W.R. Berkley Corporation has been steadily building a fortress of financial health and resilience. A combination of higher premiums, lower claims frequency in key business lines, amplified exposure, effective capital deployment, and ample liquidity makes it a standout choice for investors.

Bright Future Ahead

The company’s growth projections speak volumes about its potential. The Zacks Consensus Estimate for W.R. Berkley’s 2024 earnings indicates a robust 21.7% surge from the year-ago figures, fueled by a 9.5% uptick in revenues. The 2025 earnings estimate portrays a 9.3% increase from the prior year, propelled by a 5.9% rise in revenues. These projections are nothing short of impressive.

Positive Estimate Revisions

Furthermore, the positive estimate revisions for 2023 and 2024 earnings bolster confidence in the company’s upward trajectory. The recent 0.8% and 0.1% northward shifts in estimates over the past seven days further reinforce WRB’s promising outlook.

Steady Earnings Surprise History

W.R. Berkley has a commendable earnings surprise history, outshining estimates in three of the last four quarters with an average beat of 4.10%. It’s a track record that investors can count on.

Striking Business Tailwinds

The insurance business of W.R. Berkley is soaring, fueled by higher premiums across various essential liability lines and consistently strong underwriting income. The company’s foray into alternative assets like private equity funds and direct real estate opportunities underscores its shrewd investment strategies.

As of December 2023, WRB approved a special cash dividend of 50 cents per share, adding to the two other special dividends paid out earlier in the year. These strategic financial moves are music to the ears of investors.

With solid ratings in both Value Score and Growth Score, W.R. Berkley continues to demonstrate its enviable financial standing. In addition, the company’s operating return on equity has expanded significantly, targeting even more impressive long-term returns.

Looking Ahead

For investors eyeing the property and casualty insurance industry, W.R. Berkley is just the tip of the iceberg. Other top-ranking stocks in the same sector, including Axis Capital Holdings Limited, Mercury General Corporation, and Arch Capital Group Ltd., also present compelling opportunities for growth and value.

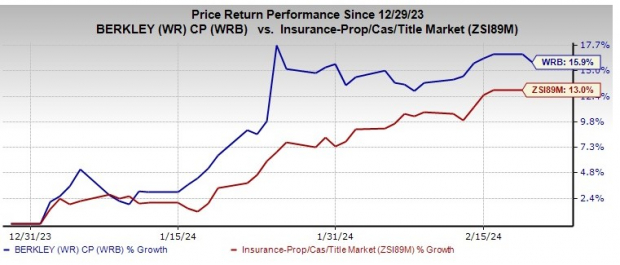

These companies have demonstrated consistent record of beating estimates and attractive year-to-date gains, making them worthy candidates for any investor’s watchlist. The market is indeed ripe with potential gems.

W.R. Berkley’s remarkable journey exemplifies the finer aspects of investing – seizing opportunities, fortifying financial muscle, and staying ahead of the curve. It’s a textbook example of grit and resilience in the face of market uncertainties and undulating economic landscapes.