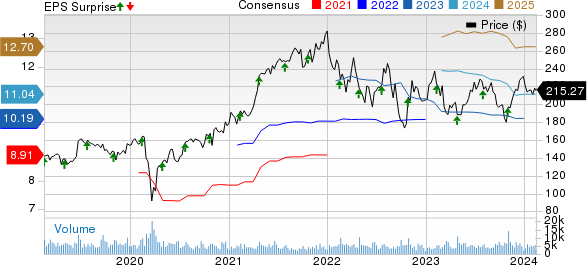

IQVIA Holdings Analytics Inc. IQV has reported fourth-quarter 2023 results that have beaten the Zacks Consensus Estimate.

The company’s adjusted earnings, excluding 11 cents from non-recurring items, stood at $2.65 per share, a remarkable 3.1% above the Zacks Consensus Estimate and indicating a 4.3% increase from the same period last year. Total revenues reached $3.87 billion, surpassing the consensus estimate by 2.2% and marking a 3.5% increase from the year-ago figure.

The company sustained a 2.6% increase in revenues on a constant-currency basis.

Quarterly Performance

IQVIA’s Technology and Analytics segment generated revenues of $1.53 billion, up 2.1% from the previous year and surpassing the estimated $1.5 billion. The segment’s revenues exhibited a healthy 1.3% growth on a constant-currency basis.

Financial Guidance for 2024

For the full year of 2024, IQVIA forecasts revenues in the range of $15.4 billion to $15.65 billion. The anticipated adjusted EBITDA for the same period is expected to fall between $3.7 billion and $3.8 billion, with projected adjusted EPS in the range of $10.95 to $11.25.

Despite its impressive performance, IQVIA currently holds a Zacks Rank #3 (Hold).

Industry Peers’ Earnings Snapshot

Among the business services stocks, competitors such as Automatic Data Processing, Inc., Booz Allen Hamilton Holding Corp., and Waste Management Inc. have also reported robust earnings and revenue figures, surpassing the Zacks Consensus Estimate.

Automatic Data Processing, Inc. (ADP) exhibited a solid performance in the second quarter of fiscal 2024, with adjusted EPS of $2.13 and total revenues of $4.67 billion beating the Zacks Consensus Estimate.

Similarly, Booz Allen Hamilton Holding Corp. (BAH) reported better-than-expected third-quarter fiscal 2024 results, with quarterly adjusted EPS of $1.41 and revenues of $2.57 billion.

Waste Management Inc. (WM) also delivered impressive fourth-quarter 2023 results, where adjusted EPS of $1.74 and total revenues of $5.2 billion surpassed the Zacks Consensus Estimate.

Zacks Reveals ChatGPT “Sleeper” Stock

As a service to readers, Zacks is providing a bonus report that names and explains this explosive growth stock and 4 other “must buys.” Plus more.

Download Free ChatGPT Stock Report Right Now >>

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.