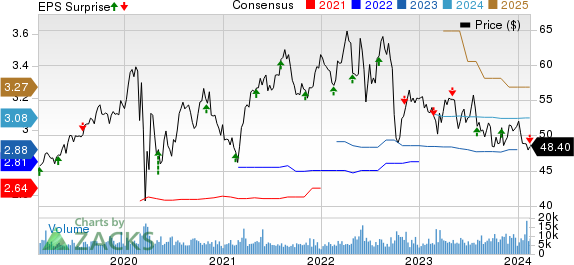

Alliant Energy Corporation LNT reported fourth-quarter 2023 operating earnings of 48 cents per share, which lagged the Zacks Consensus Estimate of 55 cents by 12.7%. The bottom line improved 4.3% from the year-ago quarter’s figure of 46 cents. Full-year 2023 earnings came in at $2.82 per share, up 0.7% from the previous year’s level of $2.80.

Decline in Revenues

Revenues totaled $961 million, which missed the Zacks Consensus Estimate of $1.3 billion by 23.1%. The top line also decreased 9.2% from the year-ago quarter’s level of $1.1 billion. Full-year 2023 revenues came in at $4 billion, down 4.2% from the previous year’s level of $4.2 billion.

Operational Highlights

Total operating expenses were $778 million for the quarter, down 13.5% from $899 million in the year-ago period due to lower electric production fuel and purchased power, and reduced cost of gas sold. Operating income totaled $183 million, up 15.1% from $159 million reported in the year-ago quarter. Interest expenses amounted to $105 million, 16.7% higher than that recorded in the prior-year period. The company’s retail electric and gas customers increased 0.6% each, year over year. LNT reported total utility electric sales of 7,612 thousand megawatt-hour (MWh), up 0.8% from the year-ago quarter’s figure. Total utility gas sold and transported were 41,520 thousand of dekatherms, up 5.6% year over year.

Financial Update

Cash and cash equivalents amounted to $62 million as of Dec 31, 2023, compared with $20 million as of Dec 31, 2022. Long-term debt (excluding the current portion) totaled $8.2 billion as of Dec 31, 2023, higher than $7.7 billion recorded as of Dec 31, 2022. For 2023, cash flow from operating activities totaled $867 million compared with $486 million in the year-ago period.

Guidance

Alliant Energy expects its 2024 earnings to be in the band of $2.99-$3.13 per share. The projection takes into account the normal temperature in its service territories, execution of cost controls and the consolidated effective tax rate of 7%. The Zacks Consensus Estimate for 2024 earnings is pegged at $3.08 per share, higher than the midpoint of the company’s guided range.

Analysis

Currently, Alliant Energy carries a Zacks Rank #2 (Buy).

Upcoming Releases

Exelon Corporation EXC is scheduled to report fourth-quarter results on Feb 21, before market open. The Zacks Consensus Estimate for earnings is pegged at 58 cents per share. EXC’s long-term (three to five years) earnings growth rate is 5.69%. The company delivered an average earnings surprise of 1.8% in the last four quarters.

Ameren Corporation AEE is slated to report fourth-quarter results on Feb 22, after market close. The Zacks Consensus Estimate for earnings is pegged at 61 cents per share. AEE’s long-term earnings growth rate is 5.89%. It delivered an average earnings surprise of 9.5% in the last four quarters.

NRG Energy, Inc. NRG is scheduled to report fourth-quarter results on Feb 28, before market open. The Zacks Consensus Estimate for earnings is pegged at 94 cents per share. NRG’s long-term earnings growth rate is 13.75%. It delivered an average earnings surprise of 4.7% in the last four quarters.

7 Best Stocks for the Next 30 Days Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.0% per year. So be sure to give these hand-picked 7 your immediate attention. See them now >>

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.