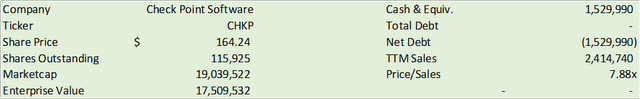

Check Point Software (NASDAQ:CHKP) reported a robust end to the fiscal year 2023 with growth at both the top and bottom line. Despite facing challenges at the start of 2023, Check Point displayed resilience and overcame the slow customer acquisition that initially hindered them. With their Infinity platform rolling out, management is optimistic that this momentum can continue and potentially ride the AI software wave. This positive outlook has led to a BUY recommendation for CHKP shares with a price target of $217.64/share at 9.45x eFY25 sales.

Business Operations

Similar to other cybersecurity firms, Check Point has been focusing on bringing customers onto their singular platform, Infinity, to leverage various security features across the network, cloud infrastructure, and business software applications. Check Point introduced their copilot feature on the Infinity platform, allowing users to navigate the platform and IT infrastructure using GenAI natural language processing. This feature is said to save cybersecurity professionals a significant amount of time navigating for errors and issues.

“Something that would have taken an analyst anything from a few minutes to a few hours to analyze to understand… with one sentence to our generative AI, the Infinity copilot, it analyzes the situation. It explains why she wasn’t able to access. It suggests a solution either to a certain group. It asks the user whether you want to implement this change and whether they want to install the new policy, and boom, in a matter of 1 or 2 minutes, everything is done.” – Gil Shwed

Management remains optimistic about growth going into 2024 as the business environment appears to be less cloudy when compared to 2023. Financing challenges were mentioned as a headwind to billings as interest rates remain elevated. As a result, it is anticipated that customers will keep contracts for shorter durations until interest rates come down, relieving some of the financing costs. This will result in fewer dollars being paid up-front and more annual renewals.

Management also hinted at a shift in the sales approach as more customers adopt Infinity. The difference will not necessarily be engagement, but rather, the transfer from a one-time product or licensing sale to a subscription-based sale.

Check Point is poised to ride the AI wave as their entire product catalog now contains some form of AI. In addition, Infinity can be deployed using various form factors, whether through cloud, email, etc. It secures all the core nodes of IT, from the network, cloud infrastructure, endpoints & applications, and the security operations center.

Gartner forecasts a strong year for IT spend in 2024, with 13.5% growth in software spend. The research firm reported that 80% of CIOs anticipate increasing their cybersecurity spend in 2024 with a focus on cost management. Check Point’s AI-powered platform can cater to this level of investment, as their copilot feature enables a user to analyze across the infrastructure in spoken language, providing more flexibility in staffing and reducing time spent across IT operations.

Financial Perspective

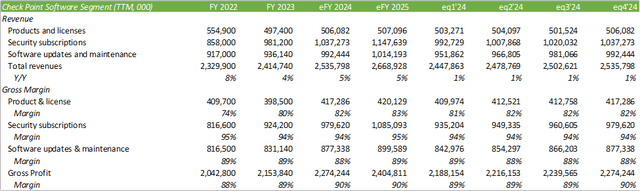

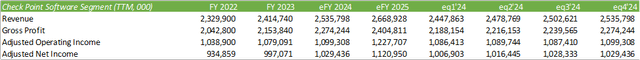

Management guided growth in-line with their historical growth rate with eFY24 revenue guidance of $2,475-2,625mm and adjusted EPS of $8.70-9.30/share. This represents revenue growth of 2-9% for eFY24 and net margin expansion to 41.60-41.93%, assuming static share count from FY23.

Operating margins may experience a -2% headwind in eFY24 resulting from Check Point’s acquisition of Perimeter 81 in September 2023. Although this acquisition may initially impact margins, the integration of Perimeter 81 is expected to bolster Check Point’s subscription-based service features and overall margins in the long term.

On the negative side, geographic challenges in Europe could pose headwinds, as the European Bloc is going through slow or contractionary growth. Specifically, Germany’s productivity is experiencing a major contractionary phase, posing a potential challenge for Check Point going into eFY24, as EMEA accounted for 48% of total sales in FY23.

Looking stateside, fiscal challenges on the horizon such as higher, for longer interest rates and persistent inflation may indirectly affect Check Point. Regional banking industry faces a $929b CRE debt wall that may be challenging to refinance at these higher rates, potentially impacting the firm and its clients.

However, positive tailwinds are anticipated as more firms seek to limit spending while optimizing operations. Similar to Palantir’s (PLTR) ability to optimize operations, Check Point has the capability to optimize the security department and overall IT environment, thus riding the beginning of the hype-cycle for AI-enabled applications for businesses. The GenAI copilot is expected to enable cost-savings by lowering the barrier to entry for executing complex security tasks while using natural language command functions.

Check Point’s Financial Outlook and Shareholder Value

Check Point Software Technologies Ltd. has remained a dominant player in the realm of cybersecurity, unyielding amidst the turbulent landscape. Its resolve to fortify digital fortresses has propelled it towards pioneering one of the most crucial aspects of modern civilization – safeguarding our virtual citadels.

Technological Leap

In its latest foray, Check Point has embraced Artificial Intelligence with open arms, envisioning a digital panacea that augments its prowess. The decision to incorporate AI not only reflects its adaptability but also underscores a strategic masterstroke, enabling the streamlining of operations and the fortification of its digital ramparts with greater efficacy. This technological leap holds the promise of elevating Check Point’s operational efficiency by leaps and bounds, a feat akin to fortifying a medieval stronghold with state-of-the-art defenses, rendering it impregnable in the digital realm. Moreover, the integration of AI is envisaged to yield a reduction in salaries, training time, and potentially headcount by expediting various operational facets. This strategic metamorphosis inherently signifies a cardinal enhancement in Check Point’s operational fabric, auguring well for the company’s long-term viability and its competitive edge in the cybersecurity domain.

Leadership Transition

As Mr. Schwed embarks on the transformative role of Executive Chairman, ceding the reins of the CEO to a new helmsman, the transition embodies the natural progression of stewardship. The seamless transition underscores the company’s robust organizational ethos, ensuring continuity in leadership and strategic vision. It is poised to solidify Check Point’s foundation and accentuate its steadfast resolve in navigating the dynamic cybersecurity landscape. Furthermore, this transition, akin to the passing of the baton in a relay race, is embarked upon with utmost composure and meticulous timing, insulating the company from any substantial perturbations in its share price, pending the anointment of a new CEO.

Valuation & Shareholder Value

Check Point’s steadfast ascent, despite not embodying the high-throttle momentum replicated by its peers, such as Palo Alto Networks (PANW) or CrowdStrike (CRWD), elicits a distinctive appeal for shareholders. In embracing a trajectory of dependable growth, this paradigm aligns with the philosophy of subdued volatility risk, shielded from the perils of pernicious market maneuvers. Embracing this awe-inspiring aligns the investor with potential for consistent growth, mitigating the turbulence that befalls high-velocity stocks, akin to the exhilarating yet precarious thrills of a roller coaster ride.

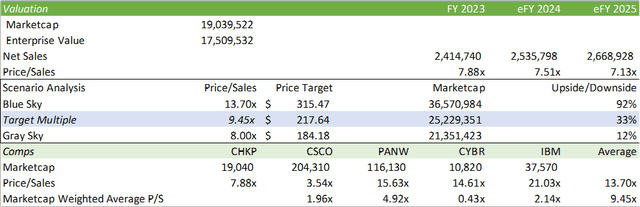

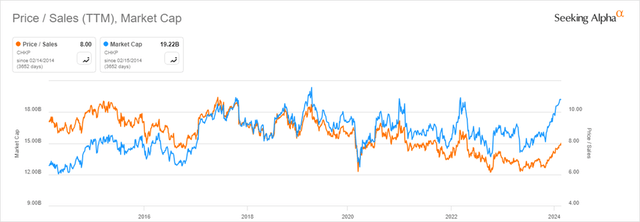

Factoring in the company’s valuation, Check Point’s shares are steadfastly steeped in a price/sales range, oscillating from as low as 6.25x to a zenith of approximately 10x. This substantial fortitude against the backdrop of obdurate valuation elucidates the company’s robust financial moorings and its normative divergence from precipitous pricing fluctuations.

Anticipating a dilation in the shares’ valuation, an ascent toward the peer average of 9.45x sales is envisaged, a testament to Check Point’s reinvigorated financial mettle. Based on eFY25 sales, the prognostication beckons Check Point’s shares to ascend to a remarkable $217.64/share, representing a staggering 33% upswing from the current price. Hence, my unequivocal recommendation perceives Check Point as a BUY, an emblem of longevity and financial prudence in every sense.