Flowers Foods, Inc. FLO has revealed its fourth-quarter fiscal 2023 results, indicating that while the bottom line aligned with the Zacks Consensus Estimate, it experienced a decline compared to the previous year. Despite this, sales witnessed an uptick from the previous year.

The company’s flagship brands displayed resilience in the face of challenging market conditions during the fourth quarter and fiscal 2023. Notably, Dave’s Killer Bread has broken through, surpassing $1 billion in retail sales in 2023. Furthermore, Flowers Foods’ portfolio strategy has led to margin improvements across the cake, foodservice, and private-label segments.

Looking ahead to fiscal 2024, management exudes confidence in successfully navigating the competitive landscape. The company anticipates benefits from moderating commodity costs, favorable pricing adjustments, and ongoing cost-saving measures. Despite this, promotional activity remains subdued compared to pre-pandemic levels. Flowers Foods is strategically focused on innovation, marketing actions, and converting its distribution model in California, all of which are expected to drive long-term value, albeit with hurdles in the near term.

Reminiscing the Past: Historical Context

Echoing the numerous economic storms battled throughout its history, Flowers Foods remains steadfast in its pursuit of success. Despite weathering these tempests, the company has continually managed to bloom and flourish in the unpredictable garden of finance. A history scattered with adversities serves as a testament to Flowers Foods’ resilience, as it continues to navigate through contemporary challenges with poise and determination.

Facing the Figures: Q4 Highlights

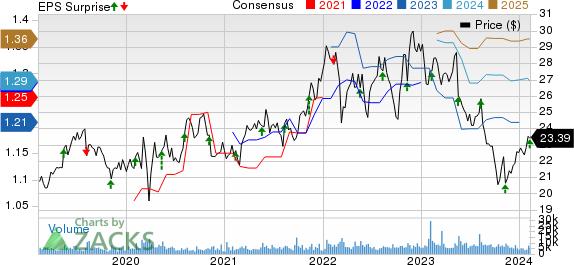

The company reported adjusted earnings per share (EPS) of 20 cents, aligning with the Zacks Consensus Estimate but reflecting a year-over-year decline of 3 cents.

Sales painted a moderately positive picture, climbing 4.3% year over year to $1,129 million, albeit falling short of the Zacks Consensus Estimate of $1,218 million. Despite this, the pricing/mix remained favorable at 5.6%, while volumes experienced a 2.4% decline. The acquisition of Papa Pita contributed to a 1.1% sales growth. Branded Retail sales saw a 3.6% rise, reaching $724.6 million, and Other sales increased by 5.6% to $404.4 million.

Costs and Margins: Noteworthy Tussles

The company observed a contraction in materials, supplies, and labor costs, landing at 52.1% of sales, with reduced input cost inflation and lower outside purchases. However, increased maintenance and labor costs offset some gains. Selling, distribution, and administrative (SD&A) expenses slightly ballooned to 39.7% of sales, attributed to higher labor, insurance, marketing, and technology expenses. Adjusted EBITDA inched up by 0.1% to $96.3 million, with the adjusted EBITDA margin contracting 40 bps.

Looking Through the Financial Lens

Concluding fiscal 2023, Flowers Foods held cash and cash equivalents of $22.5 million and long-term debt of $1,048.1 million, with stockholders’ equity amounting to $1,351.8 million. The company generated $349.4 million in cash flow from operating activities for the fiscal year, raised $129.1 million in capital expenditures, and paid dividends worth $195.2 million.

What Lies Ahead: Fiscal 2024 Guidance

Management envisions a sales range of $5.091-5.172 billion for fiscal 2024, suggesting flat to a 1.6% increase year over year. Adjusted EBITDA is anticipated to fall within the range of $524-$553 million compared with the $501.7 million recorded in fiscal 2023. Furthermore, the adjusted EPS is expected to range from $1.20 to $1.30, compared with $1.20 delivered in fiscal 2023.

Amidst the turbulence, Flowers Foods’ stock has rallied 13.4% in the last three months, overshadowing the industry’s growth of 7.3%.

Exploring Opportunities: A Bountiful Garden of Stocks

During times of market volatility, investing can be akin to wandering through a lush garden, brimming with potential. Flowers Foods stands alongside other compelling investment options, such as Chewy (CHWY), Casey’s General Stores (CASY), and Lamb Weston (LW). Each of these stocks presents unique growth opportunities, offering investors a vibrant bouquet of potential returns.

Given their respective earnings surprises and current financial outlook, these entities boast significant potential. They stand as living testaments to the varied investment opportunities present in the contemporary financial market.

Final Thoughts

Flowers Foods navigates through fiscal 2024 with a hopeful outlook, leveraging its resilience, strategic initiatives, and historical perseverance. While the storms of market conditions continue to swirl, the company emerges with measured success, sustaining its position through turbulent waves and unpredictable winds. As stakeholders gaze into the horizon of fiscal 2024, Flowers Foods remains a beacon of fortitude, standing firm amidst the ebb and flow of market dynamics.

Investors and stakeholders anticipate the continued growth of Flowers Foods alongside other compelling investment options, as they venture forth into the ever-evolving financial landscape. As the sun sets on fiscal 2023, the promise of fiscal 2024 beckons with prospects of new growth and potential.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.