Value Investing Is At Its Core The Marriage Of A Contrarian Streak And A Calculator.

– Seth Klarman

I recently stumbled upon a quote by Seth Klarman. It resonated with me, as I’ve built my investing career around the marriage of basic common sense and calculated risks. As markets unfold, I approach them as a set of probabilities, using evidence and projections to assess potential impacts on share prices. Naturally, I always keep my trusty calculator close at hand, especially when navigating less competitive market niches.

Today, I want to talk about a company that caught my eye—Frequency Electronics (NASDAQ:FEIM).

Frequency Electronics, a defense contractor primarily serving prime contractors like Lockheed Martin and the US government, mainly revolves around precision timing equipment—atomic clocks and frequency generation devices. The company’s products boast an impressive track record, having been deployed in space missions, satellites, secure communications, and various defense systems.

So why am I so optimistic about this under-the-radar company? Let’s crunch some numbers, shall we?

Starting with revenue, their existing backlog indicates stable earnings in the range of $12-13.6 million for the last 9 months. However, recent contract announcements totaling $53 million—aggressively pushed for delivery within 2 years—could potentially add $5.5 million in quarterly revenue on top of the existing backlog. Furthermore, an uptick in gross margin to about 50% (expected within the next 6 months to a year) would be a game-changer. Paired with minor increases in overheads, these projections hint at significant earnings growth.

“So SG&A on a dollar value number is going to run fairly consistent. I mean, again, if we grow substantially, yes, there’ll be some more costs in there. But percent-wise, as you see, it went down for getting the percentage to dollars even as a formula of income is down. So we expect it to stay at that current level where it is now unless things substantially grow.”

-Steve Bernstein (CFO) 12/12/2023 Conference call

Anticipating quarterly revenues of $17.5 million and taking projected costs into consideration, we’re looking at a plausible EPS of $0.47 per share. With substantial NOLs shielding it from most taxes, and no significant interest expenses, the potential for a company showing robust growth in revenues and margins speaks for itself. So why does its current share price hover at just under $11? It doesn’t take a rocket scientist to see the disparity.

All these projections, of course, rest on assumptions derived from management statements and recent data. However, the circumstantial evidence suggests a high likelihood of materializing.

Stable Revenue Run Rate

Firstly, the existing revenue run rate should be sustainable due to the reliability of their backlog as an indicator of future revenue. The recent contract influx is set to bolster this stability significantly.

Analyst Analysis of Company Performance and Future Projections

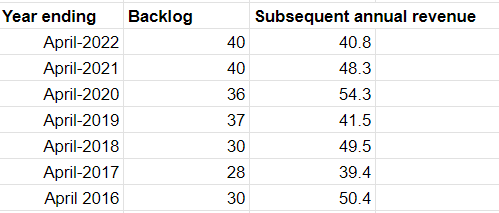

The company has set its revenue targets at 12 million dollars a quarter, while its end-of-year backlog is at $49.7 million. This assumption is based on the observation that in previous years, revenues have consistently exceeded the end-of-year backlog. This sustained level of funded backlog gives an indication of the money that has already been committed, thus making the base revenue assumptions plausible in the short term.

In light of consistent messaging from major customers and the priorities of the US government, it is reasonable to assume that the base relationship between order backlog and revenues is sustainable and realistic in the near term.

Impending Contracts

The company is also set to achieve its revenue targets with the batch of large contracts announced in December, expecting this to add to the base revenue levels. The company has stated that the work on these contracts was long in coming, indicating that they were well-prepared to start. This, along with the aggressive timeline for these contracts, alludes to the likelihood of achieving the stated revenue targets.

This is sort of a test to see if we and of course, our customer can deliver in this shortened period of time. Typically, a program like this would take roughly three years to do the same thing.

Although beginning work on contracts with an intentionally unusually short time frame does not guarantee continued progress at the same pace, it suggests that the work is progressing as expected and should move rapidly.

Profit Margins

Management has emphasized their expectation to attain 50% margins in the next 12 months, a notable increase from their historic targets of 35% to 40%. According to management, a philosophical shift in how they bid work is the reason for this change. They cite that a focus on higher-margin production work over lower-margin engineering work, as well as more disciplined bidding on contracts, have led to the revised 50% margin projection.

I think that if we look historically, we’ve had a lot of difficulty with what we refer to as NRE programs, non-recurring engineering or a lot of new development activity… I think to some extent, my experience here over many years, I have been involved in an awful lot of these development programs. And I know the pitfalls and the difficulties.

At this stage, the credibility of current management is key in evaluating the likelihood of achieving these ambitious goals. The current CEO, Thomas McClelland, has been instrumental in turning the company around since taking over after a period of significant losses under the previous CEO.

With the transformation in leadership and strategic approach, the company is expected to navigate more confidently towards achieving its revenue targets and maintaining healthy profit margins in the coming months.

Impressive Revenue Growth and Operational Upticks of Space and Defense Company

According to the recent financial reports, the space and defense company has experienced a remarkable surge in its revenues. From $8.2 million in the quarter ending July 2022, the revenues skyrocketed to $13.6 million or 65% in the quarter ending October 2023, making for an exceptional growth of 65%. Simultaneously, the operating income has turned around from a $3.1 million quarterly loss to a $0.8 million quarterly profit. Notably, gross margins have expanded from -0.06% to a positive 31.9%, reaching closer to its ambitious 50% target. The backlog surged from $40 million to $50 million or 20% excluding the recently announced contracts, showcasing the company’s robust performance. These considerable operational improvements underscore the capability and trustworthiness of the current management.

Assessing Management’s Credibility

Delving into the conference call transcripts stretching back to July 2022, an evaluation of the credibility of previous statements on the company’s outlook was deemed essential. Despite being a relatively new CEO, the current leadership’s credibility appears to be solid, given the recent performance.

Reviewing Previous Statements

At this time, we anticipate the imminent award of several significant contracts.

Q3 2023 Conference Call

Regarding the above statement, the resultant workflow reported in November aligns with the anticipation, albeit at a slower pace than expected.

Subsequently, two separate statements were made about profitability in fiscal 2023, initially in Q1 and then reiterated in Q2. In Q1, “we’re working hard to get profitable as quickly as possible. Our goal is to break even at least, if not be profitable by the end of the fiscal year.” Later in Q2, “Well, I wouldn’t say as likely that this fiscal year will be break-even. But I think the last quarter and going forward after that we do anticipate being break-even or perhaps a little bit better.”

By the fourth quarter of 2023, the company remarkably achieved what was described in the Q1 of 2023 and reiterated in Q2, generating $13 million in revenue and $0.2 million in net income, fulfilling the earlier discussed targets and projections.

Predicting Future Course

Given the recent operation shifts and their projected trajectory, the company seems to be on a promising path. The CEO, in less than two years, has demonstrated remarkable competence and accuracy in forward-looking assessments. Coupled with the company’s niche in space and defense, which is appealing to investors and a focal point of federal spending, there is potential for the company to re-rate in terms of earnings and multiple. This noteworthy performance gives rise to an enticing risk-reward scenario.

Considering the Downsides

While the current landscape seems promising, it’s important to recognize the associated risks. Federal spending schedules are notoriously susceptible to changes and delays, which could potentially impact the company’s forward trajectory. Additionally, significant customer concentration, based on federal spending and a few major customers contributing a substantial portion of revenue, poses a degree of risk. Furthermore, engineering and project issues are inherent risks that could lead to low or negative margins, although the current contracts orient towards more production than development, mitigating this concern. The upcoming budget negotiations and the potential impact of a government shutdown further underscore the cautious approach required.

Seeking Clarity

- Federal spending schedules

- Customer concentration

- Engineering and project problems

- Government shutdown risk

Efforts are underway to engage in comprehensive discussions with the management, aiming to gain further insight into the business operations. Looking ahead, the risk-reward balance presents an alluring proposition. The upcoming earnings release in March will perhaps provide a clearer perspective, validating the current thesis.