Cincinnati Financial Corporation CINF stands poised for growth, driven by a higher level of insured exposures, rate increase, agent-focused business model, consistent cash flow and a solid capital position.

Robust Growth Projections

The Zacks Consensus Estimate for Cincinnati Financial’s 2024 earnings is pegged at $6.16 per share, indicating a 2.1% increase from the year-ago reported figure on 9.2% higher revenues of $9.71 billion.

Looking ahead to 2025, the consensus estimate for earnings stands at $6.77 per share, signaling a 9.8% increase from the previous year, accompanied by 7.5% higher revenues of $10.44 billion.

Positive Estimate Revisions

The Zacks Consensus Estimate for 2023 and 2024 earnings has moved 1.6% and 3.6% north, respectively, in the past 30 days, reflecting analysts’ optimism.

Earnings Surprise History

Cincinnati Financial has a solid earnings surprise history, surpassing estimates in each of the last four quarters, with an average beat of 43.05%.

Zacks Rank & Price Performance

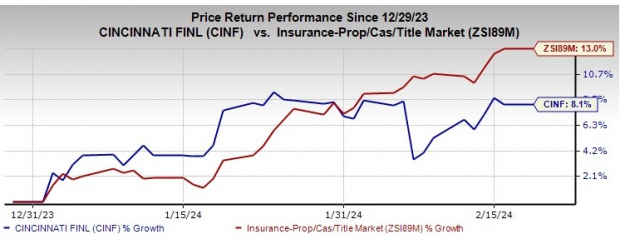

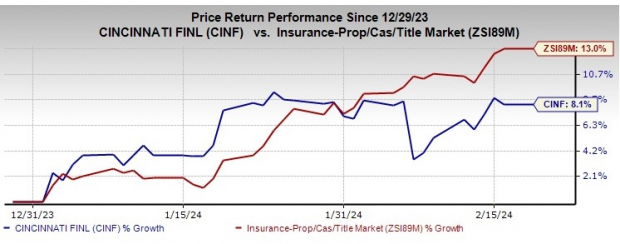

Notably, the stock currently carries a Zacks Rank #2 (Buy). Year to date, it has gained 8.1%, compared with the industry’s growth of 13%.

Image Source: Zacks Investment Research

Promising Business Tailwinds

Prudent pricing, an agent-centric model, a higher level of insured exposures, and a disciplined expansion of Cincinnati Re are expected to drive premiums for Cincinnati Financial. The company boasts above-average industry premium growth.

The Excess and Surplus line has shown strong performance since its inception in 2008. New business written premiums, increased renewal written premiums, and improved average renewal estimated pricing are anticipated to bolster the segment’s performance. Furthermore, utilization of technology and data to identify new exposures in emerging businesses is in progress.

In addition, an increase in interest income from fixed-maturity securities and a reduction in equity portfolio dividends should continue to drive net investment income for the company. Furthermore, an improved rate environment is likely to add to the positive momentum.

Cincinnati Financial’s underwriting profitability may be impacted by its exposure to catastrophe losses. However, banking on prudent underwriting, the company’s impressive track record of 34 years of favorable reserve development is commendable. Besides, it has a robust reinsurance program to limit insured loss.

Moreover, the company’s record of consistently increasing dividends for 63 consecutive years underlines its operational expertise and the board’s confidence in its capital, liquidity, and financial flexibility. With a dividend yield of 2.6%, well above the industry average of 0.2%, the stock presents an attractive opportunity for yield-seeking investors. Notably, its free cash flow conversion has remained over 150% for several quarters, highlighting its strong earnings.

Other Stocks to Consider

Additional top-ranked stocks in the property and casualty insurance industry include Arch Capital Group Ltd. ACGL, Axis Capital Holdings Limited AXS, and Mercury General Corporation MCY, each holding a Zacks Rank #1 (Strong Buy) at present.

Arch Capital has consistently surpassed earnings estimates in the past four quarters, averaging 27.32%. Year to date, ACGL has surged 15.9%.

Axis Capital boasts a solid track record of beating earnings estimates in each of the trailing four quarters, with an average beat of 102.57%. Year to date, the insurer has gained 11.9%.

Meanwhile, Mercury General exceeded estimates in three of the last four quarters, with an average beat of 3,417.48%. Year to date, the insurer has rallied 35.8%.

Just Released: Zacks Top 10 Stocks for 2024

Hurry – you can still get in early on our 10 top tickers for 2024. Hand-picked by Zacks Director of Research, Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2023, the Zacks Top 10 Stocks gained +974.1%, nearly TRIPLING the S&P 500’s +340.1%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2024. You can still be among the first to see these just-released stocks with enormous potential.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cincinnati Financial Corporation (CINF) : Free Stock Analysis Report

Axis Capital Holdings Limited (AXS) : Free Stock Analysis Report

Arch Capital Group Ltd. (ACGL) : Free Stock Analysis Report

Mercury General Corporation (MCY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.