A good way to spot trends in the stock market is to look at which companies asset management firms are investing in. While there are a lot of hedge funds out there, one of the more closely followed portfolios hails from Renaissance Technologies.

Renaissance is led by Jim Simons, who is actually a mathematician by trade. A look at the fund’s most recent filings shows one clear trend: Renaissance is investing heavily in the technology sector right now.

But with just about every tech company parroting their artificial intelligence (AI) capabilities, it can become hard to discern the winners from the wannabes. Let’s dig into Renaissance’s portfolio and assess the most bullish opportunities from Simons and his team.

1. Nvidia

Nvidia (NASDAQ: NVDA) is the third-largest position in Renaissance’s portfolio, and the biggest among its “Magnificent Seven” holdings.

What I find interesting about Nvidia’s prominence in the portfolio compared to other tech stocks is its relationship with Renaissance’s largest holding overall: Novo Nordisk. Although Renaissance trimmed its position in the Ozempic maker by 2.4 million shares last quarter, Novo Nordisk is still handily the top position in Simons’ portfolio. Following a milestone year in 2023, Novo Nordisk recently teamed up with Nvidia to help accelerate AI in the healthcare world.

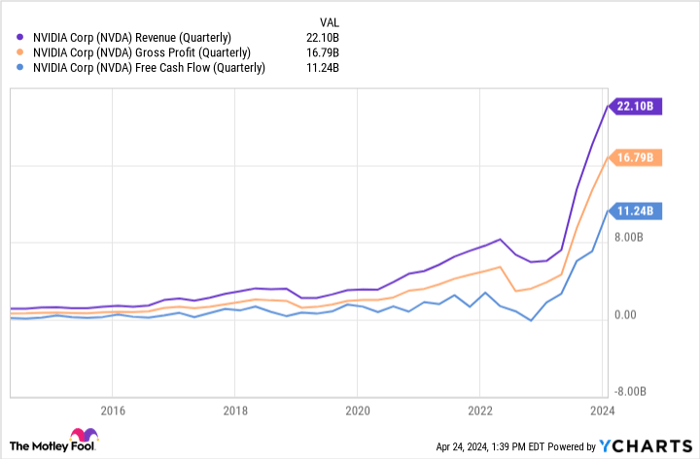

NVDA Revenue (Quarterly) data by YCharts

The chart above illustrates Nvidia’s revenue, gross profit, and free cash flow during each quarter of the last 10 years. The obvious takeaway is that the newfound demand fueling AI services has ignited a new growth frontier for Nvidia.

However, there’s more to the picture here. Nvidia is playing a monumentally important role in the AI revolution. The company’s H100 and A100 graphics processing units (GPUs) are the main engine fueling myriad AI applications, including training generative AI models, enhancing accelerated computing, and more.

Nvidia’s GPUs are being deployed in Tesla vehicles to help with autonomous driving and are also being leveraged by Meta Platforms (NASDAQ: META) to hone its targeted advertising capabilities in an intensely crowded social media landscape.

The superior pricing power that Nvidia has achieved over the competition has resulted in staggering profit growth. As an investor, what’s encouraging to see is that Nvidia is aggressively investing its profits into other high-growth opportunities.

For example, earlier this year Nvidia joined OpenAI, Intel, and Microsoft in a $675 million funding round for a humanoid robotics start-up called Figure AI.

I think this is a particularly savvy move as Nvidia has a lucrative opportunity to help Figure AI’s development from both a hardware and software perspective. In a way, owning Nvidia is similar to owning an index fund focused on several aspects of the AI realm.

Nvidia operates across semiconductor chips, robotics, enterprise software, and data center services. The prolific nature of its business is leading to a variety of AI-powered applications, and paving the way for a robust long-term roadmap.

Considering the enormous opportunities Nvidia orbits, it’s not surprising to see the company earn such a high position in a highly regarded portfolio such as Renaissance.

Image source: Getty Images.

2. Meta

Meta Platforms rounds out the top five positions in the Renaissance portfolio. For the quarter ended Dec. 31, Renaissance bought a whopping 2 million shares of Meta stock — an increase of over 2,000% from its prior allocation.

2023 was a transformational year for Meta, and I’m not surprised to see smart money pouring into the stock.

Last year, Meta underwent several rounds of layoffs in an effort to reduce its expense profile — which briefly became bloated following some hefty investments related to the metaverse in 2022. Moreover, the company doubled down on its core advertising business and proved that it can fend off rising competition from the likes of Alphabet and TikTok.

The table below illustrates some important operating metrics for Meta:

| Metric | 2022 | 2023 | Change |

|---|---|---|---|

| Revenue | $116.6 billion | $134.9 billion | 16% |

| Operating income | $28.9 billion | $46.7 billion | 62% |

| Free cash flow | $18.4 billion | $43.0 billion | 134% |

Data source: Meta.

Meta’s return to respectable top-line growth combined with disciplined cost controls ultimately led to soaring profitability. The company demonstrated a true sign of maturity by announcing that it will be reinvesting these profits in the form of a dividend and an increased share repurchase program.

Considering Meta’s forward price-to-earnings (P/E) multiple of 24.5 is currently the second lowest among the Magnificent Seven, I think the stock looks especially attractive as sales and profits look to be back on the right track.

3. Amazon

The last company I’ll be exploring is Renaissance’s sixth-largest holding, e-commerce and cloud computing specialist Amazon (NASDAQ: AMZN).

I see Amazon in a similar light to that of Nvidia. While the company is largely known for its online store, Amazon is a far more prolific business. The company is a leader in cloud computing thanks to Amazon Web Services (AWS), and it also operates in the worlds of streaming and advertising.

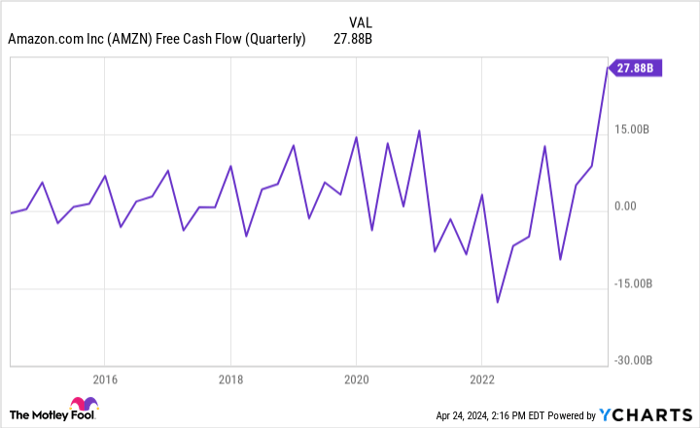

The trends below hit on an important theme for Amazon investors.

AMZN Free Cash Flow (Quarterly) data by YCharts

Lingering inflation and high borrowing costs took a toll on Amazon’s business over the last couple of years. However, 2023 was somewhat of a rebound year as Amazon sharply turned back to a consistently cash-flow-positive business. And just like Nvidia, Amazon is deploying this cash to ignite new growth.

Back in September, Amazon committed to a $4 billion investment in AI start-up Anthropic. The overarching thesis of the deal was to integrate Anthropic into AWS to help unlock new growth opportunities.

Moreover, AI has the potential to span across Amazon’s entire ecosystem. For example, the technology can help Amazon discover cost efficiencies that it can integrate into warehouse and fulfillment centers, as well as new marketing tactics that it can employ for both the e-commerce and advertising segments.

Amazon’s price-to-sales (P/S) ratio of 3.2 is essentially identical to its 10-year average, making it a compelling buy for long-term investors.

I think Simons is onto something with his specific Magnificent Seven allocations, and I see each of the companies discussed above as solid opportunities for investors with a long-term time horizon.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of April 22, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Meta Platforms, Microsoft, Novo Nordisk, Nvidia, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends Intel and Novo Nordisk and recommends the following options: long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short May 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.