Haemonetics recently inked a definitive agreement to purchase Attune Medical, the adept manufacturer behind the ensoETM proactive esophageal cooling device. This acquisition, expected to conclude in the premier quarter of fiscal 2025 upon meeting standard closing criteria, marks a decisive move to fortify Haemonetics’ global Hospital division.

Financial Terms

In adherence to the agreement’s clauses, Haemonetics will deliver an upfront cash payment of $160 million to Attune Medical upon completion, coupled with additional contingent compensation contingent on sales escalation over the following trio of years subsequent to finalization. Attune Medical displayed robust financials, clocking revenues of approximately $22 million in the just-concluded fiscal 2023, denoting a twofold surge from the preceding year. Following the acquisition’s fruition, it is foreseen to swiftly reinforce Haemonetics’ revenue and earnings trajectory. The firm intends to fund the deal utilizing a mix of existing cash reserves and a draw from its revolving credit facility.

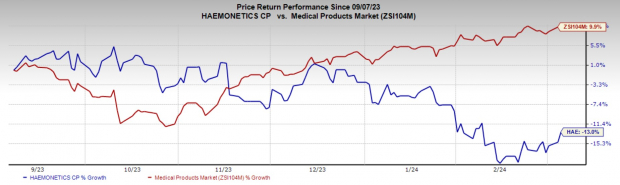

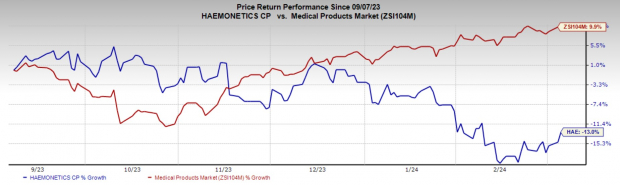

Image Source: Zacks Investment Research

A Glimpse at Attune Medical and EnsoETM

Based in Chicago, Attune Medical previously known as Advanced Cooling Therapy, Inc., was the pioneer in leveraging the esophageal cavity to proactively modulate patient temperature, thereby mitigating the probability of esophageal damage during cardiac ablation procedures. The innovative ensoETM technology is customized for a range of medical scenarios necessitating patient cooling or warming, encompassing critical care, neurocritical care, trauma, burn surgery, spine surgery, and cancer surgery, among other applications.

Amid the sphere of atrial fibrillation treatment affecting millions in the U.S., ensoETM stands out as the sole FDA-approved apparatus substantially slashing the risk of esophageal harm during radiofrequency cardiac ablations. Engineered for simplicity, ensoETM, a solitary-tube apparatus, is positioned in the esophagus and linked to an external heat exchange unit, creating a self-contained mechanism for proactive temperature management.

Over 68,000 ensoETM units have been dispatched by Attune Medical for hospital deployments, seeing action in excess of 50,000 electrophysiology procedures since its market debut in 2015.

Strategic Advantages of the Pact

Attune Medical’s ensoETM offering will bolster Haemonetics’ foothold in the electrophysiology domain, seamlessly merging with its ascendant profile in Vascular Closure. EnsoETM distinguishes itself by reducing esophageal injuries sans necessitating hospitals to procure intricate and exorbitant new ablation systems.

Haemonetics anticipates arming more clinicians with this revolutionary remedy to elevate patient outcomes. Furthermore, it will expand Haemonetics’ EP (electrophysiology) assortment with another top-tier technology to expedite the growth and resonance of its Interventional Technologies division.

Industry Outlook

Research projections indicate that the global electrophysiology devices market struck a valuation of $6.1 billion in 2022 and is poised to witness an 11.2% CAGR by 2030.

Further Hospital Business Endeavors

Haemonetics’ Hospital Business recorded a robust 22% uptick in revenues during its recently concluded third quarter of fiscal 2024, experiencing double-digit expansion across all product lines. By the fiscal year’s end, the company aims to penetrate 80% of the designated top 600 U.S. hospital accounts, equipping itself with access to the lion’s share of marketable procedures. This extensive network will also forge a groundwork for future expansions, particularly tapping into opportunities through the innovation and M&A channels.

In December 2023, Haemonetics sealed the deal on acquiring OpSens Inc. Beyond the immediate and prolonged financial windfalls foreseen for Haemonetics, the acquisition broadens the company’s Hospital division portfolio with cutting-edge fiber optic sensor technology in the lucrative interventional cardiology sector.

Share Performance

During the bygone six months, HAE stocks endured a 13% descent against the backdrop of the industry’s 9.9% ascent.

Zacks Rank and Noteworthy Selections

Presently, Haemonetics bears a Zacks Rank #3 (Hold).

Highlighted stocks in the extensive medical zone cover Cardinal Health CAH, Stryker SYK, and DaVita DVA. While Stryker boasts a Zacks Rank #2 (Buy), Cardinal Health and DaVita savor a Zacks Rank #1 (Strong Buy). Get a glimpse at today’s complete list of Zacks #1 Rank stocks here.

In the past year, Cardinal Health stocks surged by 54.8%. Earnings estimates for Cardinal Health surged from $6.91 to $7.28 in fiscal 2024 and from $7.76 to $8.03 in fiscal 2025 over the last 30 days.

CAH consistently outperformed earnings projections over the trailing four quarters, boasting an average surprise of 15.6%. In the most recent quarter, it delivered a 16.7% earnings surprise.

Estimations for Stryker’s 2024 earnings per share climbed from $11.79 to $11.86 over the preceding month. Stryker shares ascended by 33.1% in the past year, eclipsing the industry’s 8.8% upturn.

Stryker consistently surpassed earnings projections over the last four quarters, with an average surprise of 5.1%. In the recent quarter, it achieved an average earnings surprise of 5.8%.

Forecasts for DaVita’s 2024 earnings per share spiked from $8.46 to $8.97 over the last 30 days. DaVita stocks swelled by 70.7% in the past year, overshadowing the industry’s 20.3% surge.

DaVita consistently exceeded earnings projections over the trailing four quarters, with an average surprise of 35.6%. In the latest quarter, it secured an average earnings surprise of 22.2%.

Unlock Zacks’ Buys and Sells for Just $1

This is no joke.

A few years back, we astounded our members by offering them a 30-day access to all our picks for merely $1. No strings attached.

Several individuals seized this opportunity while others hesitated, suspecting a hidden agenda. There is, in fact, a rationale. We aim for you to acquaint yourself with our repertoire services like Surprise Trader, Stocks Under $10, Technology Innovators,and more. Thousands have already jumped at the chance.Thousands did not. And they assumed there was a catch. Yes, we pursue an objective. We extend our arm, virtually, to initiate you to our basket of services like Surprise Trader, Stocks Under $10, Technology Innovators,and much more. They have.

The Success of Leading Medical Sector Companies in 2023

Strategic Business Moves

In a remarkable display of skill and acumen, major players in the medical sector have demonstrated their ability to navigate the complex terrain of the market. The end of 2023 saw Stryker Corporation (SYK), DaVita Inc. (DVA), Cardinal Health, Inc. (CAH), and Haemonetics Corporation (HAE) excel, closing an impressive 162 positions with double- and triple-digit gains. This feat signals a robust performance that underscores their strength and resilience in an ever-evolving industry.

Financial Triumphs and Strategic Acquisitions

The significant achievement of closing 162 positions with substantial gains serves as a testament to the prowess of these companies in leveraging market dynamics to their advantage. Stryker Corporation (SYK), a stalwart in the medical devices arena, demonstrated its strategic finesse by securing favorable outcomes across various financial ventures.

Moreover, the recent agreement by Haemonetics Corporation (HAE) to acquire Attune Medical showcases a forward-looking approach to expansion and diversification, marking a strategic move that promises to enhance their market position and drive future growth.

Insights and Recommendations

For investors seeking astute recommendations and in-depth analysis of market trends, Zacks Investment Research offers a wealth of valuable resources. By providing insights into top-performing stocks and expert advice on market strategies, investors can make informed decisions to capitalize on emerging opportunities within the medical sector.

Industry Guidance

As the landscape of the medical sector continues to evolve, with new technologies, regulatory changes, and consumer demands reshaping the industry, companies like Stryker Corporation (SYK), DaVita Inc. (DVA), Cardinal Health, Inc. (CAH), and Haemonetics Corporation (HAE) remain steadfast in their commitment to innovation and excellence. Their sustained success signals a bright future ahead, underlining the enduring strength of these market leaders.

Perspectives and Concluding Remarks

The journey of these companies, marked by strategic maneuvers, financial triumphs, and forward-thinking acquisitions, illuminates the path to success in the competitive world of the medical sector. With a keen eye on market trends and a commitment to excellence, these companies have exemplified resilience and adaptability, qualities that are sure to propel them to greater heights in the years to come. As investors navigate the ever-changing landscape of the medical sector, the accomplishments of Stryker Corporation (SYK), DaVita Inc. (DVA), Cardinal Health, Inc. (CAH), and Haemonetics Corporation (HAE) stand as shining examples of success in the face of adversity.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.