We expect Fusion Pharmaceuticals FUSN to beat expectations when it reports first-quarter 2024 results. Without a marketed product, investors will focus on the upcomingearnings callfor updates regarding Fusion’s pipeline candidates.

In March 2024, Fusion signed a definitive agreement with AstraZeneca AZN, where the latter will acquire all outstanding shares of FUSN for $21 per share in cash, aggregating to $2 billion.The transaction is expected to close in the second quarter of 2024, subject to customary closing conditions and clearance from regulatory authorities.

Let’s see how things might have shaped up in the to-be-reported quarter.

Factors to Consider

Fusion makes next-generation radiopharmaceuticals as precision medicines. It has a diversified pipeline of targeted alpha therapy (TAT) programs.

The company’s lead product candidate, FPI-2265, is a small molecule-based TAT targeting prostate-specific membrane antigen to treat cancer.

In January 2024, Fusion announced that it has aligned with the FDA regarding the phase II/III study protocols for FPI-2265 in previously treated metastatic castration-resistant prostate cancer (mCRPC) patients. The phase II dose-optimization portion of the study is expected to begin in the second quarter of 2024.

Subject to positive results from the mid-stage portion of the study and upon reaching alignment with the FDA regarding the recommended late-stage dosing strength, the company anticipates initiating the phase III global registrational study in 2025. Further updates regarding the planned mid to late-stage mCRPC study are expected in the first-quarter earnings release.

The company has two other candidates, FPI-1434 and FPI-2059, which are currently being developed in separate early-stage studies for patients with solid tumors expressing IGF-1R and NTSR1, respectively.

Fusion reported positive initial findings from the phase I study of FPI-1434 in January 2024. The company is likely to share further updates from the study in mid-2024.

FUSN has a collaboration with AstraZenecato jointly develop novel TATs and combination programs between Fusion’s TATs and AstraZeneca’s DNA Damage Response Inhibitors and immuno-oncology agents. Its revenues comprise periodic collaboration revenues from its partnership with AZN.

Currently, Fusion and AstraZeneca are jointly developing FPI-2068, a bispecific IgG-based TAT, in an early-stage study for solid tumor indications expressing EGFR-cMET, which include head and neck squamous cell carcinoma, non-small cell lung cancer, colorectal cancer and pancreatic ductal adenocarcinoma.

Fusion expects to initiate a combination study of FPI-2265 plus Merck MRK/AstraZeneca’s Lynparza (Olaparib) in earlier lines of mCRPC treatment in the first half of 2024.

The company has collaborated with Merck to evaluate FPI-1434 in combination with the latter’s blockbuster PD-L1 inhibitor, Keytruda, in patients with solid tumors expressing IGF-1R. The company is expected to provide an update regarding the same in the upcoming earnings release.

Earnings Surprise History

The company’s earnings surpassed estimates in two of the trailing four quarters and missed on the other two occasions, delivering an average negative surprise of 7.46%.

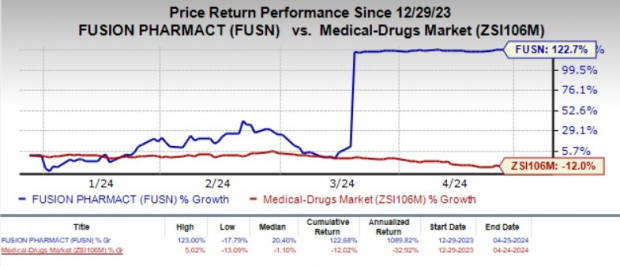

Year to date, shares of FUSN have skyrocketed 122.7% against the industry’s 12% decline.

Image Source: Zacks Investment Research

Earnings Whisper

Our proven model predicts an earnings beat for Fusion this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold) increases the odds of an earnings beat, which is the case here, as you will see below. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Fusion has an Earnings ESP of +0.34%. The Zacks Consensus Estimate for earnings is currently pegged at 37 cents.

Zacks Rank: FUSN currently carries a Zacks Rank #3.

Fusion Pharmaceuticals Inc. Price and EPS Surprise

Fusion Pharmaceuticals Inc. price-eps-surprise | Fusion Pharmaceuticals Inc. Quote

Other Stock to Consider

Here is another stock worth considering from the healthcare space, as our model shows that it has the right combination of elements to beat on earnings this reporting cycle.

Sarepta Therapeutics SRPT has an Earnings ESP of +108.99% and a Zacks Rank #3 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Shares of Sarepta Therapeutics have gained 32.1% in the year-to-date period. SRPT’s earnings beat estimates in each of the last four quarters, delivering an average surprise of 464.56%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Buy 5 Stocks BEFORE Election Day

Biden or Trump? Zacks is releasing a FREE Special Report, Profit from the 2024 Presidential Election (no matter who wins).

Since 1950, presidential election years have been strong for the market. This report names 5 timely stocks to ride the wave of electoral excitement.

They include a medical manufacturer that gained +11,000% in the last 15 years… a rental company absolutely crushing its sector… an energy powerhouse planning to grow its already large dividend by 25%… an aerospace and defense standout that just landed a potentially $80 billion contract… and a giant chipmaker building huge plants in the U.S.

AstraZeneca PLC (AZN) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Sarepta Therapeutics, Inc. (SRPT) : Free Stock Analysis Report

Fusion Pharmaceuticals Inc. (FUSN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.