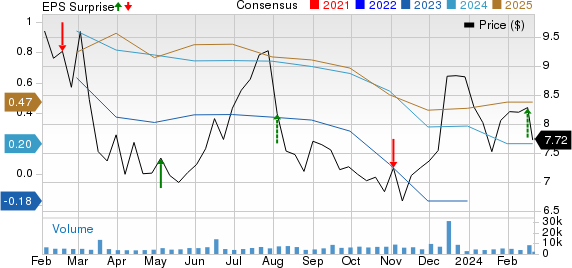

American Axle & Manufacturing Holdings delivered a Q4 2023 loss of 9 cents per share, a pleasant surprise given it was narrower than the Zacks Consensus Estimate of a loss of 16 cents. This news holds even greater weight when considering the year-ago quarter’s 7 cents per share loss. Furthermore, the company exceeded expectations by reporting quarterly revenues of $1.46 billion, outpacing the Zacks Consensus Estimate of $1.45 billion. With a notable 5% increase in revenues on a year-over-year basis, this accomplishment has certainly turned heads.

A Look at the Numbers

In the reported quarter, the Driveline segment saw sales of $1.02 billion, marking a robust 6.8% year-over-year increase.

The Driveline Buzz: A Thriving Performance

The Driveline segment’s adjusted EBITDA skyrocketed to $140.1 million, showcasing an impressive 17.9% surge from the previous year.

In addition, the Metal Forming business generated revenues of $576.2 million, a solid 2.2% rise from the previous year. While this exceeded estimates, the segment witnessed an adjusted EBITDA of $29.4 million, a decline of 24.6% from estimates.

Financial Position in the Screens

The company’s SG&A expenses totaled $95.7 million in Q4 2023, up from $88.5 million reported in the prior-year quarter.

Furthermore, American Axle’s net cash provided by operating activities plummeted to $52.9 million from $148.5 million in the year-ago period. The capital spending in the quarter was $55.9 million, up from $53.1 million previously recorded. Additionally, the company reported an adjusted free cash flow of $4.5 million, down from $99 million in the same period last year.

As of Dec 31, 2023, American Axle had cash and cash equivalents of $519.9 million, compared with $511.5 million on Dec 31, 2022. The company’s net long-term debt was $2.75 billion, a decline from $2.85 billion as of Dec 31, 2022.

Outlook for 2024

American Axle envisions revenues in the range of $6.05-$6.35 billion, compared with $6.08 billion registered in 2023. Adjusted EBITDA is estimated in the band of $685-$750 million compared with $693.3 million registered in 2023. Additionally, adjusted free cash flow is expected to range from $200-$240 million, compared with $219 million registered in 2023.

Market Ranking & Bright Picks

AXL currently carries a Zacks Rank #3 (Hold). Some better-ranked players in the auto space are Modine Manufacturing Company (MOD), NIO Inc. (NIO), and Oshkosh Corporation (OSK). MOD sports a Zacks Rank #1 (Strong Buy), while NIO & OSK carry a Zacks Rank #2 (Buy) each at present. Intriguingly, the stock world is ripe with potential, and Zacks experts have handpicked 5 stocks poised to double in 2023. With previous recommendations having soared +143.0%, +175.9%, +498.3% and +673.0%, these stocks provide an exciting opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

The road to financial recovery continues, and with the promising outlook for 2024, American Axle & Manufacturing Holdings Inc. is setting the stage for a compelling narrative in the auto industry. As the company navigates the aftermath of the pandemic, investors are eager to see how its trajectory unfolds.