GMS Inc. recently finalized the acquisition of Kamco Supply Corporation and its affiliates, a renowned provider of construction essentials such as ceilings, wallboard, steel, and lumber. Hailing from Brooklyn, NY, Kamco boasts a sturdy reputation as a leading supplier in the Greater New York City area, servicing the New York metro and tri-state regions.

Over the last 12 months, Kamco flaunted revenues of about $235 million from its four established distribution centers and a freshly unveiled Bronx greenfield. GMS envisions leveraging synergies from this union to enhance customer service and explore cross-selling opportunities, bolstered by Kamco’s expanding Wallboard and Complementary product lines.

In the realm of optimism, GMS foresees the Bronx site as a key catalyst for Kamco’s growth journey. The duo anticipates reveling in cost and revenue synergies from integrating distribution networks, innovative product additions, and shared purchasing programs.

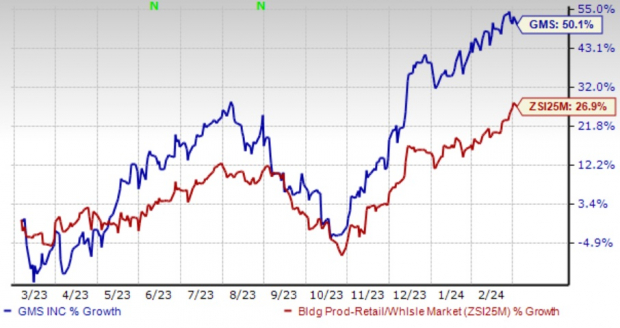

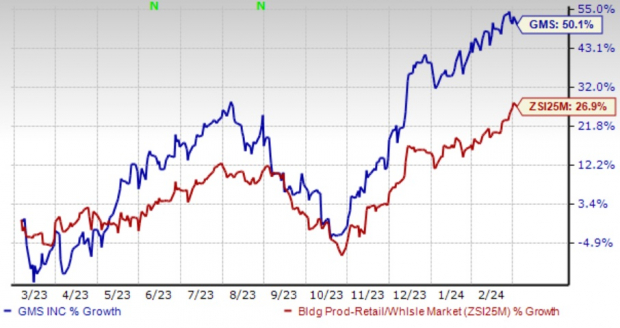

Stock Performance

In the stock market realm, GMS displayed a formidable 50.1% surge in the past year, outshining the Building Products – Retail industry’s 26.9% growth trajectory.

Image Source: Zacks Investment Research

Noteworthy for investors, the recent financial report underpins GMS’ 1.9% net sales growth over the previous year. This upward trajectory was fueled by robust demand in commercial and multi-family construction, despite inclement weather affecting January projects. GMS attributed this growth spurt to recent acquisitions, amping up their market presence further.

The company’s strategic focus on Wallboard, Ceilings, and Complementary Products sales, coupled with an acquisition-centric expansion strategy and a push for enhanced productivity and profitability, underscore a promising outlook for the firm.

Furthermore, a 40 basis point escalation in gross margin, driven by boosted volumes and accomplishments in calendar year-end volume incentives, alongside a 120 bps upsurge in adjusted EBITDA margin year over year, hint at a favorable growth trajectory ahead.

GMS remains assertive in strategically allocating resources to fortify its M&A endeavors and bolster its financial health by reducing debt levels.

Zacks Rank

At present, GMS flaunts a Zacks Rank #2 (Buy), positioning it favorably in the investment landscape. Dive deeper into today’s top Zacks rated stocks here.

Peer Releases

Beacon Roofing Supply, Inc. showcased robust performance in the fourth quarter of 2023, surpassing earnings and net sales expectations. The steadfast growth trajectory over 12 quarters underscores the resilience of Beacon’s business model, driven by efficient pricing strategies and enhanced branch operations.

Builders FirstSource, Inc. also impressed market watchers with an exceptional show in Q4 2023, showcasing improvement in earnings despite the challenging market conditions in the residential construction sector.

Home Depot Inc. delivered a mix of results in the Q4 fiscal 2023, surpassing top and bottom line estimates despite a decline in overall sales and earnings per share year over year.

Curious about the latest stock recommendations? Explore Zacks Investment Research’s offerings here.