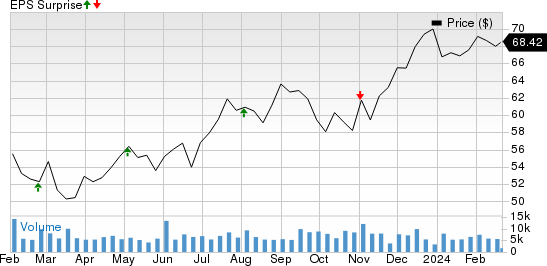

Iron Mountain Incorporated IRM is set to release its Q4 and full-year 2023 earnings on February 22, just before the opening bell. The quarterly results are expected to reveal year-over-year revenue growth and funds from operations (FFO) per share.

In the preceding quarter, the real estate investment trust (REIT) encountered an unpleasant surprise of 1.00% in terms of adjusted FFO (AFFO) per share. The revenue number also fell short of expectations.

The Anticipated Performance

Iron Mountain is expected to have benefited from its stable core storage and records management businesses during the fourth quarter. Robust revenue management and volume trends are likely to have supported storage rental revenue growth, which comprises the majority share of IRM’s revenues.

Expanding digital offerings and strong demand for traditional services are expected to have buoyed service revenue growth. Additionally, a healthy leasing activity in the data center business is projected to have driven a positive performance for the Global Data Center segment.

Despite these positives, higher interest expenses might have taken the sheen off Iron Mountain’s performance in Q4. To add to the woes, the company’s activities have failed to impress analysts, with the Zacks Consensus Estimate for quarterly AFFO per share being revised slightly downwards to $1.05 in the past month.

What the Numbers Suggest

The Zacks Consensus Estimate for storage rental revenues implies a 14.9% increase to $884.43 million, while the estimate for service revenues suggests a rise of 10.9% to $565.08 million from the prior year. Iron Mountain projected Q4 revenues and adjusted EBITDA to be $1.44 billion and $520 million, respectively, with the consensus estimate for quarterly total revenues indicating a 12.69% increase from the previous quarter.

For 2023, the company has forecasted AFFO per share in the range of $3.91-$4.00, underpinned by projected revenues in the range of $5,500-$5,600 million and adjusted EBITDA in the band of $1,940-$1,975 million. However, interest expenses are likely to have surged 21.4% for the full year, potentially diluting the positive impact of revenue growth.

What’s the Forecast?

While the quantitative model does not conclusively predict a surprise in terms of FFO per share for Iron Mountain this season, investors are keeping a keen eye on other players in the REIT sector. Extra Space Storage Inc. (EXR) and American Homes 4 Rent (AMH) may present surprises this quarter, as indicated by the model. Extra Space Storage, scheduled to report quarterly numbers on Feb 27, has an Earnings ESP of +0.70% and carries a Zacks Rank of 3.

American Homes 4 Rent, slated to release quarterly numbers on Feb 22, has an Earnings ESP of +1.68% and carries a Zacks Rank of 3 at present.

Final Thoughts

The rising interest expenses and a slight downward revision in the Zacks Consensus Estimate for AFFO per share don’t paint a rosy picture for Iron Mountain’s fourth-quarter results. However, the anticipated revenue growth and digital expansion strategies among others provide a glimmer of hope. Investors will eagerly anticipate the earnings call for further clarity on Iron Mountain’s performance in Q4 and beyond.

Keep in mind that the estimates related to earnings presented in this write-up represent funds from operations (FFO), a widely used metric to gauge the performance of REITs.