Franklin Resources, Inc. BEN is making waves in the crypto industry as the eighth firm to file for a spot Ethereum exchange-traded fund (ETF).

Having received approval from the U.S. Securities and Exchange Commission (“SEC”) for the trading of spot Bitcoin ETFs last month, a total of 11 firms are now cleared to launch this product.

The dramatic approval of rule changes by the SEC in January 2024 signaled a monumental shift in the narrative surrounding cryptocurrency regulation within the United States. This decision was pivotal for the crypto markets, which had long been under the regulatory microscope.

A spot crypto ETF, like the one proposed by Franklin Resources, tracks the market price of the underlying digital asset, offering investors exposure to the token without having to possess it directly.

If approved, this ETF would track the spot price of Ethereum, allowing investors to engage with Ethereum’s price directly rather than investing in a company involved in the Ethereum ecosystem.

The shift in the SEC’s stance from being cautious and wary of the largely unregulated crypto markets to now embracing spot Bitcoin ETFs represents a tectonic shift in the way cryptocurrencies are perceived and traded by investors.

Franklin Resources joins seven other firms in the race to bring spot Ethereum ETFs to market, all of whom launched spot Bitcoin products following the SEC’s landmark decision last month.

In November 2023, BlackRock BLK filed for a spot Ethereum ETF, called iShares Ethereum Trust, with the SEC. This move coincided with a surge in the price of Ethereum to its highest point for the year, before experiencing a subsequent pullback.

Dating back to June 2023, BLK led the charge among asset managers by being the first to file for a spot Bitcoin ETF, paving the way for a flurry of filings by other asset managers, including Fidelity, Invesco IVZ, and WisdomTree WT.

These applications were made during a time when the cryptocurrency industry was grappling with criticism from the SEC over alleged violations of securities laws.

In October 2021, IVZ retracted its initial application for a Bitcoin ETF due to regulatory headwinds within the industry. During this period, the SEC was hesitant to approve such funds, citing concerns over potential fraud and market manipulation.

Similarly, in October 2022, WT’s application for the launch of the WisdomTree Bitcoin Trust was not given the green light by the SEC over concerns of inadequate investor protection.

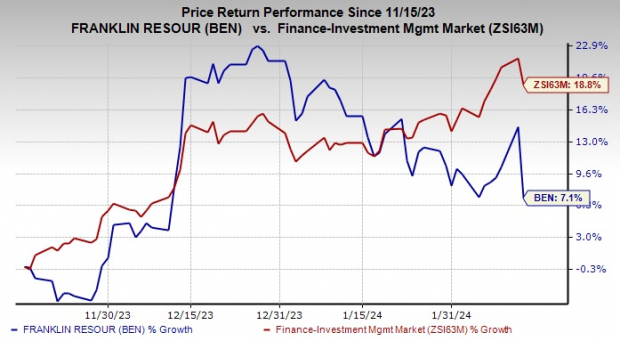

Over the past three months, shares of BEN have gained 7.1%, a modest increase compared with the industry’s 18.8% rally.

Image Source: Zacks Investment Research

Currently, BEN carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Reveals ChatGPT “Sleeper” Stock

One little-known company is at the heart of an especially brilliant Artificial Intelligence sector. By 2030, the AI industry is predicted to have an internet and iPhone-scale economic impact of $15.7 Trillion.

As a service to readers, Zacks is providing a bonus report that names and explains this explosive growth stock and 4 other “must buys.” Plus more.

Download Free ChatGPT Stock Report Right Now >>

Franklin Resources, Inc. (BEN) : Free Stock Analysis Report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

Invesco Ltd. (IVZ) : Free Stock Analysis Report

WisdomTree, Inc. (WT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.