Ready to dive into some stellar picks for January 29th,like exploring a box of assorted chocolates? Here are three standouts that are flaunting their buy ranks and impressive growth attributes, enticing investors to take a closer look.

Enersys: A Powerhouse in Growth

Enersys (ENS) sparks with a Zacks Rank #1, the crème de la crème. Over the last 60 days, its Zacks Consensus Estimate for the current year’s earnings has surged a dazzling 12.3%. This stored energy solutions company’s PEG ratio of 0.81 outshines the industry average of 1.61, and its Growth Score holds a respectable B.

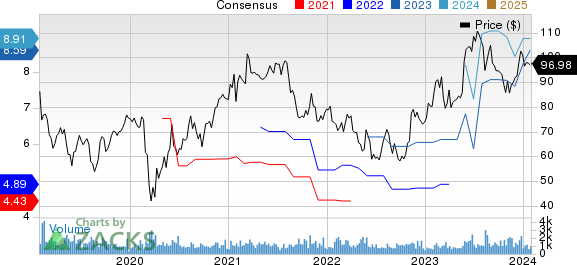

Enersys Price and Consensus

Need visual proof? See the Enersys price-consensus-chart for yourself!

Enersys PEG Ratio (TTM)

Curious about Enersys’ trend line? Peep at the Enersys peg-ratio-ttm charts.

Woodward, Inc.: Soaring in the Skies of Potential

Woodward, Inc. (WWD) is another high-flyer, carrying a Zacks Rank #1 with its current year earnings estimate soaring 4.2% over the past 60 days. The company’s PEG ratio of 1.84 outshines the industry average of 2.39, with a solid Growth Score of B.

Woodward, Inc. Price and Consensus

Don’t believe us? Feast your eyes on the enticing Woodward, Inc. price-consensus-chart!

Woodward, Inc. PEG Ratio (TTM)

Yearning for more? Gaze at the Woodward, Inc. peg-ratio-ttm insightfully.

Itron, Inc.: A Tech Marvel on the Rise

Itron, Inc. (ITRI) has landed a Zacks Rank #1, igniting excitement with a 3.2% surge in its current year earnings estimate over the past 60 days. Its PEG ratio of 1.02 outperforms the industry’s average of 3.06, and the company boasts a Growth Score of B.

Itron, Inc. Price and Consensus

Fancy some visuals? Set your sights on the Itron, Inc. price-consensus-chart!

Itron, Inc. PEG Ratio (TTM)

Seeking compelling charts? Dive into the Itron, Inc. peg-ratio-ttm displays.

For more top-ranked stocks, check out the full list.

Dive into the Growth score and how it is calculated here to beef up your knowledge.

Kindle your curiosity? Freshly unleashed by the gurus are 7 elite stocks from 220 Zacks Rank #1 Strong Buys. They’re hailed as “Most Likely for Early Price Pops.” Since 1988, the whole shebang has outshone the market with an average annual gain of +24.0%. Don’t miss out on these hand-picked 7!

newest insights from Zacks Investment Research are just a click away. Ready to download them? Its absolutely free. Click here and turn the tables.

For a closer look, don’t miss Zacks Investment Research.

While the words of the author flood these lines, remember that they don’t always mirror the opionion of Nasdaq, Inc.