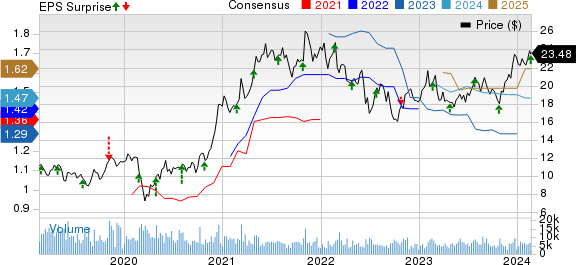

Element Solutions Inc. (ESI) reported Q4 earnings of 32 cents per share, consistent with the Zacks Consensus Estimate. The company’s fourth-quarter 2023 earnings marked a significant improvement compared to the year-ago quarter, when it reported 5 cents per share.

The quarterly net sales stood at $573.4 million, remaining flat year over year, but failing to meet the Zacks Consensus Estimate of $588.6 million. Organic net sales experienced a 3% decline.

Despite the revenue miss, the company’s circuitry and semiconductor businesses witnessed a return to organic growth in the reported quarter. Additionally, ESI achieved an 11% growth in adjusted EBITDA during the quarter.

Key Insights

Net sales in the Electronics segment grew by 4% to $352 million compared to the year-ago quarter, although organic net sales dipped by 1%. On the other hand, the Industrial & Specialty segment experienced a 6% decline in net sales, totaling $221 million, with a 7% drop in organic net sales.

The full-year 2023 results indicate a decrease in earnings to 48 cents per share from 75 cents per share in the previous year, while net sales suffered an approximately 8% year-over-year decline, amounting to $2,333.2 million.

The company’s financial position revealed a 9% year-over-year increase in cash and cash equivalents, reaching $289.3 million by the end of 2023. However, long-term debt also rose by around 2% to $1,921 million during the same period. Notably, cash from operating activities for 2023 was reported at $334 million, with a free cash flow of $282 million for the year.

Projections and Stock Performances

ESI has set its sights on achieving adjusted EBITDA within the range of $510-$530 million for 2024. For the first quarter of 2024, the company anticipates adjusted EBITDA in the band of $120-$125 million. Furthermore, ESI foresees generating a free cash flow in the range of $280-$300 million for 2024.

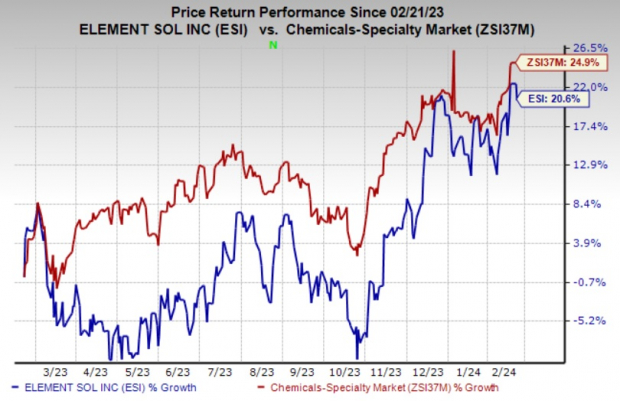

The company’s shares have demonstrated a 20.6% increase over the past year, although slightly trailing the industry’s 24.9% rise in the same period.

Image Source: Zacks Investment Research

Rankings and Recommendations

As of now, ESI possesses a Zacks Rank #3 (Hold). Moreover, other notable stocks in the basic materials space that investors may consider include Carpenter Technology Corporation (CRS), Alpha Metallurgical Resources Inc. (AMR), and Hawkins, Inc. (HWKN).

CRS, currently holding a Zacks Rank #1 (Strong Buy), has been demonstrating robust performance, with its fiscal year earnings estimated to increase by a whopping 250.9% year over year. AMR and HWKN, both carrying favorable outlooks, also present lucrative investment opportunities.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2023. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor. Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alpha Metallurgical Resources, Inc. (AMR) : Free Stock Analysis Report

Element Solutions Inc. (ESI) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Hawkins, Inc. (HWKN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.