The Chart of the Day: Archrock’s Soaring Ride

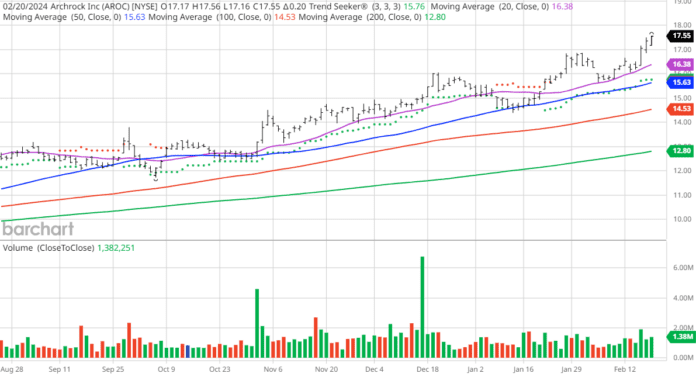

Today’s chart-topping stock belongs to none other than the natural gas company Archrock (AROC). Utilizing Barchart’s robust screening capabilities to pinpoint stocks with the strongest technical buy signals, highest Weighted Alpha, and superior current momentum, the stock inched its way to the limelight. Since the Trend Seeker provided a buy signal on January 24, the stock has propelled upwards by a staggering 10.53%. It’s akin to a rocket ship blasting off from the launchpad and soaring into the stratosphere.

Archrock, Inc., an energy infrastructure juggernaut in the United States. It operates in two core segments: Contract Operations and Aftermarket Services. The company is deeply entrenched in the full spectrum of activities related to natural gas compression equipment. Its services cater to customers in the oil and natural gas sphere – designing, sourcing, installing, and maintaining its fleet of natural gas compression equipment. It’s like a harmonious symphony in the world of energy infrastructure – all the moving parts working in concert to create a melodious outcome. The company, which was previously known as Exterran Holdings, Inc., rebranded itself as Archrock, Inc. in November 2015. A veritable phoenix rising from the ashes, transforming itself and now soaring to new heights.

Barchart’s Insight

Barchart’s Opinion trading systems provide live updates every 20 minutes, offering a real-time glimpse into the market fluctuations. The technical indicators are nothing short of spectacular – featuring 100% technical buy signals, a whopping 74.74+ Weighted Alpha, and trend seeker buy signal. The stock has also outperformed with an 83.77% gain in the last year, with its relative strength index at a robust 69.86%. Moreover, the stock is perched above its 20, 50, and 100-day moving averages, staying ahead of the curve. It’s like a seasoned athlete leading the pack, with every muscle flexed and ready to conquer the race.

Fundamentally, the company boasts a market cap of $2.71 billion and a dividend yield of 3.60%. Wall Street’s projections for this energy behemoth are equally awe-inspiring. Revenue is expected to surge by 16.40% this year and a further 7.80% next year. Earnings are estimated to skyrocket by 131.00% this year and an additional 40.30% next year. This unyielding growth paints a picture of a company that is not just conquering the present but also laying the groundwork for an even more triumphant future.

Analysts and Investor Sentiment

While the charts sing a harmonious tune, what do the minds in the market think? Wall Street analysts have sung a largely positive chord, issuing 4 buy recommendations this month alone. The price targets rallied between $16 to $18, painting a resoundingly optimistic future. The individual investors echoing a similar sentiment – 9 votes to 2 for the stock to outperform the market on Motley Fool. The experienced investors unanimously vote 2 to 0 for the same result. CFRAs MarketScope holds a “hold” rating, indicating a hint of caution amidst the unbridled enthusiasm. Wrapped in these sentiments, the stock is monitored diligently by 5,940 investors on Seeking Alpha. The sea of voices opine and converge, creating an orchestra of investor sentiment that’s hard, but not impossible, to ignore.

Adding some perspective, the Barchart Chart of the Day signifies stocks that are experiencing exceptional current price appreciation. However, these stocks are not a one-size-fits-all proposition. They require significant caution and systematic risk assessment. Proceed with eyes wide open and put in place a moving stop loss discipline commensurate with your personal investment risk tolerance. As markets change, so does the story, and the same goes for stocks. It’s akin to riding a rollercoaster – thrilling, but with the potential for sudden drops.

On the date of publication, Jim Van Meerten had no positions (either directly or indirectly) in any of the securities mentioned in this piece. For more details, refer to the Barchart Disclosure Policy.

These views resonate solely from the author and do not necessarily reflect those of Nasdaq, Inc.