A Resilient Giant

Tradeweb Markets TW, a Zacks Rank #1 (Strong Buy), has been powering ahead as a global operator of electronic trading marketplaces. The stock’s recent surge past its previous all-time high reflects its resilience in the face of fluctuating markets. Further buoyed by a resurgent financial sector, the stock’s standout performance over the past year surpasses market expectations, with its upward trajectory poised to extend into 2024.

An Industry on the Rise

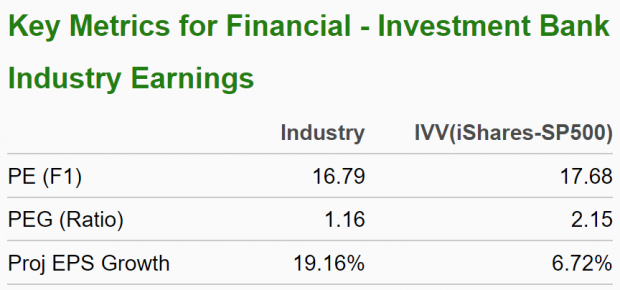

The company’s inclusion in the top 12% of the Zacks Financial – Investment Bank industry group solidifies its position as a market leader, underlining its potential to outperform the broader market in the next 3 to 6 months. Historical data supports the notion that a stock’s industry grouping heavily influences its price appreciation, with top-performing industries outpacing the rest by more than a 2 to 1 margin. Tradeweb’s standing in the upper echelons of Zacks Ranked Industries underscores its advantageous market position.

Image Source: Zacks Investment Research

Company Overview

Tradeweb Markets excels in constructing and maintaining global electronic marketplaces, offering seamless trading across various asset classes such as equities, rates, credit, and money markets. Its extensive suite of services includes pre-trade and post-trade data and analytics, trade execution and processing, as well as reporting services. The company’s range of electronic, voice, and hybrid platforms cater to the precise needs of dealers, financial institutions, and traders, solidifying its reach and influence across different market segments.

By catering to institutional, wholesale, and retail clients, Tradeweb Markets maintains a robust customer base comprising asset managers, hedge funds, central banks, proprietary trading firms, insurance companies, and brokerage firms, indicating its pivotal role in the global financial ecosystem.

Remarkable Earnings Performance and Future Projections

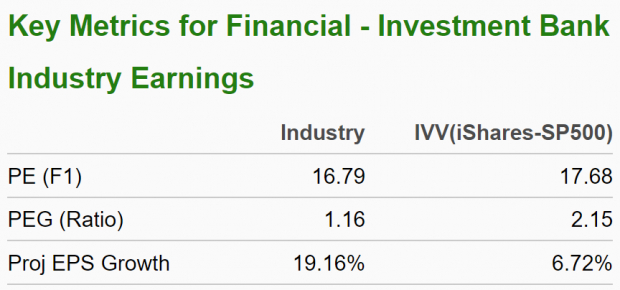

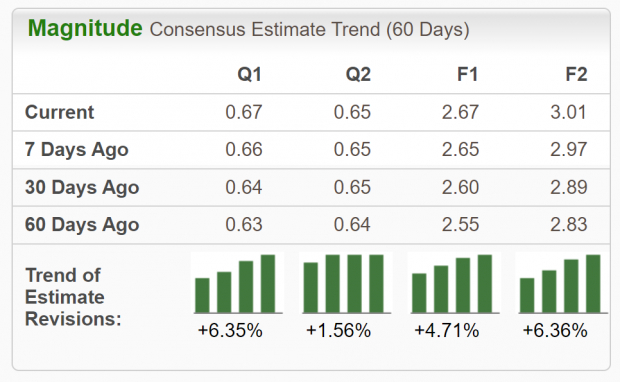

The company’s stellar earnings track record, characterized by consistent outperformance in the last four quarters, showcases its robust financial performance. With a recent earnings surprise of 1.59% over consensus estimates, along with a significant year-over-year improvement in earnings and revenues, Tradeweb Markets is evidently positioned for sustained growth. The significant uptick in analysts’ earnings estimates for the current quarter underscores the widespread confidence in the company’s potential. Forecasts indicate a prospective 24.1% year-over-year increase in EPS, coupled with a 19.9% rise in revenues.

Image Source: Zacks Investment Research

Embracing Favorable Technical Trends

With a remarkable 42% surge in the last year, TW shares are exemplars of favorable technical trends. Notably, both the 50-day and 200-day moving averages are on an upward trajectory, showcasing the stock’s sustained momentum. The company’s consistent generation of fresh 52-week highs and its recent breakthrough of its previous all-time high underline its robust technical underpinning. This, coupled with its strong fundamentals, paints a promising outlook for Tradeweb Markets.

Image Source: StockCharts

Looking Ahead

Tradeweb Markets’ ability to navigate the ever-evolving technological landscape positions it as a formidable player in the market. Bolstered by its membership in a leading industry group and an enviable track record of surpassing earnings estimates, the stock presents an alluring case to investors. Its strong technical underpinnings, combined with robust fundamentals, project a bullish trajectory for Tradeweb Markets in the coming months.