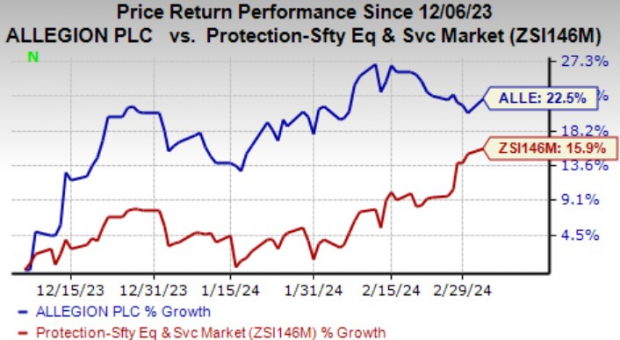

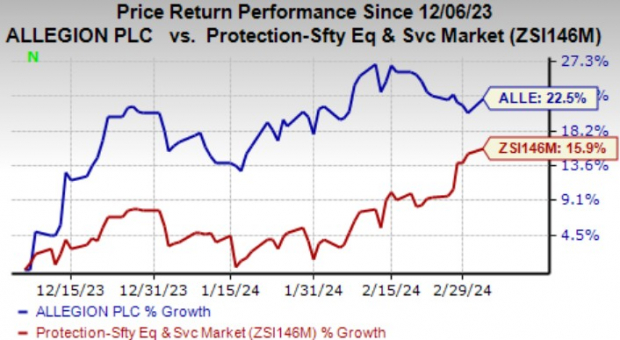

Image Source: Zacks Investment Research

Over the past three months, Allegion’s shares have surged by 22.5%, outpacing the growth of the industry at 15.9%.

The Zacks Consensus Estimate for Allegion’s 2024 earnings stands at $6.90, indicating a 2.7% uptick from the figure reported 30 days ago.

Analyst Insights and Stock Recommendations

Notable stocks within the same industry segment are outlined below.

Napco Security Technologies, Inc. NSSC holds a Zacks Rank of 1 (Strong Buy). For more Zacks #1 Rank stock updates, check them out here.

NSSC has delivered an average earnings surprise of 27.7% over the past four quarters. In the last 30 days, the Zacks Consensus Estimate for Napco Security’s 2024 earnings has risen by 16.1%.

MSA Safety Incorporated MSA boasts a Zacks Rank #1. The company registered a four-quarter average earnings surprise of 21.8%. Within the recent 30-day period, there has been a 4.3% upsurge in the Zacks Consensus Estimate for MSA Safety’s 2024 earnings.

Cadre Holdings, Inc. CDRE currently holds a Zacks Rank of 2 (Buy). CDRE demonstrated an average earnings surprise of 32.8% over the past four quarters. In the last month, the Zacks Consensus Estimate for Cadre Holdings’ 2024 earnings has grown by 1.8%.

Exciting News: Zacks Top 10 Stocks for 2024

Hurry – it’s not too late to explore our top 10 stock picks for 2024. Handpicked by Zacks’ Director of Research, Sheraz Mian, this collection has been consistently high-performing and impressive. From its launch in 2012 till November 2023, the Zacks Top 10 Stocks showcase an impressive +974.1% growth, nearly tripling the S&P 500’s increase of +340.1%. Sheraz meticulously analysed over 4,400 companies rated by Zacks and selected the top 10 for potential investment in 2024. Be among the first to discover these freshly unveiled stocks with huge potential.

The opinions expressed in this article are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.